The journey to becoming wealthy isn’t about finding a magic formula or overnight success.

It’s about implementing proven strategies consistently over time.

While there’s no single path to riches, financial experts have identified key principles that can significantly increase your chances of building substantial wealth.

In this guide, we’ll explore seven science backed strategies that can help transform your financial future and set you on the path to becoming rich.

But remember, if you want to become rich, don’t rely on luck or shortcuts.

Wealth starts with the right mindset, but it grows through smart actions, high income skills, and scalable business models.

That’s what changed everything for me.

I joined a digital course that helped me learn a high income marketing skill, dramatically increase my monthly income, and start building the foundations of real wealth.

What you get with it:

- Access to 52+ marketing and business modules so you can create or grow a business based on your preferences.

- A thriving community of over 123.5k members sharing results, strategies, and motivation.

- Weekly support sessions and expert webinars in multiple languages to help you stay on track and keep growing.

Some students have seen real results within weeks, while others take longer, it all depends on your effort, time, and consistency.

What matters most is that you’ll be able to build multiple income streams, setting yourself up for long term financial freedom.

This is the same path I took, and it’s working.

Discover Digital Wealth Academy (DWA)

a free beginner’s guide

DWA Sneak Peek

Learn the easiest and fastest way to start or exponentially grow your existing business.

Table of Contents

1. Cultivate a Wealth Building Mindset

The psychological aspects of wealth building are often overlooked but can be the most critical factors in your success.

Developing a wealth mindset means adopting the thought patterns and behaviors that support long term financial success.

Delayed Gratification and Patience

The ability to delay immediate pleasure for greater future rewards is strongly correlated with financial success.

Wealth building is a marathon, not a sprint.

Those who can maintain discipline over decades typically achieve the greatest results.

Practice making decisions based on long term outcomes rather than short term satisfaction.

Continuous Financial Education

The most successful wealth builders never stop learning about personal finance, investing, and wealth management.

Dedicate time each week to expanding your financial knowledge through books, podcasts, courses, or mentorships.

This ongoing education helps you adapt to changing markets and discover new opportunities for wealth creation.

“Formal education will make you a living. Self education will make you a fortune. The more you learn, the more you earn”.

Wealth building principle

Overcoming Wealth Building Obstacles

Recognize and address the psychological barriers that can derail your wealth building journey:

Common Mental Blocks

- Fear of financial failure or success

- Scarcity mindset and limiting beliefs

- Impulsive decision making

- Social comparison and lifestyle inflation

Mindset Solutions

- Focus on learning from setbacks

- Practice abundance thinking

- Implement decision making frameworks

- Define personal success independent of others

Your financial journey will inevitably include setbacks and challenges.

Developing resilience and persistence in the face of these obstacles is what ultimately separates those who become rich from those who don’t.

2. Create a Personalized Financial Plan

Building wealth begins with a clear roadmap tailored to your specific goals and circumstances.

A personalized financial plan serves as your blueprint for the rich life you envision.

Without a plan, you’re essentially navigating without a map.

You might move forward, but you’re likely to take detours that delay reaching your destination.

Setting SMART Financial Goals

Effective wealth building requires specific, measurable, achievable, relevant, and time bound (SMART) goals.

Rather than saying “I want to be rich”, define what that means in concrete terms.

For example, “I will accumulate $1 million in investment assets within 15 years” provides clarity and accountability.

Components of a Wealth Building Plan

Net worth assessment (current assets minus liabilities)

Income and expense tracking system

Debt reduction strategySavings rate targets (aim for 15 to 20% of gross income)

Investment allocation strategy

Tax optimization approach

Protection planning (insurance, estate planning)

Your financial plan should evolve as your life circumstances change.

Review and adjust your plan at least annually or whenever you experience significant life events like career changes, marriage, or having children.

“A goal without a plan is just a wish. The single most important factor to getting rich is getting started with a clear financial roadmap”.

Financial planning principle

3. Master the Art of Saving

Saving money is the foundation of wealth building.

You can’t invest what you haven’t saved first.

While it might seem basic, consistent saving is what separates those who become rich from those who remain financially stressed.

