Are you desiring to know how to attract money?

Align your mindset and take strategic action.

What if everything you thought about wealth was backwards?

Let me tell you a secret:

Financial freedom isn’t about chasing dollars.

It’s about rewiring how you see opportunity and taking consistent action.

I’ve watched people transform their money reality not with lottery tickets, but by flipping their mindset first.

Recent research from Vietnam shows people who view wealth positively are 3x more likely to build it.

Why?

They see abundance everywhere, not scarcity.

That doesn’t mean ignoring bills or pretending debt doesn’t exist.

It means recognizing opportunities others miss.

Here’s the kicker: I used to hate budgeting.

Now?

I help people create life changing habits without spreadsheets.

No magic wands here, just psychology meets real world strategy.

Whether you’re stuck paycheck to paycheck or want to upgrade your finances, this works.

We’ll explore why visualizing stacks of cash actually hurts your progress (science says so!).

How to spot “invisible” income streams, and why your gut feelings about wealth might be dead wrong.

If you’re asking how to attract money, it starts with more than just positive thinking.

It requires clarity, confidence, and consistent action.

The most powerful way to attract wealth is to invest in yourself first.

When you learn a high income skill and create your first income producing asset, you naturally increase your financial magnetism.

You shift from hoping for money to building it intentionally.

That’s why I highly recommend Digital Wealth Academy (DWA).

DWA helps you align your mindset with real world strategies, teaching you how to build online income streams, step by step, even if you’re starting from scratch.

Many members start seeing results in weeks because they’re not just visualizing success, they’re creating it through action.

If you want to attract money consistently, start by becoming the kind of person who knows how to generate it.

DWA gives you the tools to do exactly that.

a free beginner’s guide

DWA Sneak Peek

Learn the easiest and fastest way to start or exponentially grow your existing business.

Table of Contents

Key Takeaways

Wealth building starts with recognizing existing opportunities, not waiting for luck

Positive money attitudes triple wealth building intentions (2023 research)

Practical strategies beat mystical rituals for long term results

A scarcity mindset blocks financial growth more than income level

Sustainable abundance requires both action and perspective shifts

Understanding the Basics of Money Attraction

Ever notice how cash acts like a truth serum for personalities?

I once watched a client triple their income only to discover their anxiety tripled too.

That’s when I realized wealth doesn’t create character, it reveals it.

Money as a Multiplier

Think of your bank account as a personality amplifier.

Generous folks become philanthropists.

Chronic worriers?

Professional stressors.

As Ayn Rand nailed it:

“Money will take you wherever you wish, but it won’t replace you as the driver.”

I’ve seen this play out repeatedly.

Clients who fix their mindset first handle windfalls better.

Those who don’t?

Their new sports car often comes with upgraded panic attacks.

The Psychology Behind Wealth and Abundance

Your brain’s like a bouncer at Club Opportunity.

If you believe you belong in the VIP section, you’ll spot golden tickets everywhere.

Doubt your worth?

That mental bouncer will keep slamming the door.

Here’s the kicker: 73% of lottery winners go broke within 5 years.

Why?

Their beliefs never upgraded.

Your emotions around cash create invisible rules.

Like whether you’ll negotiate raises or self sabotage success.

The real power move?

Treating wealth like a neutral tool.

Become someone who uses it wisely, and watch your world shift.

Next, we’ll explore practical ways to build this muscle.

How to Attract Money Using Proven Techniques

Your bank account isn’t just numbers.

It’s a mirror reflecting your deepest financial convictions.

Let’s cut through the noise with strategies that actually move needles.

Belief in Your Financial Abilities

I once coached a client who kept saying, “I’m bad with money.”

Surprise, her accounts agreed.

We flipped the script by tracking small wins: negotiating a $15 per month bill reduction, then a $500 side gig.

Proof builds belief faster than affirmations.

Taking Consistent, Focused Action

Daily micro actions create compound growth.

One client automated $5 per day investments.

Now they’ve got $12k working for them.

What’s your version?

Could be:

- Reviewing one expense category weekly

- Sending two LinkedIn pitches monthly

- Reading 10 pages of finance content daily

Visualization and Goal Setting

Neuroscience shows detailed mental rehearsals activate the same brain regions as real experiences.

Try this:

| Weak Approach | Strong Approach |

|---|---|

| “I want more money” | “I earn $6,300 monthly by October” |

| Vague savings goals | $500/month into HYSA |

| Imagining stacks of cash | Feeling secure while paying bills |

Your turn: Grab paper.

Write one specific financial target with a date and amount.

Tape it where you’ll see it daily.

That’s how success gets traction.

Developing a Positive Wealth Mindset

Ever felt like your brain’s stuck on broke mode?

