Desiring to know how to get rich?

What if everything you know about building wealth is wrong?

Dr. Jim Dahle nailed it:

“Make more than you spend, save the difference, and let compound growth do the heavy lifting”.

Sounds simple, right?

Yet 68% of six figure earners live paycheck to paycheck.

The secret isn’t complicated math, it’s avoiding self sabotage.

But remember, if you want to get rich, focus first on what actually moves the needle:

Increasing your income by learning high value skills and building assets that generate money consistently.

That’s exactly what I did.

I joined a digital program that helped me master a high income marketing skill, and from there, I significantly boosted my monthly income and created multiple income streams.

Inside this same course, you’ll get:

- Over 52 marketing and business modules to help you start or grow your online business based on your goals.

- An active community of 123.5k+ members sharing real results, feedback, and motivation.

- Weekly live sessions and webinars in several languages led by experts who’ve done it themselves.

Some students have seen results in just weeks, while others take longer.

It depends on your effort, time, and dedication.

But what’s powerful is that you can build multiple business models, which means more income streams and more stability.

Want to get rich? Start by investing in yourself.

Learn More About Digital Wealth Academy (DWA)

a free beginner’s guide

DWA Sneak Peek

Learn the easiest and fastest way to start or exponentially grow your existing business.

Table of Contents

Key Takeaways

Wealth boils down to three non negotiable habits: earn smart, spend smarter, invest consistently.

Six figure salaries don’t guarantee riches, lifestyle choices make or break financial freedom.

Compound growth works best when started early, even with small amounts.

Most wealth building failures stem from emotional decisions, not market conditions.

Real world examples prove that ordinary people achieve extraordinary results using basic strategies.

Financial security takes 7 to 15 years. Shortcuts usually lead to dead ends.

Understanding the Journey to Wealth

Ever notice how lottery winners often end up broke?

Here is a secret of rich people.

True wealth isn’t about sudden windfalls.

It’s about playing the long game.

Let’s talk about why your calendar matters more than your calculator when building financial security.

The Concept of Building Wealth Over Time

Here’s the cold truth: your Netflix subscription will outlast most “hot stock tips”.

That J.P. Morgan study revealing 10 market days drove half the 20 year returns?

It proves why staying invested beats timing the market.

Compound interest works like your favorite sourdough starter.

Start with $500 per month at 25, and you’ll have over $2M by 65 (7% return).

Wait until 35?

You’ll need $1,100 per month for the same result.

Time literally grows money while you sleep.

Defining Success in Financial Freedom

Financial freedom isn’t about private jets.

It’s when your dividend stocks cover your grocery bill.

Let’s break it down:

- Basic FI: Covers needs (rent, utilities, beans)

- Comfort FI: Adds wants (Netflix, avocado toast)

- Fat FI: Funds “Why not?” choices (first class tickets, charity donations)

My barista friend reached Basic FI at 42 through index funds and avoiding lifestyle creep.

No trust fund.

No crypto bets.

Just consistent investing and understanding that wealth is measured in years, not dollars.

Essential Tips on How to Get Rich

Did you know 83% of Americans set money related New Year’s resolutions that fail by February?

The difference between wishing and winning comes down to strategy.

Let’s transform your financial daydreams into a concrete roadmap.

Setting Clear Financial Goals

Vague targets create vague results.

A friend Sarah, thought “I want money” counted as planning.

Then we tried this:

- Reverse engineer your freedom number: Need $40k per year in dividends? That requires $1M portfolio at 4% withdrawal rate.

- Break it into bite sized chunks: $500 per

- month invested x 30 years = $1.2M (7% returns).

- Make it visual: One teacher tracked progress with a coloring book page, and each $10k earned a new shaded area.

Embracing the Power of Persistence

Warren Buffett built 99% of his wealth after 50.

The math is simple: Consistency > Genius.

My neighbor automated $50 weekly transfers during three recessions.

His secret?

“I treated investing like paying rent to Future Me”.

When emergencies hit (and they will), keep your plan alive with micro actions.

Lost your job?

Keep contributing $5 per week.

Market crashes?

Rebalance with spare change.

Small wins compound faster than you think.

Celebrating each $10k milestone kept me motivated through 14 years of grinding.

Your turn: Grab a notebook and answer this:

What does ‘made it’ look like in dollars and dates?

That clarity alone puts you ahead of 92% of people reading articles like this.

Boosting Your Income: Making More Money

What’s stopping you from doubling your income?

Most professionals leave thousands on the table through avoidable mistakes.

Let’s fix that.

