Ever wonder how we went from trading goats to tapping phones for coffee?

The history of money explains to you how.

Let’s unpack this wild ride.

Money isn’t just paper in your wallet.

It’s humanity’s greatest collaboration tool.

Think of it as the original social network, connecting people across continents and centuries.

Picture this: early humans swapping tools for food.

Messy, right?

Bartering worked until someone wanted a cow but only had chickens.

Enter the first game changer

Objects with agreed value.

Shells, grains, even giant stone wheels (yes, really).

These weren’t just currencies.

They were trust made tangible.

Fast forward a few millennia.

Coins stamped with rulers’ faces solved counterfeiting.

Paper notes replaced heavy metal.

Each leap tackled trade’s pain points.

Today’s digital wallets?

Just the latest fix for our need for speed and convenience.

Here’s the kicker: every payment method reflects its era’s values.

Ancient societies prized durability.

Medieval kingdoms needed portability.

Now?

We demand instant transactions.

This story isn’t about stuff. It’s about us.

Our creativity, our flaws, and our relentless drive to make life easier.

Understanding the history of money helps you see how wealth creation has evolved, and why learning how to earn online today is one of the smartest moves you can make.

Money started as barter systems, where people exchanged goods and services directly.

Eventually, societies introduced commodity money like gold and silver, then coins and paper currency, and later credit systems and digital banking.

Today, we live in a world where digital income streams and online businesses are redefining how wealth is built.

That’s why I chose to invest in myself by joining Digital Wealth Academy (DWA).

A proven program that helped me master a high income marketing skill and significantly increase my monthly income.

DWA gives you:

- Over 52 business and marketing modules, so you can start or scale your online business

- An active community of 123.5k+ members to support and learn with

- Weekly webinars and coaching sessions in multiple languages

- Guidance to build multiple income streams and digital assets based on your preferences

Some students have seen real results in just a few weeks, though your outcome depends on your effort, consistency, and dedication.

If history shows us anything, it’s that those who adapt early to the next evolution of money are the ones who grow their wealth the fastest.

Learn the New Rules of Money with DWA

a free beginner’s guide

DWA Sneak Peek

Learn the easiest and fastest way to start or exponentially grow your existing business.

Table of Contents

Key Takeaways

Early exchange systems relied on physical goods before standardized currencies emerged

Trust forms the foundation of all monetary systems, from shells to digital transactions

Currency innovations directly addressed limitations in trade efficiency

Payment methods evolved to match technological capabilities and cultural needs

Modern finance systems inherit core principles from ancient exchange practices

Digital payments represent

Introduction to the Evolution of Currency

Imagine trying to buy groceries with a sack of salt.

That’s where we started.

Currency evolution isn’t about shiny coins or crisp bills.

It’s humanity’s endless quest to solve three big headaches:

Who can I trust?

Where do I store value?

How do we swap stuff without the hassle?

Let’s break down the three main players in this game.

Commodity money had real value.

Think of gold coins you could melt into jewelry.

Representative money acted as an IOU, like paper notes backed by gold in a vault.

Then came fiat money, where we all just agree green paper has worth.

Wild, right?

Here’s the kicker: these systems overlapped for centuries.

Ancient Mesopotamians used barley as currency while trading silver rings.

Medieval Europeans juggled coins, tally sticks, and promissory notes.

Every form of currency solved specific problems.

Until new challenges demanded better solutions.

| Type | Basis of Value | Example | Era |

|---|---|---|---|

| Commodity | Material worth | Gold coins | Ancient – 1900s |

| Representative | Asset backed | Gold certificates | 1600s – 1971 |

| Fiat | Government decree | Modern dollars | 1971 – present |

Technological leaps changed the game faster than kings could mint coins.

Political shifts redrew monetary systems overnight.

Economic crashes forced reinventions.

That’s evolution money in action.

Not straight progress, but constant adaptation to our messy human needs.

Prehistoric and Ancient Exchanges

Let’s shatter a classroom myth first: no one ever ran a full economy on pure barter.

Forget those textbook tales of farmers trading sheep for wheat.

Really early societies used something smarter.