The Power of Starting Early

Time is your greatest ally when building wealth due to the power of compound growth.

Consider this: If you save $500 monthly starting at age 25, by 65 you could accumulate over $1 million (assuming 7% average returns).

Wait until 35 to start, and you’d need to save nearly twice as much monthly to reach the same goal.

Automating Your Wealth Building

The most effective savers don’t rely on willpower.

They automate their financial success.

Set up automatic transfers to your savings and investment accounts on payday before you have a chance to spend the money.

This “pay yourself first” approach ensures consistent progress toward your wealth goals regardless of life’s distractions.

Traditional Saving Approach

Wait until month end to save leftover money

Inconsistent saving amounts

Saving becomes optional when expenses arise

Requires constant willpower and decisions

Automated Wealth Building

Money automatically moved to savings or investments on payday

Consistent, predictable saving amounts

Saving happens before discretionary spending

Requires zero ongoing willpower once set up

Money automatically moved to savings or investments on paydayConsistent, predictable saving amountsSaving happens before discretionary spendingRequires zero ongoing willpower once set up

Start with saving at least 10% of your income, then gradually increase to 15% to 20% as your income grows.

Remember that every percentage point increase in your savings rate significantly accelerates your path to wealth.

4. Manage Debt Strategically

Not all debt is created equal when it comes to building wealth.

Strategic debt management distinguishes between wealth building leverage and wealth destroying liabilities.

Eliminating Wealth Destroying Debt

High interest consumer debt acts like a wealth vacuum, pulling away resources that could be growing your net worth.

Credit card debt, with average interest rates exceeding 20%, should be your first financial target.

For every $1,000 in credit card debt you eliminate, you’re essentially earning a guaranteed 20% return on that money.

Leveraging Strategic Debt

Not all debt hinders wealth building.

Some forms can actually accelerate it when used wisely.

Mortgage debt to purchase an appreciating home or low interest loans for education that increases earning potential can be wealth building tools.

The key distinction is whether the debt finances appreciating assets or depreciating consumption.

| Debt Type | Typical Interest Rate | Wealth Impact | Priority |

| Credit Cards | 16-24% | Highly Negative | Eliminate ASAP |

| Personal Loans | 7-36% | Negative | High Priority |

| Car Loans | 4-10% | Negative | Medium Priority |

| Student Loans | 3-7% | Neutral/Positive | Low Priority |

| Mortgage | 3-6% | Potentially Positive | Lowest Priority |

A strategic approach to debt management means aggressively eliminating high interest debt while potentially maintaining lower interest debt that finances appreciating assets.

This balanced approach maximizes your overall wealth building potential rather than focusing solely on becoming debt free.

5. Increase Your Income Streams

While controlling expenses is important, there’s a limit to how much you can cut.

Your income, however, has virtually unlimited growth potential.

The wealthiest individuals rarely rely on a single source of income.

They develop multiple revenue streams.

Maximizing Your Primary Income

Before diversifying, optimize your main career earnings through strategic advancement.

Develop in demand skills, negotiate salary increases, and position yourself for promotions.

Research shows that changing employers every 3 to 5 years can increase lifetime earnings by up to 50% compared to staying with one company.

Developing Secondary Income Sources

Building wealth accelerates dramatically when you develop income beyond your day job.

These additional revenue streams provide both financial security and accelerated wealth accumulation.

Active Side Income

- Freelancing in your expertise area

- Consulting services

- Teaching/tutoring

- E-commerce/retail business

Passive Income Investments

- Dividend paying stocks

- Real estate rental properties

- REITs (Real Estate Investment Trusts)

- Bonds and fixed income securities

Semi Passive Business Income

- Digital products (courses, ebooks)

- Affiliate marketing

- Content creation (YouTube, blog)

- App or software development

Start small with one additional income stream and gradually expand as you gain experience.

The goal isn’t just more money.

It’s developing income that doesn’t require trading your time directly for dollars.

This transition from active to passive income is a crucial step on the path to true wealth.

6. Develop a Smart Investment Strategy

Saving alone won’t make you rich.

