Let’s get real: that pit in your stomach feeling when bills arrive isn’t just stress.

It’s life hijacking your peace.

I’ve been there for years.

Turns out.

73% of Americans feel financial stress daily, according to Capital One’s 2025 survey.

My breaking point?

Getting by without work, having a family depending on me.

Millennials battle rent hikes.

Gen X scrambles for retirement plans.

Me?

I mastered the art of triaging financial challenges without losing sleep.

This isn’t about spreadsheets or guru advice.

It’s about sustainable fixes that stick.

Like realizing “budgeting” works better when you call it “spending strategy night” with pizza involved.

Here’s what changed everything: treating money like a tool, not a tyrant.

Small wins, negotiating one bill, automating savings, and building momentum.

Progress beats perfection every time.

Now I’m sharing the exact playbook that transformed my relationship with cash flow chaos.

Most money problems don’t come from how much you earn.

They come from not knowing how to earn more, manage what you have, or multiply it.

The truth is, if you want to break free from living paycheck to paycheck, you need to focus on building skills that generate consistent and scalable income.

That’s exactly what I did with Digital Wealth Academy (DWA).

The same program that taught me a high income marketing skill, helped me grow my monthly income, and gave me the tools to create multiple streams of income based on my preferences.

DWA offers:

- 52+ business and marketing modules to start or scale an online business

- A 123.5k+ active community for support and real-time learning

- Weekly live sessions and webinars with specialists in multiple languages

- Step by step guidance to help you build real online assets, not just temporary cash fixes