After years of research, trial and error, the best way that I’ve found to boost your monthly income is by learning high income marketing skills that last forever.

And that is the Discover Digital Wealth Academy (DWA) course.

What do you get with it?

- Access to 52+ marketing and business modules so you can create or grow a business based on your preferences.

- A thriving community of over 123.5k members sharing results, strategies, and motivation.

- Weekly support sessions and expert webinars in multiple languages to help you stay on track and keep growing.

Some students have seen real results within weeks, while others take longer.

It all depends on your effort, time, and consistency.

What matters most is that you’ll be able to build multiple income streams, setting yourself up for long term financial freedom.

The Digital Wealth Academy

earn 85% as AN affiliate – learn how to start or scale your own business

Career Enhancements That Actually Work

I watched a nurse practitioner boost her income by 127% in 18 months.

Her secret?

Optimizing her skillset while negotiating better insurance reimbursements.

Here’s what works:

| Strategy | Time Investment | Income Boost Potential |

|---|---|---|

| Specialty Certifications | 3 to 6 months | 15-40% |

| Insurance Negotiation | 8 hours per year | 12-25% |

| Team Leadership | Ongoing | 18-50%+ |

Real power comes from stacking these strategies.

A friend combined Medicaid optimization with weekend emergency shifts, and now he clears $47k per month.

Side Hustles That Scale

Not all side gigs are created equal.

Avoid time for money traps.

Focus on:

- Digital products (courses, templates)

- Consulting in your expertise zone

- Asset sharing (equipment rentals)

A physical therapist friend creates YouTube rehab videos, earning $3k per month passively.

Her rule:

If it can’t make money while I sleep, it’s not worth waking up for.

Education pays dividends fastest.

One coding bootcamp grad tripled his salary in 14 months.

Whether it’s mastering AI or getting AWS certified, skills compound like money.

Maximizing Earnings with Smart Investment Strategies

Think your investment strategy needs constant tweaking? 📉

Spoiler alert: The best portfolios often look boring.

Let’s break down why simplicity wins and how it can accelerate your wealth timeline.

The Digital Wealth Academy

earn 85% as AN affiliate – learn how to start or scale your own business

Leveraging Passive Index Investing

I’ve seen more people lose money chasing “next big thing” stocks than in casino parking lots.

Passive index funds quietly outperform 90% of actively managed portfolios over 15+ years.

Why?

Lower fees.

Less emotional trading.

Market matching returns that compound reliably.

Employing a Diversified Investment Portfolio

Vanguard’s century of data proves diversification works.

Check these historical averages:

| Portfolio Mix | Annual Return | Risk Level |

|---|---|---|

| 100% Stocks | 10.1% | High |

| 80/20 Stocks or Bonds | 9.4% | Moderate |

| 60/40 Stocks or Bonds | 8.6% | Balanced |

Bumping stocks from 60% to 80% could shave 1.4 years off your career.

But here’s the catch: Only increase risk if you can stomach 30%+ dips.

My rule?

Set your allocation, automate contributions, and check balances quarterly, not daily.

Rebalance like a pro during market swings.

When tech stocks soared in 2021, I sold 18% of mine to buy undervalued sectors.

Tax loss harvesting saved me $2,300 that year.

Remember: Every 1% saved in fees becomes $486,000 extra over 40 years.

Now that’s a return worth chasing.

Minimizing Expenses to Accelerate Wealth Growth

Ever wonder why six figure earners still stress about bills?

Cutting costs isn’t sexy, but it’s the rocket fuel your portfolio needs.

Let me show you how to slash smart, not suffer, while building real wealth.

Managing Lifestyle Creep and Maintaining Frugality

My lawyer friend upgraded his car with every promotion.

At $310k per year, he still rents.

Why?

That BMW X5 cost him $1.4M in lost stock gains.

Lifestyle inflation hits harder than avocado toast prices.

Here’s your survival guide:

- Housing is your biggest wealth killer or creator: Spending >30% of income? You’re trading future millions for granite countertops now.

- Cars are reverse ATMs: A $800 per

- month payment could become $480k in 30 years (7% returns).

- Prudent frugality: I brew coffee at home but splurge on Broadway tickets, cut mercilessly on what doesn’t spark joy.

| Housing Choice | Monthly Cost | 30 Year Opportunity Cost |

|---|---|---|

| Luxury Apartment | $3,200 | $4.8M |

| Moderate Home | $1,900 | $2.9M |

| Roommate Setup | $1,200 | $1.8M |

Fixed costs are financial quicksand.

