Are you desiring to know how to save money on a low income?

Let’s cut through the noise:

Nearly 60% of Americans feel uneasy about their emergency funds, and inflation isn’t helping.

But here’s what most personal finance gurus won’t tell you:

Building financial security isn’t about your paycheck size.

It’s about playing chess with your cash.

I’ve watched folks making $30k out save.

How?

They treat their budget like a GPS, recalculating routes when life throws detours.

You don’t need magic beans or a money tree.

Just smart systems that work while you sleep.

Think automatic transfers smaller than your Netflix subscription.

Cash back apps that turn grocery runs into mini paydays.

Or my personal favorite, the “spending autopsy” that reveals where your dollars actually go each month.

These aren’t sacrifices, they’re upgrades to your financial firmware.

Remember, saving money on a low income is possible, but it starts with a mindset shift and the right strategy.

The fastest way to make progress is to increase your income first, even slightly, so you can consistently set money aside, no matter where you’re starting from.

That’s what I did with the help of the same digital course that taught me a high income marketing skill and helped me boost my monthly income significantly.

Here’s what you’ll get:

- 52+ marketing and business modules, so you can build a business around your lifestyle, preferences, and strengths.

- An active community of over 123.5k members offering daily support, encouragement, and feedback.

- Weekly support sessions and webinars in multiple languages, hosted by real specialists.

This program empowers you to choose from multiple business models and build multiple income streams that lead to more consistent income, even if you’re starting small.

Some students have seen real results in just a few weeks, but remember: it depends on your effort, consistency, and dedication.

If you’re serious about changing your financial situation, even on a limited income:

Explore Digital Wealth Academy (DWA)

a free beginner’s guide

DWA Sneak Peek

Learn the easiest and fastest way to start or exponentially grow your existing business.

Remember always:

First, educate yourself financially before taking any financial decision.

Second, increase your income by learning a high income skill, and after years of research, trial and error, I don’t know any better way than Digital Wealth Academy (DWA).

DWA allows you both to start your own online business from scratch through multiple business models, where you choose which one to implement, but also, in case you already have a business, learn how to expand it and make it grow.

Table of Contents

Key Takeaways

Emergency funds matter more than income level, $500 beats $0 any day

Automation turns saving from a chore to a background process

Community resources can stretch budgets further than coupons

Behavioral tweaks > drastic lifestyle changes

Cash back apps act as invisible income streams

Financial security starts with tracking, not deprivation

Ready to crack the code?

Let’s transform “impossible” into “I’ll pencil that in using strategies that fit real life, not spreadsheet fantasies”.

Understanding Your Financial Landscape on a Low Income

Picture this: your bank account isn’t a mystery novel.

The plot twists?

Those unexpected expenses that ambush your paycheck.

But here’s the secret: clarity beats cash flow every time.

Assessing Your Income and Expenses

I once helped a friend track their daily purchases.

Turns out, their “occasional” latte habit costs more than their electric bill.

Start by grabbing every receipt, yes, even the crumpled gas station ones.

Sort them into categories like:

- Groceries vs. impulse snacks

- Fixed bills vs. surprise costs

- Needs vs. “I deserved this” purchases

Identifying Spending Patterns

Bank statements don’t lie.

Last month, I found three streaming charges for services I hadn’t used since 2022.

Track cash, too.

Those $5 bills vanish faster than cookies at a bake sale.

Pro tip: Label recurring charges with sticky notes.

You’ll spot patterns faster than a toddler finds candy.

Your budget isn’t about restriction.

It’s a map showing where your dollars wander.

When do you see $80 per month on parking tickets?

Suddenly, that bus pass looks genius.

Next up: turning these insights into action.

Tracking Your Expenses to Gain Control

Here’s a truth bomb: You can’t manage what you don’t measure.

Last month, my neighbor thought she only spent $120 on coffee runs.

Her expenses tracker revealed $287.

Oops.

