Desiring to know how to pay off debt quickly?

Ever stare at your credit card statement and wonder why financial freedom feels like a distant meme?

I’ve been there, juggling payments, dodging calls, and feeling like debt’s a permanent roommate.

But here’s the kicker: breaking free isn’t about magic hacks.

It’s about strategy that actually sticks.

Most folks think tackling credit balances means sacrificing Netflix or eating ramen for years.

Newsflash: that’s burnout waiting to happen.

What if I told you there’s a smarter way to slash what you owe without turning your life into a sad spreadsheet?

I’ve helped dozens of friends flip their finances using tactics that banks don’t advertise.

This isn’t theory, it’s real world stuff that works whether you’re battling student loans or store cards.

We’re talking about aligning payments with your cash flow, negotiating like a pro, and using psychological tricks to stay motivated.

Remember, with the right plan and mindset, you can turn things around faster than you think.

After years of testing different financial tools and systems, one method consistently helped people take control of their money: Digital Wealth Academy (DWA).

The Digital Wealth Academy

earn 85% as AN affiliate – learn how to start or scale your own business

While DWA is known for helping people earn online, one of its hidden strengths is teaching you multiple business models that you can implement to increase your income and pay off your debt faster, even if you’re starting from scratch.

Many users begin seeing progress in just weeks, using that extra income to crush their debts faster than they imagined.

But remember: the speed at which you pay off debt depends on how focused and disciplined you are.

The more action you take, the quicker your financial freedom becomes a reality.

Ready to break free from debt?

Start by learning the skills that put you in control.

Ready to rewrite your money story?

Table of Contents

Key Takeaways

Debt elimination requires a personalized strategy, not one size fits all solutions

High interest balances demand priority over emotional payoff approaches

Automated systems prevent missed payments and late fees

Creditors often negotiate terms if approached strategically

Small behavioral changes create big financial momentum

Introduction to Your Debt Free Journey

Let’s be real: staring down credit balances feels like facing a hungry bear.

But here’s the secret, that bear’s actually made of paper.

I learned this the hard way after ignoring my statements for months.

Turns out, knowledge beats anxiety every time.

Your first move?

Grab all your bills and stack them like poker chips.

I helped my cousin do this last year.

She discovered $12k in credit debt but turned it around in 18 months.

Here’s what works:

| Approach | Focus | Risk | Best For |

|---|---|---|---|

| Emotional | Quick wins | Higher interest costs | Motivation seekers |

| Strategic | Interest savings | Delayed gratification | Number crunchers |

Either way, you need a plan that fits your cash flow.

One client reduced payments by 40% through simple rate negotiations.

Banks won’t tell you this, but they’d rather get paid slowly than not at all.

Truth bomb: Your credit score isn’t a report card, it’s a tool.

Use it to unlock better terms.

I’ve seen 620 FICO scores land 0% balance transfer offers.

The journey begins when you stop reacting and start strategizing.

Understanding Your Debt Landscape

Truth time: Your financial battlefield needs recon before you charge in.

Last month, my neighbor thought she owed $15k.

Turns out her credit card balances alone totaled $22k.

Knowledge isn’t power here, organized knowledge is.

Inventory Your Financial Opponents

Grab your phone or a cocktail napkin, we’re making a debt hit list.

Every lender gets a line item: current balance, minimum payment, APR.

Don’t sugarcoat it.

The average credit card debt climbed to $6,501 last year, chances are you’re not the biggest spender on the block.

| Debt Type | Examples | Interest Impact | Flexibility |

|---|---|---|---|

| Revolving | Credit cards | 18-29% APR | Variable payments |

| Installment | Auto loans, mortgages | 4-7% APR | Fixed terms |

Decode the Numbers Game

Those percentage rates aren’t just scary numbers.

They’re your strategic map.

I helped a friend slash $200/month by focusing on her 29% credit card first.

Pro tip: AnnualCreditReport.com gives free snapshots, but 34% of reports contain errors anyway.