Keep them below 50% of your income.

When my emergency fund hit $10k, I upgraded from a studio to a 1 bedroom, only after maxing my Roth IRA.

Remember:

Every dollar saved in your 20s works 8x harder than one saved in your 50s.

Track spending like you track Netflix shows.

Automate savings first.

Live on what’s left.

Your future self will throw a retirement party in your honor.

Making Your Money Work as Hard as You Do

Picture this…

Are your dollars clocking in for overtime while you binge watch Netflix.

That’s capitalism’s open secret:

Your capital never sleeps.

I treat my portfolio like a team of robot employees.

They don’t demand pizza parties or vacation days.

They just quietly multiply.

Understanding Compound Interest and Reinvestment

Let me show you why time beats timing every time.

A $20 daily coffee habit invested at 25 becomes $347,000 by 65 (7% returns).

Wait until 35?

Just $146,000.

That’s the compound interest difference.

| Starting Age | Monthly Investment | 65 Year Total |

|---|---|---|

| 25 | $300 | $1.02M |

| 35 | $600 | $1.01M |

| 45 | $1,200 | $983k |

Assumes 7% annual returns

Reinvesting dividends is like hiring more workers.

Pull out earnings early?

You’re firing your best performers.

An aunt $5,000 Microsoft shares from 1996?

Worth $1.4 million today, because she never touched the dividends.

Utilizing Financial Tools and Resources

You don’t need a finance degree.

Start with three books:

Then automate everything:

- Set up dollar cost averaging, turns market dips into bargain shopping

- Use Personal Capital to track net worth while brushing your teeth

- Enable auto reinvest on all brokerage accounts

My favorite hack?

The “72 rule” calculator.

the Divide 72 by your expected return to see doubling time.

At 7% growth?

Your investments double every decade.

Now that’s how money works smarter, not harder.

Harnessing the Power of Leverage

Ever watched someone lift a car with a hydraulic jack?

That’s leverage in action, using smart tools to move heavy financial goals.

But here’s the twist: debt can build empires or bury them, depending on who’s steering.

Using Debt Strategically for Investment

Real estate investors love leverage for good reason.

Buy a $500k property cash?

If it doubles, you make $500k.

Put 20% down?

Same profit costs you just $100k.

That is a 6X return.

But remember 2008?

Many forgot that leverage cuts both ways.

Thomas Anderson’s research shows the sweet spot:

Keep debt between 15% to 33% of assets if retirement is within 20 years.

A friend learned this hard way, used 80% credit on stocks, and lost 40% in the 2022 crash.

Now he sticks to 25% max.

Evaluating Risk Versus Reward in Leverage

Not all debt is created equal.

Here’s your cheat sheet:

| Leverage Type | Best For | Danger Zone |

|---|---|---|

| Mortgages | Long term assets | Adjustable rates >5% |

| Margin Accounts | Short plays | Loans >30% portfolio |

| Business Loans | Scaling revenue | No cash flow backup |

Calculate true costs: 4% mortgage?

Add 1.5% property tax + 2% maintenance.

That “cheap” money actually costs 7.5% annually.

I use this rule:

Expected returns must triple borrowing costs.

Build safeguards like automatic sell triggers.

One investor sets 15% stop losses on leveraged positions.

“It’s like having a financial seatbelt,” she says.

Your money strategy needs both gas pedals and airbags.

Planning for Long Term Financial Security

What if I told you your retirement could be fully funded by your 30th birthday?

Meet “Coast FI”, the secret sauce letting your early investments do all future heavy lifting.

Let’s crack the code on making compound growth your full time employee.

Preparing for Retirement and Future Expenses

Here’s the magic number: $150,000 invested at 25 becomes $1.5 million by 65 (7% returns).

No additional savings needed.

That’s Coast FI in action: hit your target early, then let time handle the rest.

| Starting Age | Initial Investment | Value at 65 |

|---|---|---|

| 25 | $150k | $1.5M |

| 30 | $225k | $1.7M |

| 35 | $340k | $1.6M |

The 4% withdrawal rate isn’t bulletproof.

Sequence of returns risk can torpedo early retirees.

My solution?

Build a 2 year cash buffer during market dips.

A teacher client did this, now she travels Asia while her index funds recharge.

- Healthcare hack: Pair HSAs with catastrophic insurance

- Flexibility tip: Keep 10% in real estate for rental income backup

- Emergency protocol: Automate 1% extra savings during bull markets

Retirement isn’t an age, it’s a math equation.

Crunch your numbers early, adjust for inflation, and remember:

Time forgives most financial sins.