Pick your weapon: apps like Mint or YNAB for tech lovers, or a dollar store notebook for analog fans.

I once tried 7 different tools in a week before realizing my best system was sticky notes on the fridge.

The key?

Use what you’ll stick with, not what looks impressive.

Check your account weekly, not daily.

Daily tracking feels like babysitting a toddler with a credit card.

Miss a day?

No guilt trips, just log it and move forward.

Those mystery charges (“Why did I spend $38 at CVS?”) become fewer over time.

Pro tip: Highlight weekend spending in red.

You’ll spot patterns faster than a detective solving a donut shop robbery.

After three weeks, one client realized 40% of their money vanished on Friday nights.

Knowledge = power to pivot.

This isn’t about creating a perfect budget.

It’s about building awareness.

Your future self will high five you when those small tweaks add up to real control.

a free beginner’s guide

DWA Sneak Peek

Learn the easiest and fastest way to start or exponentially grow your existing business.

Crafting a Realistic Budget

Your budget isn’t a straitjacket.

It’s a permission slip.

I learned this the hard way when my “financial plan” consisted of crossing fingers until payday.

The breakthrough came when I treated it like a roadmap rather than a rulebook.

Your Financial Co Pilot

Tracking apps are like having a money therapist in your pocket.

My favorite client uses colored emojis instead of categories, 🍔 for food, 🎮 for gaming.

Whether you choose Mint’s automation or a bullet journal, the goal stays the same: expenses transparency.

Pro tip: Set weekly check ins shorter than your TikTok scroll time.

The Flexible Formula

The 50/30/20 rule works like adjustable jeans.

Last month, my neighbor allocated 60% to rent but only 5% to savings.

That’s a victory.

As financial coach Tiffany Aliche says:

“Progress beats perfection every pay cycle”.

Try this twist for tight months:

- Essentials: 55% (bills, groceries, meds)

- Wants: 25% (Netflix, takeout)

- Future you: 20% (even $5 counts)

Review your allocations like a Netflix queue, keep what serves you, ditch what doesn’t.

Your budget should bend, not break, when life throws curveballs.

Making Savings a Regular Part of Your Budget

Want to know the real secret to building savings?

It’s not about willpower, it’s about creating systems that work without you.

Automating Transfers to Save Consistently

Set up transfers that hit your account faster than a caffeine craving.

Start with $10 per paycheck, less than most streaming subscriptions.

One client called this her “financial invisibility cloak” because the money vanishes before she can spend it.

Ask your employer to split direct deposits between checking and savings.

It’s like portion control for your income.

Pro tip: Schedule transfers for payday mornings.

Your future self will thank you when car repairs or vet bills appear.

Planning for Irregular Expenses

Those “once a year” costs?

They’re predictable as holiday traffic.

Create separate buckets for:

- Emergency fund (think flat tires)

- Annual bills (insurance premiums)

- Fun stuff (concert tickets)

I use apps that round up purchases and stash the change.

Last year, those digital pennies funded my niece’s birthday gift.

Remember: Saving $20 monthly beats scrambling for $240 every December.

Essential Techniques: How to Save Money on a Low Income

Saving without specific objectives is like throwing darts blindfolded, you might hit something, but probably not the bullseye.

I learned this when a client proudly announced they’d “save more this year”, then wondered why their account stayed flat.

Here’s the game changer: precision beats good intentions every time.

Goal Setting That Actually Works

Transform vague wishes into GPS coordinates for your bank account.

Instead of “I’ll stash some cash”, try:

- “$500 emergency cushion by Halloween”

- “$1,200 vacation fund by June”

- “$50 per month toward next year’s car insurance”

Break big numbers into weekly bites.

Saving $1,200 annually becomes $23 per week, less than most pizza deliveries.

As financial coach Tiffany Aliche says:

“Micro goals create macro results. Celebrate every $100 milestone like it’s a touchdown”.

Use visual trackers that show progress.

One friend colors in a thermometer drawing on her fridge.