- Red alert: Balances above 30% credit limit hurt scores

- Hidden gem: Some store cards offer rate reductions on request

- Time machine: Payment history accounts for 35% of FICO® Score

Seeing everything laid out does something weird.

It turns panic into a playbook.

You’ll spot patterns (why three streaming services?), opportunities (hello, forgotten 401k loan), and maybe even hope.

Tracking Spending and Setting Up Your Budget

Remember that time you swore you only spent $100 on coffee last month…

until your bank statement laughed in your face?

We’ve all been there.

Building a budget that sticks starts with confronting reality, not the Instagram filtered version of your finances.

Analyzing Monthly Expenses and Income

Your credit card statements are like a GPS for your money.

They show exactly where you wandered off course.

Grab your last three months’ bills and look for patterns:

- Surprise expenses that pop up like uninvited guests

- Subscription services you forgot existed

- Weekend splurges that seemed reasonable at the time

| Essential Expenses | Common “Oops” Categories | % of Income Goal |

|---|---|---|

| Rent/Mortgage | Food Delivery | 25-30% |

| Utilities | Streaming Services | 5-10% |

| Groceries | Impulse Buys | 10-15% |

Establishing a Baseline Budget for Essentials

Here’s where grown up decisions happen.

Separate your “can’t live without” from your “makes life nicer”.

My rule?

If it won’t kill you to lose it for 30 days, it’s probably a want.

Your baseline should cover:

- Housing costs (even if that means roommates)

- Basic utilities (electricity > Netflix)

- Minimum debt payments (keep creditors happy)

Pro tip: Track every dollar for one month using your phone’s notes app.

You’ll spot leaks faster than a plumber.

That $12 daily lunch habit adds up to $3k/year!

Creating a Realistic Debt Repayment Plan

What’s your financial personality type, instant gratification junkie or spreadsheet superhero?

Your answer determines which debt repayment plan will stick.

Let’s break down the two heavyweight strategies battling for your attention.

Snowball vs Avalanche: Choose Your Fighter

The snowball method works like gaming achievements, knock out your smallest balance first.

Think of the Lacys: they vaporized a $1,200 store card in 30 days.

That rush?

It fueled their $21k debt knockout in 22 months.

| Method | Focus | Best For | Savings Potential |

|---|---|---|---|

| Snowball | Quick wins | Motivation seekers | Psychological boost |

| Avalanche | High interest rates | Numbers people | Long term savings |

Strategic Debt Prioritization

Here’s the math: paying 29% APR costs $242/year per $1k owed.

The avalanche method slashes that faster.

But if spreadsheets make you snooze, the snowball’s early wins prevent burnout.

Pro tip: Hybrid approaches exist.

One client tackled her $500 medical bill first (balance first strategy), then switched to attacking 24% credit card interest.

The key?

Flexibility beats perfection every time.

Your plan should fit like favorite jeans, snug enough to work, loose enough to breathe.

Whether you’re team snowball or avalanche, consistent action matters more than textbook strategies.

a free beginner’s guide

DWA Sneak Peek

Learn the easiest and fastest way to start or exponentially grow your existing business.

How to pay off debt quickly: Proven Strategies in Action

What if your credit card company started rooting for you?

Wild thought, right?

Here’s the playbook that turns minimum payments into knockout punches.

I watched my sister obliterate $8k in card debt using this exact blueprint, no lottery wins, just smart execution.

Your first move: Treat minimum payments like seatbelts, non negotiable safety nets.

But here’s where magic happens.

That $50 you spend on Friday night tacos?

Redirect it to your target credit card.

Every dollar above minimums becomes a debt shredding laser beam.

Let’s break down real world math:

| Strategy | Monthly Payment | Interest Saved | Time Saved |

|---|---|---|---|

| Minimums Only | $300 | $0 | 0 months |

| Focused Attack | $500 | $1,892 | 27 months |

See that difference?

That’s actual money staying in your pocket.

A friend used tax refunds to nuke his $3k balance, then rolled those payments into his next target.

The snowball effect is real.