You need to harness the power of compound growth through strategic investing.

The most successful wealth builders put their money to work in assets that appreciate and generate returns over time.

Understanding Risk and Return

All investments involve some degree of risk, but not all risks are equal.

The key to successful investing is understanding the relationship between risk and potential return.

Generally, higher potential returns come with higher volatility and risk of loss.

Building a Diversified Portfolio

Diversification, spreading investments across different asset classes, is fundamental to managing risk while pursuing growth.

A well diversified portfolio typically includes a mix of stocks, bonds, real estate, and potentially alternative investments.

The specific allocation depends on your age, risk tolerance, and time horizon.

| Asset Class | Historical Annual Return | Risk Level | Recommended Allocation |

| Stocks/Equities | 7-10% | High | 50-80% |

| Bonds/Fixed Income | 3-5% | Low Medium | 20-40% |

| Real Estate | 7-12% | Medium High | 0-20% |

| Cash/Equivalents | 1-2% | Very Low | 5-10% |

The Power of Index Fund Investing

For most wealth builders, low cost index funds offer the most reliable path to investment success.

These funds provide instant diversification, minimal fees, and returns that consistently outperform most actively managed investments.

A simple portfolio of broad market index funds can provide the growth needed to build significant wealth over time.

“The simplest approach to successful investing is to buy a low cost index fund, and keep buying it regularly through thick and thin, especially through thin”.

Investment wisdom from market experts

Remember that successful investing is about time in the market, not timing the market.

Consistent contributions to quality investments over decades are the most reliable wealth building strategy.

7. Optimize Your Tax Strategy

Taxes represent one of the largest expenses you’ll face on your wealth building journey.

Strategic tax planning can significantly accelerate your path to becoming rich by keeping more of your money working for you.

Maximizing Tax Advantaged Accounts

Tax advantaged retirement accounts offer powerful wealth building benefits through tax deferral or tax free growth.

Prioritize maxing out accounts like 401(k)s, IRAs, and HSAs before investing in taxable accounts.

The tax savings alone can add hundreds of thousands of dollars to your wealth over a lifetime.

Tax Efficient Investment Strategies

Beyond retirement accounts, how you structure your investments can significantly impact your after tax returns.

Consider these tax optimization strategies for your investment portfolio:

Asset location

Hold tax inefficient investments (like bonds) in tax advantaged accounts and more tax efficient investments (like growth stocks) in taxable accounts

Tax loss harvesting

Strategically realize investment losses to offset gains and reduce tax liability

Long term capital gains

Hold investments for more than one year to qualify for lower long term capital gains tax rates

Tax efficient funds

Choose ETFs and index funds with minimal distributions for taxable accounts

Roth conversion ladders

Strategically convert traditional retirement funds to Roth accounts during lower income years

Working with a tax professional to develop a comprehensive tax strategy can provide some of the highest returns on your investment.

Remember that it’s not what you earn that matters most.

It’s what you keep after taxes that builds your wealth.

Your Journey to Becoming Rich Starts Today

Building wealth isn’t about finding shortcuts or get rich quick schemes.

It’s about implementing proven strategies consistently over time.

The seven strategies we’ve explored provide a comprehensive framework for your wealth building journey:

- Cultivate a wealth building mindset

- Create a personalized financial plan

- Master the art of saving

- Manage debt strategically

- Increase your income streams

- Develop a smart investment strategy

- Optimize your tax approach

Remember that the most important step is simply getting started.

Even small actions taken today.

Setting up an automatic savings plan, opening an investment account, or educating yourself about personal finance, can compound into significant wealth over time.

Your path to becoming rich won’t be identical to anyone else’s.

It will reflect your unique goals, resources, and circumstances.

By applying these principles consistently and adapting them to your situation, you can build the wealth needed to create the life you envision.

The journey of a thousand miles begins with a single step.

Take yours today.