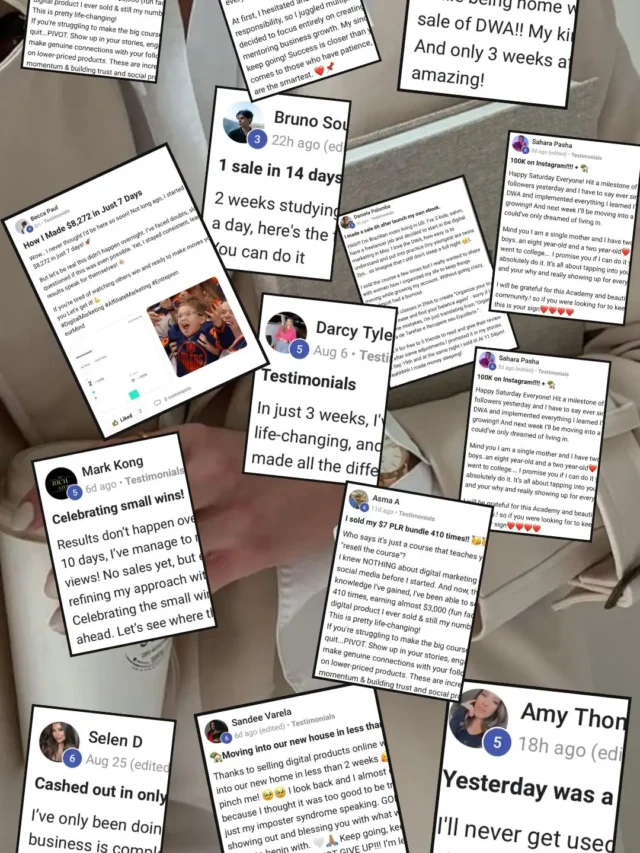

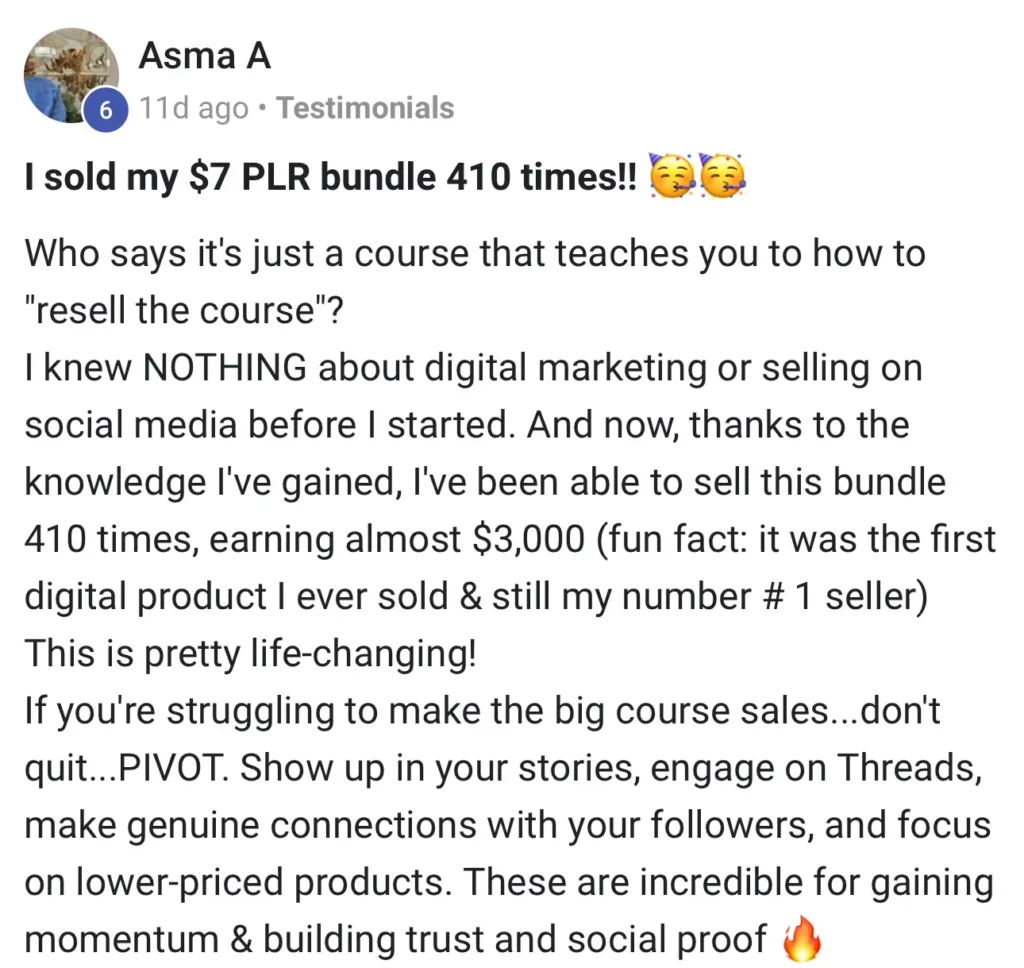

Some students have even seen results in just a few weeks.

But of course, results vary depending on your effort, dedication, and consistency.

The key to solving money problems is building income producing assets, managing your cash flow wisely, and investing in yourself first.

Explore DWA and Start Solving Your Money Problems

a free beginner’s guide

DWA Sneak Peek

Learn the easiest and fastest way to start or exponentially grow your existing business.

Table of Contents

Key Takeaways

Financial stress impacts 3 out of 4 Americans daily

Different generations face unique monetary hurdles

Practical strategies work better than rigid systems

Small, consistent actions create lasting change

Mindset shifts are crucial for financial confidence

Understanding Money Problems and Their Impact

What if I told you cash flow issues could literally keep you up at night?

I used to dismiss financial strain as temporary math errors, until my body started sending invoices.

Chronic headaches.

Canceled plans.

Endless scrolling through bank apps at 3 AM.

Defining the Silent Budget Killer

Financial anxiety isn’t about numbers.

It’s the gut punch when your card declines at the pharmacy.

The shame spiral when friends plan dinners you can’t afford.

I once canceled three birthday parties in a row before realizing:

“This isn’t frugality. It’s survival mode”.

“Every overdraft fee felt like personal failure, until I learned 68% of Americans live paycheck to paycheck”.

When Stress Becomes Physical

Your shoulders tense when bills arrive.

Your jaw clenches during money talks.

I tracked my symptoms for a month: 14 sleepless nights, 7 skipped meals, 3 explosive family arguments.