Another uses an app that plays confetti animations when she hits targets.

These dopamine hits keep motivation alive better than any spreadsheet.

Life happens?

Adjust your aims without guilt.

Last year, I shifted a travel fund to medical bills, still a win.

Remember: flexible goals survive longer than rigid plans.

Your future self will high five you either way.

Cutting Back on Non Essential Spending

Time to play detective with your bank statements.

Last year, I discovered $47 per month vanishing into a yoga app I hadn’t opened since the pandemic.

Recurring charges are like financial ghosts, silent but costly.

Silent Budget Killers: Subscriptions

Grab a red pen and your last three statements.

Circle every auto renewing charge.

That $12.99 music service you used once?

The $29 gym membership collecting digital dust?

They add up faster than laundry piles.

One client found $113 per month in forgotten services, enough to cover their electric bill twice over.

| Subscription | Monthly Cost | Annual Drain |

|---|---|---|

| Streaming Service #3 | $9.99 | $119.88 |

| Meal Kit Forgotten | $45.00 | $540.00 |

| Cloud Storage Overkill | $4.99 | $59.88 |

Fun Without Funds

Entertainment doesn’t require Amex black cards.

My crew hosts monthly “appliance potlucks”, everyone brings a slow cooker dish.

We’ve discovered more recipes than Food Network.

For nights out:

- Follow pizza joints on Instagram for surprise BOGO deals

- Swap movie tickets for library DVD rentals (yes, they still exist)

- Use services like Eventbrite’s free local events filter

Dining trick: Order appetizers as mains.

Last Thursday’s calamari plate cost $9 vs. $22 steak.

Still got Instagram, worthy pics.

Spending smart feels better than spending more.

Maximizing Employer Benefits and Retirement Savings

Your job benefits might be hiding treasure chests you’ve never opened.

Last year, I met a teacher who discovered her district offered a retirement plan match worth $1,200 annually, enough to fund her family’s summer road trip.

Free Cash You’re Missing

That 401(k) match isn’t just “nice to have”, it’s free fuel for your future.

Imagine your boss handing you $900 annually for stashing $1,800.

That’s what happens when you contribute 6% on a $30k salary with a 50% match.

Pro tip: Start with 1% contributions.

You’ll barely notice $25 missing from a $2,500 paycheck.

| Your Contribution | Employer Match | Annual Free Money |

|---|---|---|

| 3% ($900) | 1.5% ($450) | $450 |

| 6% ($1,800) | 3% ($900) | $900 |

| 9% ($2,700) | 4.5% ($1,350) | $1,350 |

Tax Ninja Moves

Pre tax benefits work like financial invisibility cloaks.

My cousin reduced her taxable income by $2,400 last year using an HSA.

“It’s like the government paying part of my doctor bills”, she told me.

These accounts aren’t just for tech bros, I’ve seen nurses use them strategically.

Most HR departments have secret menus of benefits.

Ask about:

- Flexible Spending Accounts (FSAs) for daycare costs

- Commuter benefits that slash transit expenses

- Student loan repayment matching programs

Remember: Small percentages create big results over time.

Even 1% more in your retirement plan could mean extra tacos in your golden years.

Leveraging Credit Cards and Banking Tools Wisely

Let’s talk plastic without the guilt trip.

I nearly drowned in credit card debt during college, learned the hard way that swiping feels like Monopoly money until the bill arrives.

But when used strategically, these tools can actually boost your credit score while padding your wallet.

When Plastic Becomes Poison

Rewards points turn sour fast if you’re paying 29% interest.

One client’s $300 cash back haul got erased by $427 in fees last year.

Start small: aim to slash debt by $1,000 first.

That alone saves $150+ annually, enough for three tank fills or a surprise dental visit.

Banking apps now offer debt snowball features.

Link your cards and watch algorithms find the fastest payoff path.

My favorite trick?

Set up automatic $25 payments every Friday.

Over a year, that’s $1,300 vanished from your balance, painlessly.