You’d be shocked to learn that most communities relied on gift networks and “I’ll pay you later” agreements instead of direct swaps.

Bartering and Early Trade Systems

Here’s the truth.

Barter worked like a handshake between strangers.

Neighbors?

They kept mental tabs.

Enemies?

That’s where actual goods for goods deals happened.

Anthropologist David Graeber nailed it:

“Barter becomes common only when trust evaporates”.

Ancient tribes faced the same issues we do with Venmo requests.

If you had extra spears but needed berries, finding someone who wanted spears right now was tough.

This “double coincidence of wants” problem made simple trade as rare as a quiet toddler.

The Rise of Commodity Money

Enter cattle, grain, and shells.

Nature’s first credit cards.

Societies needed items that everyone agreed held value.

Four rules emerged:

- Portable enough to carry

- Divisible without losing worth

- Durable through seasons

- Universally desired

Roman soldiers got paid in salt (that’s where “salary” comes from).

Pacific Islanders used massive stone disks.

Sound familiar?

Today’s cash follows the same principles.

Just swap limestone for plastic cards.

The seeds of modern finance were planted when someone realized:

Value doesn’t live in objects, but in our shared belief in them.

From barley to Bitcoin, that truth never changed.

The Emergence of Money of Account

Let me show you how our ancestors tracked debts before emojis existed.

Physical currency came late to the party.

Humans kept financial records for 20,000+ years using sticks, bones, and clay.

This “invisible” accounting system powered economies long before coins jingled in pockets.

Early Accounting Methods and Tally Sticks

Meet the Ishango bone.

A 20,000 year old baboon femur found near the Nile.

Its carved notches reveal moon phase tracking and basic math operations.

Archaeologists still debate whether it was a calculator, calendar, or IOU ledger.

Either way, it proves our brains were wired for numbers before we had alphabets.

The tally stick system worked like a Stone Age blockchain.

Two parties would:

- Split a wooden stick lengthwise

- Carve identical notches representing debts

- Keep half each as transaction proof

“These sticks weren’t just records. They were legally binding contracts recognized across medieval Europe”.

| Artifact | Purpose | Material | Period |

|---|---|---|---|

| Ishango Bone | Math/Timekeeping | Baboon femur | 20,000 BCE |

| Tally Sticks | Debt tracking | Wood | 30,000 BCE – 1826 CE |

| Clay Tablets | Tax records | Mesopotamian clay | 5,000 BCE |

Mesopotamian temples took it further.

Their clay tablet archives tracked grain loans, worker wages, and tax obligations.

One tablet from Ur details a beer merchant’s inventory down to the jug.

Proving ancient accountants were as detail obsessed as modern CPAs.

Here’s the kicker: these systems handled more transactions than physical coins until the 1700s.

Your bank app today uses the same basic principle.

Just swap fire hardened clay for cloud servers.

The Invention and Impact of Metal Coinage

Picture trying to buy bread with a miniature bronze shovel.

That’s exactly what early Chinese traders did around 1000 BCE.

Metal coinage solved a critical problem.

How to carry value without hauling actual tools or livestock.

What started as bronze copies of cowrie shells became standardized tokens everyone recognized.

Bronze, Copper, and Early Coin Innovations

China’s knife shaped coins weren’t just quirky.

They were revolutionary.

Workers could stack them like modern poker chips.

Romans later upgraded from rough bronze chunks to stamped discs.

This wasn’t just about looks.

Official marks guaranteed weight and purity.

The original “trust seals” for commerce.

The Role of Precious Metals in Value

Why silver and gold?

These metals don’t rust, melt easily for division, and shine like portable wealth.

When Lydia (modern Turkey) minted silver coins around 500 BCE, traders across continents accepted them.

Precious metals became the ultimate cross cultural handshake.

Valuable in Athens, India, and beyond.

Here’s the kicker: Chinese bronze spades and Lydian lion stamped coins emerged independently.

Different cultures, same solution.

Metal currency wasn’t invented. It evolved through necessity.

From copper imitations to gold standards, our wallets still carry echoes of these ancient breakthroughs.

The Formation and Evolution of Paper Money

Ever tried carrying a wheelbarrow of coins to buy dinner?