Turns out, financial strain:

- Triggers cortisol spikes comparable to public speaking

- Reduces cognitive function by 13% (per Harvard research)

- Makes “treat yourself” feel like betrayal

The turning point?

My doctor connected my mystery rashes to constant worry.

Now I see financial health as self care, no yoga mat required.

Identifying Key Financial Stressors

Ever felt like your bank account has a mind of its own?

Mine once maxed out three credit cards while I slept.

Turns out, most financial fires start small.

A forgotten subscription here, an emergency vet bill there.

But when they spread?

Watch out.

Spotting the Root Causes: Debt, Credit Card Challenges, and Job Loss

My wake up call came when my $5,000 debt ballooned to $7,200 in 18 months.

Those sneaky 28.70% interest rates?

They’re like termites eating your financial foundation.

I learned to:

- Track every swipe (spoiler: DoorDash was my sleepwalking spend)

- Separate needs from “but it’s on sale!” impulses

- Negotiate rates with card companies. Yes, that actually works

Job loss anxiety hit harder than I expected.

Even stable paychecks felt shaky after seeing friends get laid off.

I started treating my emergency fund like a non negotiable bill, because panic attacks don’t accept credit.

“Compound interest is either your best friend or your worst enemy. I made mine enemy of the year three times running”.

Unexpected costs?

They’re inevitable.

My strategy: name them.

“Tire replacement” sounds less scary than “random disaster”.

Now I budget $200 per month for life’s plot twists.

Pro tip: Your credit score will thank you for this approach.

Creating a Budget and Managing Expenses

Budgeting hit me like a rogue Netflix subscription.

Sneaky, persistent, and way more impactful than expected.

My “I’ll remember what I spent” system?

Failed harder than my sourdough starter during lockdown.

Here’s what finally worked.

Tracking Your Income and Outflows

I started with net income.

The actual cash is hitting my account after taxes.

Shock #1: My $75k salary felt more like $52k.

I tracked every dollar for 30 days, including that $4.50 latte I swore I’d quit.

Turns out lattes add up faster than Taylor Swift eras.

The 50/30/20 rule became my GPS.

Needs (rent, groceries) got 50%.

Wants (concert tickets, fancy cheeses) 30%.

The remaining 20% tackled savings and debt.

Automatic payments for bills saved me $127 in late fees last year alone.

Note: The 50/30/20 rule has a problem.

This is how you can fix it.

It’s an good starting point.

Utilizing Apps and Tools for Effective Budgeting

My game changer?

Apps that auto categorize spending.

Bank of America’s tool showed me 23% of my income vanished into “miscellaneous”, code for impulse buys.

Now I get alerts when my grocery trips exceed $150 per week.

Three app features I can’t live without:

- Real time balance updates (bye, overdraft surprises)

- Custom spending caps per category

- Monthly reports showing progress toward goals

Biggest lesson?

Budgets thrive on flexibility.

I adjust mine quarterly, because sometimes life needs more than ramen noodles and regret.

Strategies for Paying Down Debt

Debt feels like quicksand.

The harder you struggle, the deeper you sink.

I learned this the hard way with $6,580 in credit card debt (TransUnion’s 2024 average).

My wake up call?

Realizing my monthly payments barely covered the interest.

Exploring the Snowball and Avalanche Methods

I tested both popular tactics.

The snowball method, crushing small balances first, gave me quick dopamine hits.

Paying off that $300 store card felt like winning a boxing match.

The avalanche approach (targeting high interest debt) made mathematical sense but lacked emotional payoff.

| Method | Pros | Cons |

|---|---|---|

| Snowball | Motivational wins | Higher long term costs |

| Avalanche | Saves on interest | Slow initial progress |

“I kept one card frozen in literal ice. No impulse swipes during payoff mode”.

Avoiding New Credit Pitfalls

New charges during debt repayment are like adding rocks to your backpack mid hike.

I canceled unused cards but kept my oldest account open to protect my credit history.

Automatic payments became non negotiable.

