Are you interested in knowing how does money works?

Let’s cut through the noise:

Money is humanity’s greatest collaboration tool.

Imagine trying to trade your graphic design skills for groceries or your homemade kombucha for car repairs.

Sounds exhausting, right?

That’s why we invented this magical thing called currency.

Throughout history, people used everything from cowry shells in Africa to stone wheels bigger than SUVs on Pacific islands.

Even Native Americans traded with beads made from quahog clams.

These weren’t just quirky choices.

They solved the “I need something you have, but you don’t want what I’m offering” problem.

Today, your wallet holds paper rectangles with dead presidents.

Your phone stores digital numbers.

Both let you buy tacos or pay rent without negotiating like a flea market vendor.

Money acts as a universal translator, turning chaotic bartering into smooth transactions.

Think about your morning coffee run.

You exchange $5 for caffeine without explaining your job skills to the barista.

That’s the beauty of currency.

It’s a trusted middleman we all agree has value.

Whether physical cash or cryptocurrency, the core idea remains: simplified trading.

Remember, money works as a tool, not just a medium of exchange.

It flows toward value, attention, and leverage.

To make money work for you, you first need to understand how to earn, manage, multiply, and protect it.

That’s why the best investment you can make is in yourself.

By learning a high income skill that allows you to increase your income and start building digital assets that grow over time.

I did this through Digital Wealth Academy (DWA), the same course that helped me:

- Learn how to market and sell online with over 52 business and marketing modules.

- Build my own business using proven models, all taught step by step.

- Access a global community of 123.5k+ people, all focused on growing their income and achieving financial freedom.

- Get support through weekly webinars and sessions in multiple languages with expert guidance.

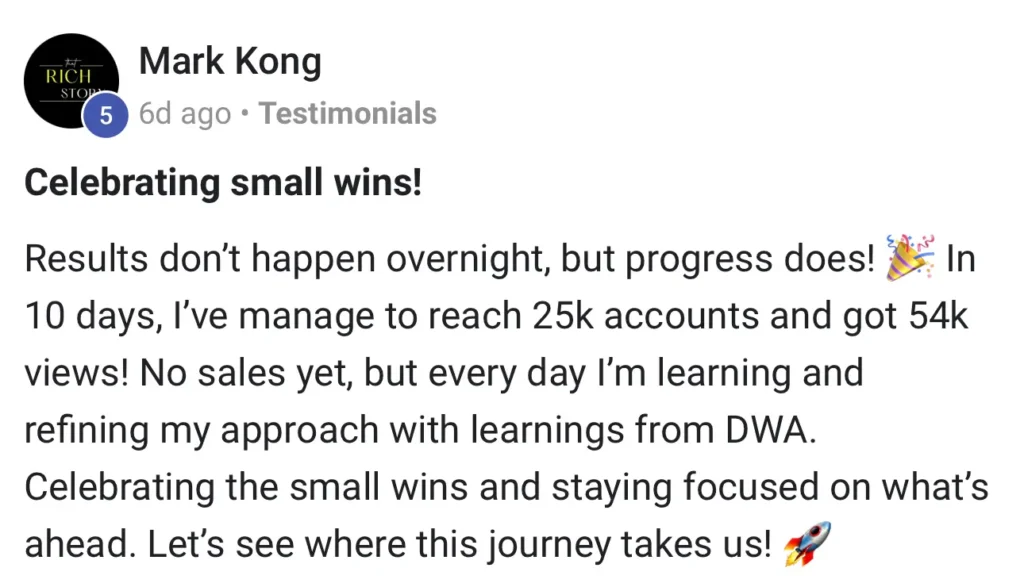

Some students start seeing results within weeks, although every journey is different. It all depends on your effort, time, and consistency.

With DWA, you’re not just learning theory.

You’re building real income streams through multiple business models tailored to your preferences.

This is how you begin making money work for you instead of the other way around.

a free beginner’s guide

DWA Sneak Peek

Learn the easiest and fastest way to start or exponentially grow your existing business.

Table of Contents

Key Takeaways

Currency solves the inefficiency of direct barter systems

Historical forms range from shells to digital entries

Acts as a universal measurement for goods or services value

Enables complex economic systems through simple exchange

Physical and digital versions serve identical core purposes

Modern transactions rely on collective trust in their value

The Evolution and Functions of Money

Picture this: Roman soldiers getting paid in salt (yes, actual salt).

That’s where we get the word “salary”.

Throughout history, currency has taken wild forms.

From cattle in Africa to giant stone discs in Micronesia.

Each solution addressed specific needs: portability, durability, or universal acceptance.

From Barter to Bitcoin

Early societies used commodity money.

Items with inherent worth.

Gold coins worked because everyone valued the metal itself.

But hauling precious metals got risky.

Enter paper certificates backed by gold reserves, creating representative money.

Today’s dollars?

Pure fiat currency.

No gold backing, just collective trust in governments.

This shift solved portability issues but introduced new challenges like inflation control.

Digital transactions now let us exchange value faster than ever.

Money’s Three Superpowers

Every dollar in your wallet performs three jobs:

- Store of value: Your $20 bill buys roughly the same pizza next week

- Unit of account: Lets you compare car prices to coffee costs

- Medium of exchange: Swipe your card instead of trading chickens for gas

Ancient civilizations struggled with these functions.