That’s exactly why China flipped the script.

While Europe still clung to metal, Chinese merchants were trading paper notes lighter than a rice pancake.

This wasn’t just convenient.

It rewrote the rules of commerce.

Chinese Innovations in Paper Currency

Long before Starbucks accepted Apple Pay, Emperor Huan of Han introduced leather paper money prototypes.

Imagine using one foot deerskin squares as shopping vouchers in 118 B.C.

Marco Polo later marveled:

“These papers… are current for more than a silver coin!”

The real breakthrough came in 806 A.D. with true paper currency.

Merchants deposited heavy coins at banks, receiving portable notes instead.

Suddenly, buying a horse required just folded paper, not a mule team hauling metal.

Transitioning from Coins to Banknotes

China’s experiment lasted five centuries, a masterclass in monetary growing pains.

At its peak:

- Notes were mass printed like concert tickets

- Inflation hit 900% during Mongol rule

- Entire dynasties abandoned paper after economic crashes

By 1455, China temporarily ditched paper money like last year’s TikTok trend.

But the genie was out of the bottle.

These early notes proved something revolutionary: value lives in collective belief, not shiny objects.

Your dollar bill today?

Just the latest iteration of that 1,200 year old Chinese lightbulb moment.

Medieval Currency Systems and Trade

Think your local coffee shop’s pricing is confusing?

Try being a 13th century merchant juggling three metal currencies.

Europe’s medieval money maze began unraveling when Frederick II rebooted gold coins during the Crusades.

This wasn’t just about shiny metal.

It was political theater.

Gold became the ultimate flex for kings wanting to look powerful in international trade.

By the 14th century, silver took a backseat to gold across Europe.

Why?

New African gold routes and Italian banking networks made the yellow metal king.

Vienna’s 1328 switch to gold wasn’t just trendy.

It kept them competitive in growing trade alliances.

But here’s the catch: copper coins still bought bread, silver paid soldiers, and gold settled international deals.

| Metal | Primary | Regions | Challenges |

|---|---|---|---|

| Gold | International trade | Italy, France | Limited supply |

| Silver | Local transactions | Germany, England | Weight issues |

| Copper | Daily purchases | All regions | Rapid inflation |

Merchants faced exchange rate chaos daily.

Imagine calculating if 12 silver pennies equaled 1 gold florin today.

But maybe not tomorrow.

Bankers developed early forex systems using standardized weights and credit notes.

Sound familiar?

Modern currency markets owe their DNA to these medieval headaches.

The real game changer?

Currency systems became tools of economic warfare.

Cities that mastered metal mixes dominated trade routes.

Those stuck with unstable coins?

They became medieval ghost towns.

Turns out, money problems never really change.

Just the coins we argue about.

Exploring the “history of money”

What if I told you philosophers were arguing about cash 2,400 years before Bitcoin existed?

Aristotle and Plato had opposing views that still shape how we handle transactions today.

One saw coins as metal with value, the other as tokens of trust.

Let’s break down the two camps.

Commodity theorists claim value lives in physical stuff.

Gold coins you can melt into jewelry.

Credit theorists argue it’s all about relationships.

As economist Alfred Mitchell Innes put it:

“Money isn’t a thing, but a social practice”.

This split explains why some currencies stick while others fail.

Societies valuing tangible wealth clung to precious metals.

Those prioritizing trade networks embraced paper notes early.

Check how these theories play out:

| Theory | Core Belief | Modern Example |

|---|---|---|

| Commodity | Value in materials | Gold reserves |

| Credit | Value in agreements | Cryptocurrencies |

Ancient arguments resurface constantly.

When Rome debased silver coins, they proved commodity theory’s limits.

China’s paper money collapse?

A credit system stretched too thin.

Today’s digital wallets blend both ideas.

Bits representing metal backed promises.

Here’s the kicker: every financial breakthrough reflects this tug of war.

Your contactless payment works because we collectively agree pixels have power.

Money’s real magic?

Turning abstract trust into something you can spend.

Economic Theories Behind Money

What’s the real difference between gold bars and Bitcoin receipts?

It all comes down to two camps battling for centuries.