Remember: Credit limits aren’t spending targets.

Treat them like fire extinguishers, there for emergencies, not everyday use.

Those airline miles?

Only valuable if you’re not funding them through interest payments.

Smart banking means making systems work for you.

Round up features turn coffee runs into debt destroyers.

Balance alerts act like financial seatbelts.

And always, always, pay more than the minimum.

Your future self will toast to that.

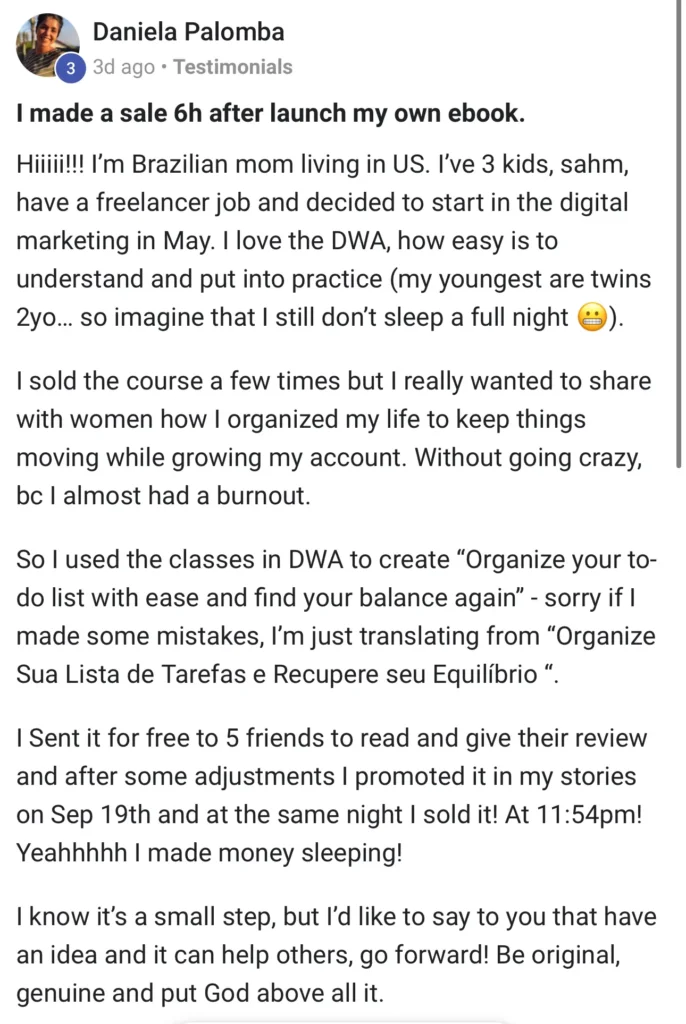

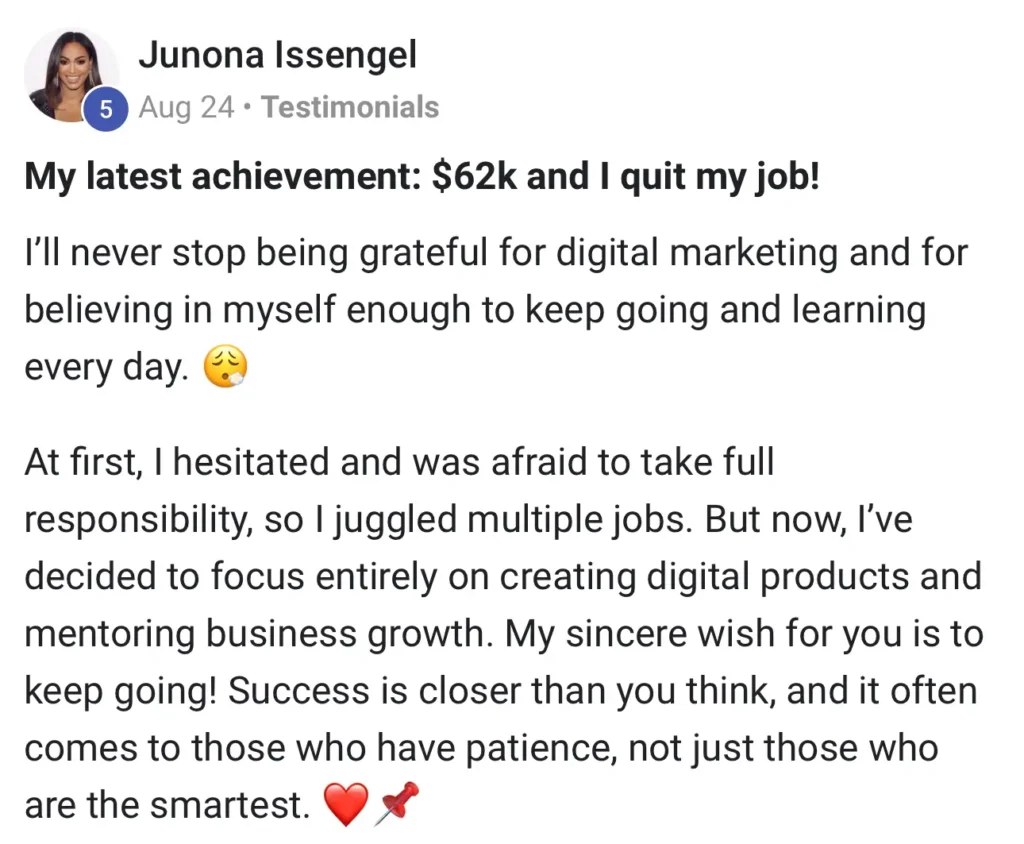

Real Life Results: Explore More DWA Testimonials

Discover how Digital Wealth Academy is changing lives.

Read authentic success stories and see the incredible results members are achieving with the DWA program.

FAQ

Can I really build savings with irregular income?

Absolutely! Start by calculating your bare minimum monthly expenses, then use the 50/30/20 rule as a flexible guide. Apps like Mint or YNAB help track variable paychecks. Even weekly transfers to a high yield savings account add up faster than you’d think.

Should I bother with retirement savings on a tight budget?

Yes, especially if your employer offers 401(k) matches. That’s free money! Even 1% of each paycheck adds up through compound growth. If no employer plan exists, Roth IRAs let you withdraw contributions penalty free, making them dual purpose emergency funds with tax benefits.

What’s the best hack for tracking daily spending?