No more $38 late fees.

Considering Debt Consolidation Options

When my progress stalled, I explored loan options.

A personal loan at 12% APR slashed my overall interest rates from 22 to 29%.

Key lesson: Consolidation works best with spending discipline.

Otherwise, you’re just moving chairs on the Titanic.

Your strategy doesn’t need to be perfect.

Mine certainly wasn’t.

But consistent action, even $20 extra payments creates momentum that compound interest can’t defeat.

Building an Emergency Fund for Stability

Emergency funds sound about as fun as flossing.

Everyone says you need one, but starting feels impossible.

My “savings account” used to be the $17 in my glove compartment.

Then my dentist charged $300 for a crown, and I learned why 56% of Americans can’t cover a $1,000 surprise (Bankrate 2024).

Setting Achievable Savings Goals

Three to six months of living expenses?

I nearly choked on my coffee.

So I broke it down: $1,000 first, then one month’s rent, then three.

My “latte fund” became my emergency fund.

$25 weekly transfers added up faster than I expected.

“Those with $500 saved reduce financial stress by 43%”

Federal Reserve Report

Here’s what worked:

- Calculated essential costs (rent, utilities, meds)

- Set monthly savings targets based on net income

- Celebrated every $500 milestone with free rewards

Automating Contributions to Your Fund

Manual transfers lasted three days.

Automation changed everything.

Now 10% of every paycheck vanishes before I see it.

Like magic, but with better interest rates.

| Manual Savings | Automated Savings |

|---|---|

| 27% success rate | 89% consistency |

| Forgetful withdrawals | Stealth wealth building |

Pro tip: Treat your emergency fund like a non negotiable bill.

Mine lives in a separate credit union account.

Out of sight, out of spending range.

Overcoming Financial Stress and Emotional Challenges

Financial anxiety ever make your hands shake while logging into your bank app?

Mine did.

That 52% statistic about cash related mental health struggles?

Been there, printed the T-shirt, burned it in cathartic frustration.

Recognizing the Mental Toll

I used to think “financial problems” meant math errors.

Then came the physical receipts: migraines during tax season, insomnia before payday, and a permanent pit in my stomach.

The American Psychological Association nailed it: “Chronic money stress rewires your brain’s threat response”.

Three red flags I ignored:

- Dreading mail time like jury duty

- Feeling phantom phone vibrations from creditors

- Rationalizing “I’ll deal with it later” for 6 months straight

“Avoidance feeds anxiety. I started treating bills like Band Aids. Rip fast, heal faster”.

Stress Management That Actually Works

My breakthrough came when I paired spreadsheets with self care.

Here’s the combo that worked:

| Avoidance Tactics | Action Steps |

|---|---|

| Ignoring statements | 15 minute weekly money dates |

| Panic scrolling | Box breathing during bill pay |

| Isolation | Accountability chats with my sister |

Pro tip: Schedule financial tasks when you’re mentally sharp.

For me?

Saturday mornings with oat milk lattes.

The key is pairing tough tasks with small rewards.

Progress isn’t linear.

Some weeks I still feel that familiar chest tightness.

But now I have tools, and data, showing how far I’ve come.

Turns out facing challenges head on builds more than credit scores.

It builds grit.

Tips to Increase Income and Control Spending

Ever tried budgeting while your bank account laughs?

I discovered attacking financial challenges requires dual tactics: boosting cash flow and plugging leaks.

Here’s how I turned my financial stalemate into forward motion.

Exploring Side Hustles and Alternative Income Sources

My “aha” moment?

A Saturday morning dog walking gig paid my internet bill.

Now I mix freelance writing with seasonal tax prep work.

The key: match skills to income opportunities that don’t burn you out.

Three rules I live by:

- Track hourly rates vs. energy spent

- Automate 30% of side hustle earnings to savings

- Reinvest in skills that increase earning potential

“Side hustlers earning $500+ per month reduce financial stress by 38%”

Upwork 2024 Report

| Hustle Type | Time Commitment | Avg Earnings |

|---|---|---|

| Freelance Writing | 6 hrs per week | $420 |

| Rideshare Driving | 10 hrs per week | $310 |

| Online Tutoring | 4 hrs per week | $280 |

Cutting Unnecessary Expenses for Better Financial Health

I found $127 per month in forgotten subscriptions.