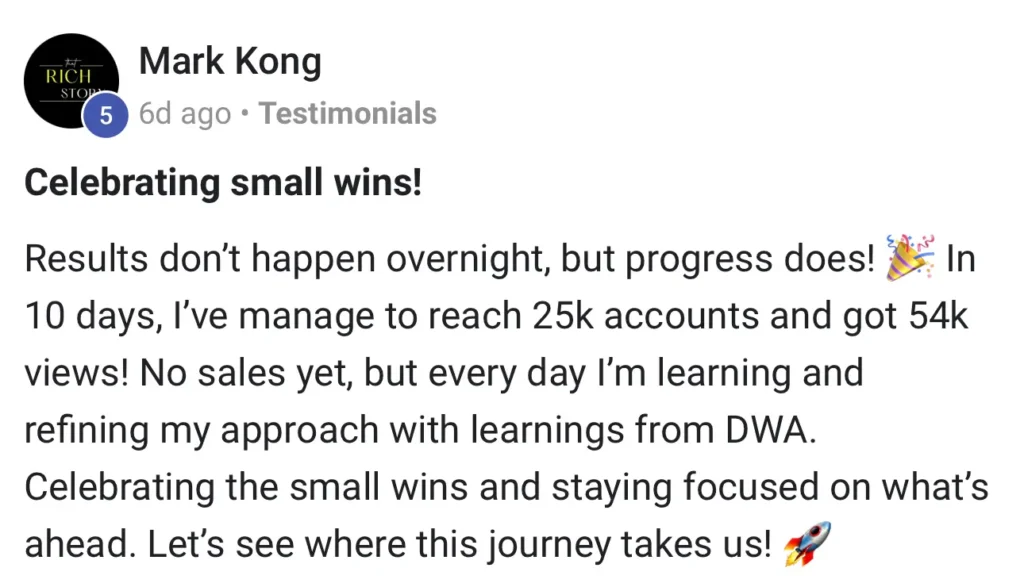

Real Life Results: Explore More DWA Testimonials

Discover how Digital Wealth Academy is changing lives.

Read authentic success stories and see the incredible results members are achieving with the DWA program.

FAQ – Frequently Asked Questions About Building Wealth

How do 90% of millionaires make their money?

Contrary to popular belief, most millionaires don’t inherit their wealth or win the lottery.

According to research, approximately 90% of millionaires build their wealth through:

– Consistent saving and investing over decades

– Income from business ownership or high value careers

– Real estate investments (both residential and commercial)

– Living below their means and avoiding lifestyle inflation

– Minimizing debt and maximizing tax advantaged investments

The majority of millionaires achieve their status through disciplined financial habits rather than spectacular windfalls or risky ventures.

How to be quietly wealthy?

Quiet wealth focuses on financial security without conspicuous consumption.

To build wealth quietly:

– Avoid status symbols and flashy purchases that depreciate

– Invest in assets rather than appearances

– Live in a modest home relative to your means

– Drive reliable vehicles rather than luxury cars

– Focus spending on experiences and relationships rather than material goods

– Maintain privacy about your financial situation

Many of the wealthiest individuals live surprisingly modest lifestyles, allowing their money to compound rather than being spent on maintaining appearances.

How to become a millionaire by 40?

Reaching millionaire status by age 40 requires aggressive saving and investing from an early age.

A practical approach includes:

– Starting no later than age 25

– Saving 25% to 30% of your income

– Investing primarily in growth oriented assets (stocks, real estate)

– Developing high income skills or business ventures

– Avoiding lifestyle inflation as income increases

– Maximizing tax advantaged accounts

For example, investing $1,500 monthly with an 8% average return from age 25 would result in approximately $1 million by age 40.

The key is combining a high savings rate with consistent investing in growth assets over the 15 year period.

How to become a millionaire in 5 years?

Becoming a millionaire in just 5 years typically requires one or more of these approaches:

– Building and selling a successful business

– Developing highly specialized, in demand skills commanding exceptional compensation

– Strategic real estate development or flipping in rapidly appreciating markets

– Starting with substantial capital ($500K+) and achieving exceptional investment returns

This accelerated timeline involves significantly higher risk and typically requires specialized knowledge, connections, or existing capital.

For most people, a longer term approach with more moderate risk offers a more reliable path to wealth.