Three tactical moves I’ve seen work:

- Set calendar reminders two days before due dates

- Use app rounding features to sneak in extra payments

- Negotiate one streaming service instead of three

Remember: Repayment isn’t about deprivation, it’s about redirecting cash flow.

Those “I’ll just charge it” moments add up faster than you think.

Stay focused, stay consistent, and watch those balances crumble.

Leveraging Balance Transfers and Debt Consolidation Options

Ever feel like your credit card company’s laughing all the way to the bank?

Here’s your secret weapon: shifting high interest balances to smarter payment tools.

I helped my barista friend crush $8k in plastic debt using these moves, no second job required.

Benefits of 0% APR Balance Transfer Cards

The Citi Simplicity Card offers 21 months interest free on transferred balances, that’s like hitting pause on a financial avalanche.

But watch the 3-5% transfer fee.

Pro tip: Calculate if the fee beats your current interest.

For $5k debt at 24% APR, you’d save $2,100 even after a 5% fee.

Considering Debt Consolidation Loans

When balance transfers aren’t an option, personal loans can be lifesavers.

Average rates hover around 11%, way better than plastic’s 20%+ torture.

Check this comparison:

| Option | Rate | Fee | Best For |

|---|---|---|---|

| Balance Transfer | 0% | 3-5% | Short term payoff |

| Consolidation Loan | 6-24% | $0-5% | Multi year plans |

The kicker: 78% of people who consolidate without budget changes end up deeper in the hole.

Lock those paid off cards in a drawer, literally.

Whether you choose credit reshuffling or loan consolidation, the math must win.

Run the numbers, set autopay, and watch those balances shrink faster than ice in July.

The Digital Wealth Academy

earn 85% as AN affiliate. learn how to create or scale your business.

Practical Tips to Slash High Interest Rates

Did you know your credit card company might actually help you save money?

I discovered this when my neighbor Karen called her issuer and shaved 4% off her APR, no Jedi mind tricks required.

Let’s break down two powerful moves to shrink those pesky percentage rates.

Negotiating Lower Credit Card APRs

Your phone might be mightier than you think.

LendingTree data shows 76% of users who asked for rate reductions succeeded last year.

Here’s how to join them:

- Call during business hours, avoid weekend reps

- Mention competitor offers (even if you don’t have one)

- Highlight your payment history

| Strategy | Success Rate | Average APR Drop | Best Time to Ask |

|---|---|---|---|

| Loyalty Play | 68% | 2.1% | After 6 months |

| Balance Threat | 82% | 3.4% | Before the due date |

A friend got his 24% interest slashed to 19% by simply saying, “I’m considering balance transfer options”.

Sometimes the threat works better than the execution.

Exploring Cash Advances and Alternatives (With Caution)

Cash advances are like financial quicksand, easy to step into, hard to escape.

One friend learned this the hard way when a $500 advance ballooned to $728 with fees and 29% rates.

Consider these instead:

- Peer to peer lending apps for short term needs

- Credit union personal loans (avg. 9% APR)

- Side hustle income streams

Remember: Every percentage point reduction on a $5k credit card balance saves $50/year.

That’s a weekend getaway fund growing silently in your wallet.

Reducing Unnecessary Expenses to Boost Repay

Your morning latte isn’t the enemy, but those 17 streaming subscriptions might be.

I once helped a coworker find $287/month in sneaky charges just by auditing his “essential” services.

Turns out, budget leaks often hide in plain sight.

Start with low hanging fruit: negotiated my internet bill down 20% last Tuesday.

Companies like Comcast and Verizon often have retention deals they won’t offer unless you ask.

That $15/month savings?

That’s $180/year toward balances.

Three painless cuts I’ve seen work:

- Swapping DoorDash for weekly meal prep (saves $200+/month)

- Using library apps instead of Amazon book binges

- Pausing one streaming service quarterly

A friend saved $600 annually by carpooling twice weekly, and gas money became debt demolition fuel.

Remember: This isn’t about deprivation.

It’s about redirecting cash flow toward what truly matters.