Go analog for 30 days. Carry a cash allowance for non essential spending, when it’s gone, you’re done. For digital tracking, try the “Round Up” feature in apps like Chime or Acorns. Every coffee purchase becomes a forced savings move, and you’ll barely notice the micro transfers.

How do I create an emergency fund without extra cash?

Start with a 0 mini cushion. Sell unused items on Facebook Marketplace, take one no spend weekend per month, or redirect credit card rewards directly to savings. Keep this fund in a separate online bank account, out of sight, out of mind, but accessible within 2 or 3 days if needed.

Any sneaky ways to save without feeling deprived?

Try the “48 hour rule” for impulse buys, if you still want it after two days, budget for it. Use cashback apps like Rakuten for essentials you’d buy anyway. Host potluck game nights instead of dinners out. Swap streaming services with friends every 3 months, fresh content, same subscription cost split four ways.

How do I use credit cards without drowning in debt?

Treat plastic like cash replacements, not loans. Pay balances in full every month to avoid interest rates that gut your budget. Use cards with cashback rewards on groceries or gas, then immediately transfer those earnings to your savings account. Pro tip: Set up text alerts for when spending hits 30% of your limit.

What’s the fastest way to cut monthly bills?

Negotiate insurance rates and utility plans first. Providers often have unadvertised discounts. Cancel subscriptions you haven’t used in 60 days (looking at you, forgotten gym memberships). Switch to autopay for credit cards and services. Many companies offer 5% to 10% discounts for automated payments.