Start now, and your future self will high five you across the decades.

Learning from Real Life Strategies and Case Studies

Why do millionaires keep recommending index funds?

The answer lies in patterns smarter than any single stock pick.

Let’s dissect what actually works through proven examples.

Insights from Successful Entrepreneurs and Investors

Warren Buffett still lives in his $31,500 Omaha house.

Sara Blakely funded Spanx with $5,000 in savings.

These icons share one trait: relentless focus on fundamentals over flash.

My college buddy turned $300 per month into $2.1M using three moves: automated index fund buys, ignoring financial news, and driving a 2004 Camry.

His secret?

“Wealth building strategies become effortless when you stop fighting math”.

Study failures, too.

A crypto trader lost $800k chasing trends.

Now he uses dollar cost averaging in boring ETFs.

“Financial freedom tastes better than Lamborghini leather”.

…he admits.

Your playbook:

Steal tactics from those who’ve walked the path.

Automate savings.

Outsmart lifestyle inflation.

Let compound growth whisper sweet nothings to your portfolio.

The finish line?

Closer than you think.

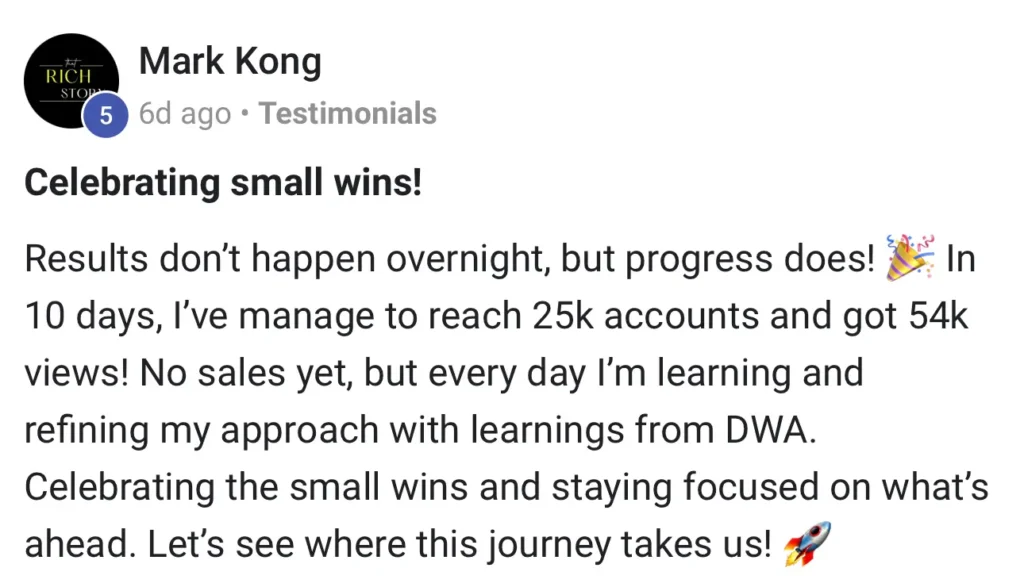

Real Life Results: Explore More DWA Testimonials

Discover how Digital Wealth Academy is changing lives.

Read authentic success stories and see the incredible results members are achieving with the DWA program.

Does building wealth require a six figure salary?

Nope. I’ve seen baristas outpace tech bros by mastering frugality and index fund investing. It’s about the saving rate, not income. Someone earning 2k, saving 40% builds wealth faster than a 10k earner blowing cash on leased Teslas.

How do I start investing with just $300 per month?

Micro investing apps like Acorns or Fidelity’s fractional shares let you buy slices of ETFs. I began with $300 per month in VOO (Vanguard S&P 500 ETF) – that snowballed into six figures through compound growth. Consistency beats big lump sums.

Are side hustles worth the time versus focusing on my career?

Depends. A freelance gig earning 5 per hour? Maybe. But upscaling for a 20% raise at your main job? Often smarter. Some people doubled her salary, that’s passive income without the grind. Crunch your ROI per hour.

Should I pay off debt or invest aggressively?

If your debt’s under 6% interest (like most mortgages), invest. Over 8% (credit cards)? Nuke that debt first. A paid debt is always a guarantee of ROI.

How do I avoid lifestyle creep as my income grows?

Automate savings first (pay yourself first). When I got an additional income, I instantly diverted it to my brokerage account. You won’t miss what you never see. Still bought the occasional concert ticket. Chase for balance, not deprivation.

What’s the biggest mistake people make financially?

Not educating themself financially first.