Every dollar saved becomes a weapon against interest charges.

Found $50/month?

That’s $600 yearly, enough to vaporize a $1k balance in 18 months.

Small wins create big momentum when you channel savings strategically.

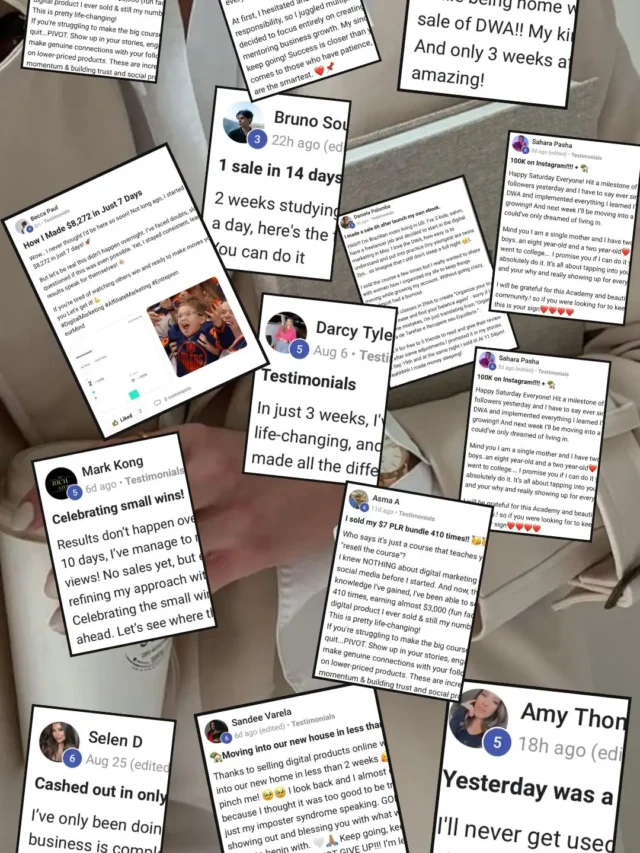

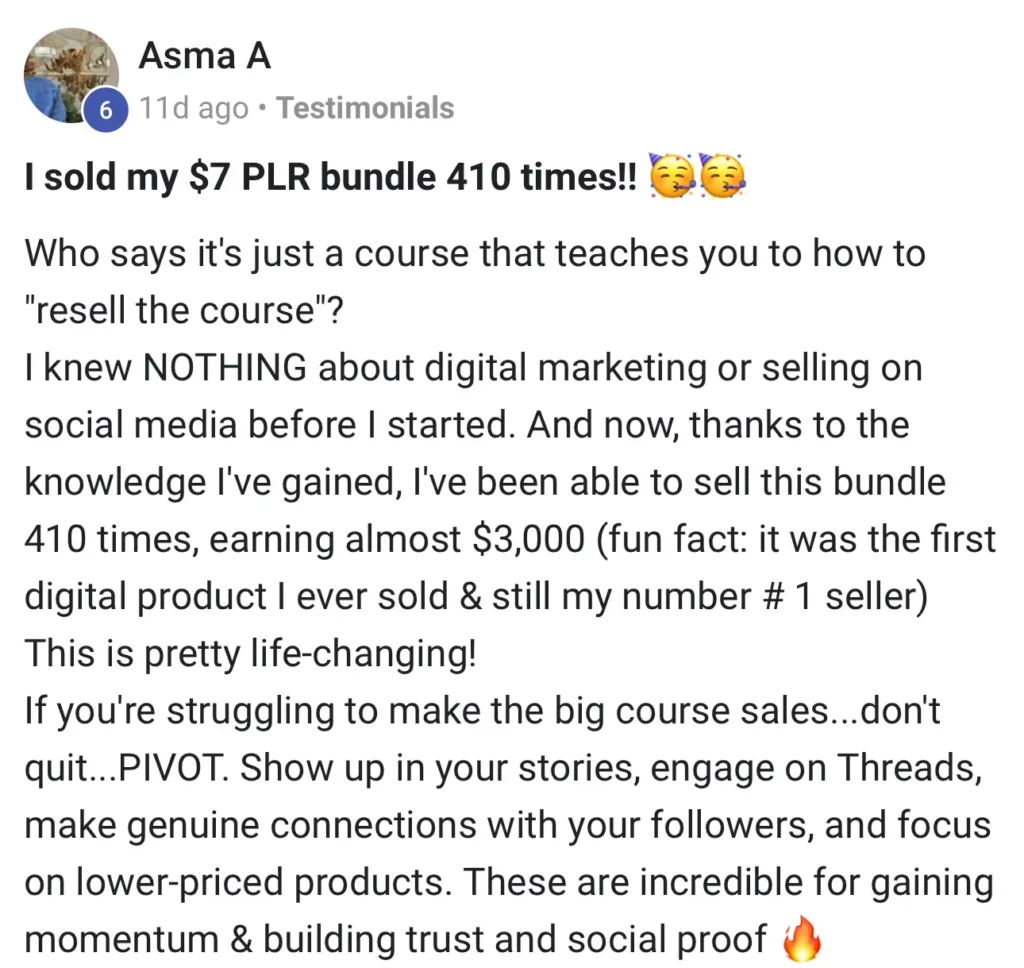

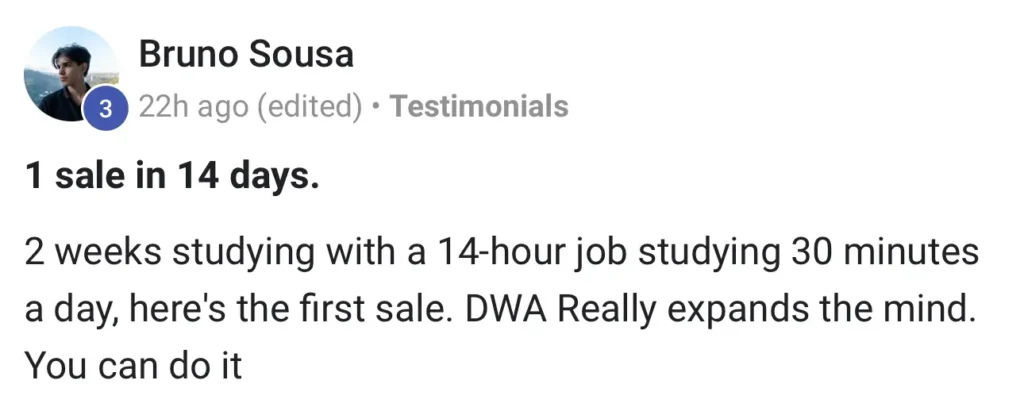

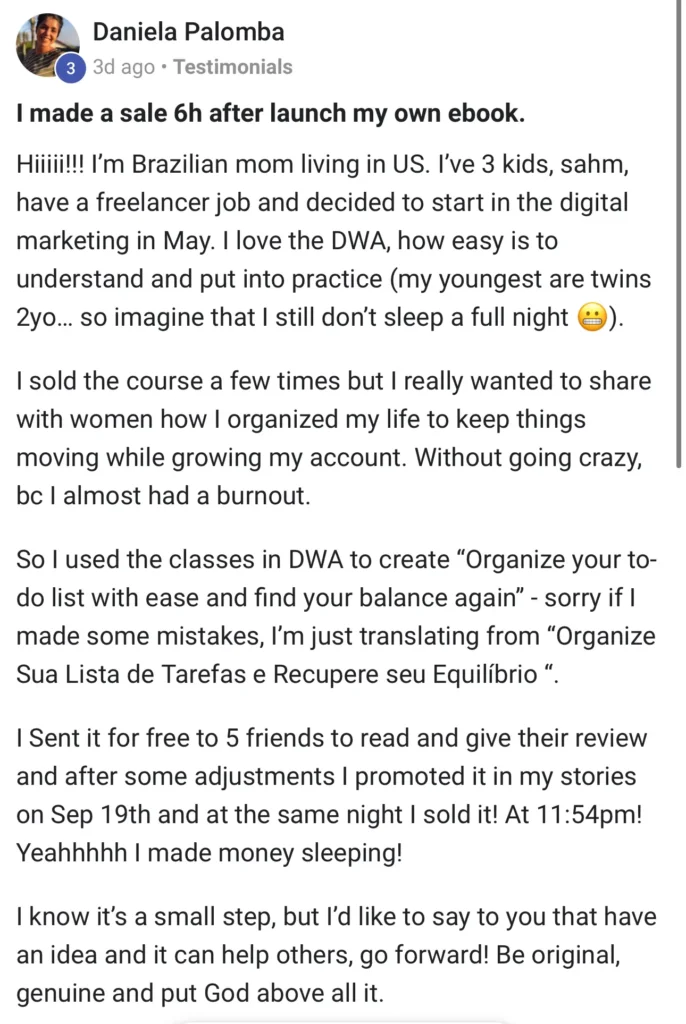

Real Life Results: Explore More DWA Testimonials

Discover how Digital Wealth Academy is changing lives.

Read authentic success stories and see the incredible results members are achieving with the DWA program.

FAQ

Which debt repayment method hits harder, snowball or avalanche?

The snowball method punches debt in the face by tackling your smallest balance first. Those quick wins keep you motivated. The avalanche method goes for the throat by crushing high interest rates first. Choose based on whether you need psychological wins (snowball) or maximum interest savings (avalanche).

Can balance transfer cards actually help me escape credit card debt?

Hell yes, if you play it smart. A 0% APR balance transfer card lets you pause interest for 12-21 months. But watch out: you’ll need a decent credit score (usually 670+), and those 3-5% transfer fees add up. Pro tip: Crunch the numbers to ensure you’ll clear the balance before the promo period ends.