Imagine pricing a house in sheep!

Modern systems standardize value measurement while enabling complex economies.

Whether physical cash or crypto, the core principles remain unchanged.

Understanding Currency, Inflation, and Interest Rates

Here’s the brutal truth: your dollar bills are playing a high stakes game of tug of war.

Currency value swings based on supply, demand, and whether the economy feels like doing yoga that day, stable or wobbly.

Let’s break down why your childhood candy bar now costs triple.

How Inflation Impacts the Value of Currency

Inflation isn’t just corporations being greedy.

Imagine a silent thief stealing 2 or 3% of your purchasing power yearly.

That $1 movie ticket from 1999?

Today’s $15 charge isn’t just capitalism.

It’s currency slowly losing its muscle.

Your grandparents’ $20,000 house now costs $300,000?

Thank inflation.

Governments print more money → more supply → each dollar buys less.

Like watering down orange juice until it’s basically sugar water.

The Role of Interest Rates in Economic Decisions

Banks play a sneaky game with interest rates.

Borrow $10,000 for a car?

They’ll charge you 7% extra.

Save $10,000?

They’ll pay you 4% to park it.

The Federal Reserve adjusts these rates like a thermostat, cranking them up to cool spending, and then lowering them to spark action.

Smart move: Lock savings in high yield accounts when rates rise.

Choose fixed rate mortgages when rates are low.

Interest rates shape everything from business loans to your Netflix subscription price.

Master this, and you’ll dance through financial storms while others get soaked.

Exploring how does money work in Everyday Transactions

Imagine your Tuesday morning: coffee in hand, gas tank filled, groceries bought.

None of this requires negotiating like a medieval merchant.

Currency acts as your invisible wingman, smoothing every interaction without awkward haggling.

The Silent Deal Maker

That latte costs $5.

You hand over cash, no need to offer guitar lessons or homemade jam.

Goods and services flow freely because we all agree green rectangles hold value.

Try paying your mechanic with concert tickets instead of dollars.

See how that goes.

Businesses crave this simplicity too.

Your local grocery store takes cash not just because it’s law, but so they can pay suppliers without arranging elaborate trades.

Transactions become domino effects: your payment becomes their inventory order becomes a farmer’s paycheck.

Digital payments turbocharge this system.

Swiping a card or tapping your phone?

Just faster ways to move agreed upon value.

Exchange happens before you finish saying “frappuccino”.

Ever wonder why new payment methods struggle?

Network effect rules: dollars work because everyone takes them.

Cryptocurrency fans face the same challenge colonial traders did.

Convincing others their shells (or Bitcoin) have worth.

Investing, Saving, and Budgeting: A Beginner’s Approach

Here’s the lowdown on making your dollars work smarter, not harder.

Financial stability isn’t about stock market genius.

It’s mastering three core skills: growing your funds, protecting your progress, and spending with purpose.

Let’s break these down without the Wall Street lingo.

Investment Basics and Managing Risk

Think of investing as planting oak trees.

You water them (add funds), wait through seasons (time), and accept some might get nibbled by squirrels (risk).

The key?

Balance high growth stocks (potential sunshine) with stable bonds (reliable shade).

Effective Saving Strategies for Financial Stability

Automate transfers to your savings account like clockwork.

Choose a bank offering competitive rates.

Your emergency fund should earn its keep.

This isn’t deprivation.

It’s paying your future self first.

Budgeting Tips for Everyday Success

Track spending for two weeks.

You’ll spot more leaks than a pirate ship.

Allocate funds to needs before wants.

That $60 game?

Save $15 weekly.

In a month, you’re gaming debt free while building financial muscle memory.

Real Life Results: Explore More DWA Testimonials

Discover how Digital Wealth Academy is changing lives.

Read authentic success stories and see the incredible results members are achieving with the DWA program.

FAQ

Why does paper money hold value if it’s just printed paper?

Its value comes from government backing as legal tender and collective trust. Unlike commodity money (like gold), modern fiat currency relies on economic stability and policy decisions. Think Federal Reserve regulations or inflation targets.

How does inflation actually erode my purchasing power?

When prices rise faster than wages, your dollar buys fewer goods or services. Imagine paying $5 for a latte that cost $3 last year. Central banks use interest rates to curb inflation, but an oversupply of currency can accelerate it.

What’s the difference between saving cash and investing?

Cash in a savings account offers low risk stability but loses value to inflation. Investing grows wealth through assets like stocks. Though it carries market risk. Balancing both is key to long term financial health.

Why do some currencies fluctuate wildly in value?

Factors like political instability, trade imbalances, or speculative trading impact currency markets. For example, hyperinflation in Zimbabwe rendered their dollar nearly worthless, a stark reminder of monetary policy gone wrong.

How do digital payments work without physical cash?

Transactions rely on electronic mediums of exchange, like credit cards or apps. Your bank adjusts balances digitally, while systems like ACH or Fedwire ensure secure transfers. It’s all about trust in the financial infrastructure.

Can cryptocurrency replace traditional money?

Crypto offers decentralized transactions but lacks widespread acceptance as a unit of account. Volatility (looking at you, Bitcoin) and regulatory hurdles make it more speculative than practical, for now.