Including a French cheese club I’d never used.

Now I audit expenses quarterly using app alerts.

Pro tip: Rename “budget cuts” to “financial upgrades”.

It stings less.

My elimination hierarchy:

- Recurring charges without benefits

- Convenience fees (looking at you, $3 ATM charges)

- Duplicate services (how many streaming platforms?)

Small changes create big impacts.

Cutting two $40 weekly takeout orders funds an extra $320 per month debt payment.

Bonus: My kitchen skills now rival Chef Boyardee’s.

Conclusion

Financial freedom isn’t a destination.

It’s building bridges over daily cash flow gaps.

My journey taught me that lasting change comes from progress, not perfection.

Those late night spreadsheet sessions?

They matter less than showing up consistently, even when life throws curveballs.

Your path might involve crushing debt first.

Mine required rethinking retirement plans at 35.

What unites us?

The courage to create a plan that bends without breaking.

I keep a Post It on my monitor: “$20 today beats $0 tomorrow”.

New data shows 61% of Americans now track spending weekly, up from 39% in 2020.

That’s the power of small steps.

Whether you automate savings or renegotiate bills, each action chips away at financial stress.

Here’s the truth no one mentions: goals evolve as you do.

My “emergency fund” became a “life happens fund”.

My budget now includes line items for joy and spontaneity.

Your turn, what’s one tweak you’ll make this week?

Real Life Results: Explore More DWA Testimonials

Discover how Digital Wealth Academy is changing lives.

Read authentic success stories and see the incredible results members are achieving with the DWA program.

FAQ

How does financial stress actually impact daily life?

It’s like carrying a backpack full of bricks, hidden but exhausting. Stress from credit card balances, missed payments, or living paycheck to paycheck can tank your focus, sleep, and even relationships. I’ve seen folks delay career moves or skip social events just to avoid spending. It’s a silent productivity killer.

What’s the fastest way to identify my biggest financial stressors?

Grab your last three bank statements and a highlighter. Circle recurring charges for stuff you don’t need, streaming services you forgot about, that gym membership collecting dust. Then look for patterns: late fees, interest charges, or overdrafts. Those red flags scream “fix me first”.

Snowball vs avalanche debt methods. Which actually works better?

Depends on your brain wiring. Snowball (paying smallest debts first) gives quick wins for motivation addicts. Avalanche (tackling high interest debt) saves more cash long term. I hybridized them: knock out one small balance for momentum, then crush the 24% APR card. Why choose when you can game the system?

Can I really build an emergency fund while paying down debt?

Yes, but think “micro fund” first. Even $500 stops you from reaching for plastic when the tire blows. Automate $20 per week to a separate account. Name it “Oops Fund” if that helps. Once debts are below 30% credit utilization, ramp up savings. Baby steps beat standing still.

How do I stop emotional spending without feeling deprived?

Replace the ritual, not the reward. If retail therapy is your stress reliever, try “window shopping” in your cart for 24 hours before buying. Or swap Amazon deep dives for free library apps. One client reallocated her “guilt spend” to a “F It Fund” for intentional treats. Less shame, more strategy.

Are side hustles worth the time if I’m already overwhelmed?

Only if they’re stupidly efficient. Focus on skills you already have, like reselling unused items (hello, Facebook Marketplace) or weekend dog walking. I prioritize gigs under 5 hours per week that pay $25+ per hour. Time poverty is real. Your side hustle shouldn’t become a second full time job.

Is debt consolidation a trap or a legit solution?

It’s a tool, not magic. Rolling multiple payments into one can lower interest and simplify tracking. But if you close old accounts, your credit score might dip temporarily. Always read the fine print. Some companies sneak in fees equal to what you’d pay in interest. Pro tip: Credit unions often offer better terms than online lenders.