Can I really negotiate lower interest rates with credit card companies?

Absolutely. I’ve done it myself. Call your issuer and say, “I’m committed to paying this off. Can we work on the APR?” Mention competitor offers or your payment history. Even a 5% rate drop can save hundreds. Worst case? They say no. Best case? You’re suddenly paying less interest on that credit card debt.

Should I get a debt consolidation loan or stick with balance transfers?

Depends on your debt’s interest rates and your discipline. Debt consolidation loans turn multiple payments into one fixed rate payment, great if you hate juggling due dates. But if you’ve got good credit and can pay fast, balance transfer cards’ 0% periods are golden. Just don’t rack up new charges on the old cards!

What’s the fastest way to free up cash for debt payments?

Three words: Ruthless. Expense. Autopsy. Cancel unused subscriptions, meal prep instead of Uber Eats, and sell stuff collecting dust. Use that extra cash to nuke your credit card balances. Bonus move: Start a side hustle, even $200/month extra, can cut your repayment timeline by months.

How do I decide which debts to attack first?

Two schools of thought: 1) The “I need wins now” crew should follow the snowball method (smallest balances first). 2) The math nerds should target debts with the highest interest rates first. Either way, keep making minimum payments on other accounts to avoid late fees.

Are cash advances ever a good idea for paying off debt?

Only if you enjoy financial self sabotage, cash advances hit you with insane interest rates (often 25%+) and fees. They’re like putting out a fire with gasoline. Instead, build a $500 to $1k emergency fund so you’re not tempted to swipe when surprises hit.

What expenses should I slash first to boost debt payments?

Start with the “Big Three”: 1) Dining out/Starbucks runs, 2) Streaming services you never use, 3) Impulse Amazon purchases. Next, negotiate bills like insurance and phone plans. Use a budgeting app to track where your money’s actually going. You’ll find leaks faster than a sinking canoe.

What expenses should I slash first to boost debt payments?

Start with the “Big Three”: 1) Dining out/Starbucks runs, 2) Streaming services you never use, 3) Impulse Amazon purchases. Next, negotiate bills like insurance and phone plans. Use a budgeting app to track where your money’s actually going. You’ll find leaks faster than a sinking canoe.