Commodity theorists swear value lives in physical stuff.

Credit believers argue it’s about relationships.

Your wallet?

A battleground for these ideas.

Commodity Versus Credit Theories

Picture this: I’m holding a silver dollar.

Commodity folks say its worth comes from the metal itself.

Melt it, make jewelry, still valuable.

Credit thinkers counter:

“That coin’s just a placeholder for trust in the government”.

Modern examples prove both sides right.

Crypto?

Digital tokens backed by code (commodity thinking).

Credit cards?

Pure trust in payment networks (credit theory).

The truth?

Most systems blend both approaches.

Here’s why it matters: every financial crisis reignites this debate.

Housing crashes expose shaky credit.

Gold rushes reveal commodity limits.

Your Venmo transfers?

They’re winning arguments for credit theorists daily.

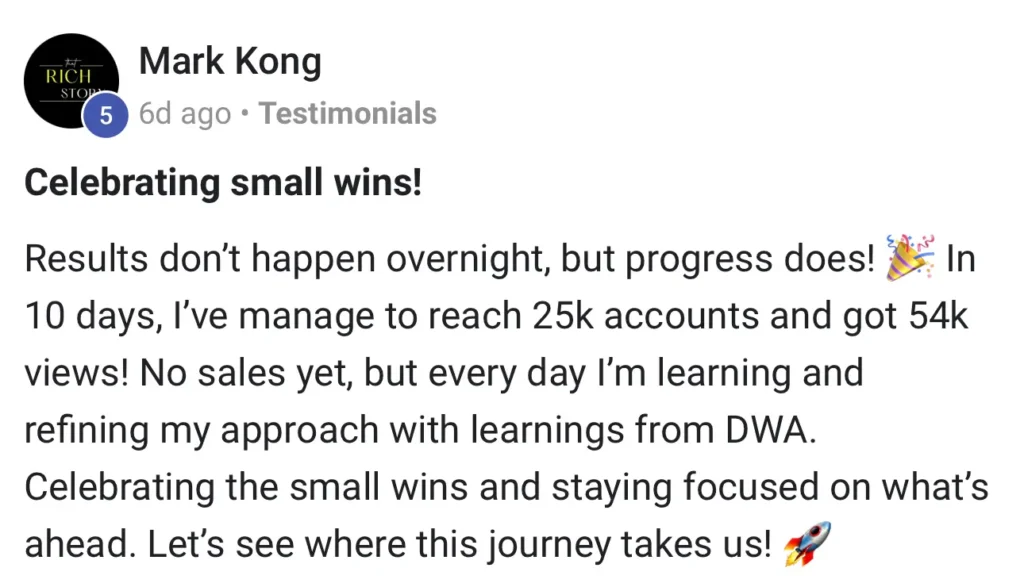

Real Life Results: Explore More DWA Testimonials

Discover how Digital Wealth Academy is changing lives.

Read authentic success stories and see the incredible results members are achieving with the DWA program.

FAQ

What replaced bartering as societies grew more complex?

People started using commodity money like livestock, grains, or shells. These items had intrinsic value and were easier to trade than negotiating individual deals for random goods.

Where were the first standardized coins created?

The Kingdom of Lydia (modern day Turkey) minted gold and silver coins in the 7th century BCE. These became the blueprint for metal coinage systems across civilizations from Greece to China.

Why did paper currency first emerge in China?

During the Tang Dynasty (7th century), merchants used promissory notes to avoid hauling heavy coins. By the 11th century, the Song Dynasty issued the world’s first government backed paper money. A game changer for large scale trade.

When did money stop being backed by gold?

The 20th century saw most countries shift to fiat currency. The U.S. fully abandoned the gold standard in 1971, letting currencies float based on government stability rather than precious metal reserves.

How did medieval banks influence today’s money?

Italian bankers invented bills of exchange. Early checks, letting merchants travel without physical coins. This laid groundwork for credit systems and modern banking practices we still use today.

What’s the difference between commodity and credit theories?

Commodity theory says money’s value comes from its material (like gold). Credit theory argues it’s based on trust in institutions, which explains why your digital bank balance has value despite being invisible!