I spent years mentally rehearsing worst case scenarios until I realized my beliefs were hijacking my bank account.

True story: My first side hustle failed because I kept thinking “This’ll never work” instead of “What if it does?”

Shifting from Scarcity to Abundance

Scarcity thinking acts like bad radio static, it drowns out opportunities.

Catch yourself thinking “I can’t afford this” or “Rich people are lucky”?

Time to change the station.

Here’s what works:

| Scarcity Thought | Abundance Reframe |

|---|---|

| “There’s never enough” | “Money flows where attention goes” |

| “I have to work harder” | “I work smarter using existing resources” |

| “Success is limited” | “Every win creates new opportunities” |

Start small.

When a friend lands a promotion, say “That’s awesome!” instead of “Why not me?”

Their win doesn’t shrink your pie it proves the oven’s hot.

Aligning Thoughts and Emotions with Success

Your emotions are financial GPS signals.

Anxiety says “Danger ahead!” while confidence whispers “Safe to proceed”.

One client doubled her rates after realizing her pricing fears came from childhood money fights.

Try this tonight: Write three money wins from the past month.

Even $5 saved counts.

Over time, these proofs build positive mindset muscles stronger than any affirmation.

Remember: Your current balance reflects old beliefs.

New thoughts create new results, but only if you let them bake long enough.

What recipe are you using?

Smart Financial Habits for Building Wealth

Ever watched someone buy lattes daily while complaining about being broke?

Turns out, financial freedom isn’t about deprivation.

It’s about making your dollars work smarter than your excuses.

Practicing Budgeting and Wise Investments

Budgeting gets a bad rap, but think of it as a treasure map for your finances.

One couple I worked with found $300 per month hiding in forgotten subscriptions.

That’s $3,600 year they now invest in index funds.

Your move?

| Wealth Drainers | Wealth Builders |

|---|---|

| Guessing monthly expenses | Tracking every dollar for 30 days |

| Impulse Amazon purchases | 48-hour “want vs need” cooling period |

| Keeping savings in checking | Automated transfers to high yield accounts |

Here’s the secret sauce: manage money like you’re training a puppy.

Consistency beats intensity.

Start with micro habits:

- Review one bank statement weekly

- Invest 1% of income automatically

- Celebrate small money wins

Research shows people who automate investments save 3x more than manual savers.

Why?

You outsmart your inner spender.

My rule?

Set transfers to happen 24 hours after payday.

Future you will high five present you.

Manifesting Wealth Through Spiritual Practices

Think wealth and spirituality don’t mix?

Let’s flip that script.

I used to roll my eyes at “woo woo” money techniques, until a client doubled her income using gratitude journaling while renegotiating contracts.

Spiritual practices grease the wheels for practical action.

Clearing Abundance Blocks and Negativity

Your third grade teacher’s comment about “greedy rich kids”?

That’s still running your money life.

I worked with a CEO who subconsciously avoided profits because his minister father called wealth “sinful”.

We uncovered this through:

- Journaling childhood money memories

- Testing beliefs against current reality

- Creating new mantras like “Wealth fuels my impact”

Scarcity patterns crumble when you confront them.

One client replaced “I’ll never earn enough” with “Opportunities find me daily”.

Her freelance bookings jumped 40% in two months.

Scripting and Visualization for Financial Freedom

Here’s where magic meets math.

Scripting isn’t fantasy, it’s neural training.

Write morning pages describing your ideal financial freedom:

“I smile seeing $12,347 hit my account, another client prepaid. My wealth allows weekend surf trips without checking balances.”

Note the specificity and emotion.

A real estate investor I know scripts exact commission amounts and donation percentages.

Last year, he hit 93% of those targets.

The key?

Pair this with action steps.

Light candles while sending invoices.

Chant affirmations while analyzing stock trends.

Abundance responds to aligned effort.

Conclusion

Building wealth isn’t about luck, it’s about making your daily choices count.

I’ve watched clients transform their finances by pairing practical steps with perspective shifts.

Remember that couple who found hidden cash in subscriptions?

Their story proves financial freedom grows from small, consistent actions.

Your mindset acts like soil for money seeds.

Water it with gratitude for current resources while planting new abundance habits.

Automate savings.

Renegotiate bills.

Celebrate micro wins.

These actions compound faster than any get rich quick scheme.

True success comes when your bank balance matches your self worth.

One client recently texted: “I finally feel like I deserve my raise”.

That shift, from doubt to ownership, changed everything.

Ready to upgrade your money life?

Start today.

Review one financial statement.

Write a specific goal.

Thank past you for lessons learned.

Financial freedom isn’t a destination, it’s who you become through daily practice.

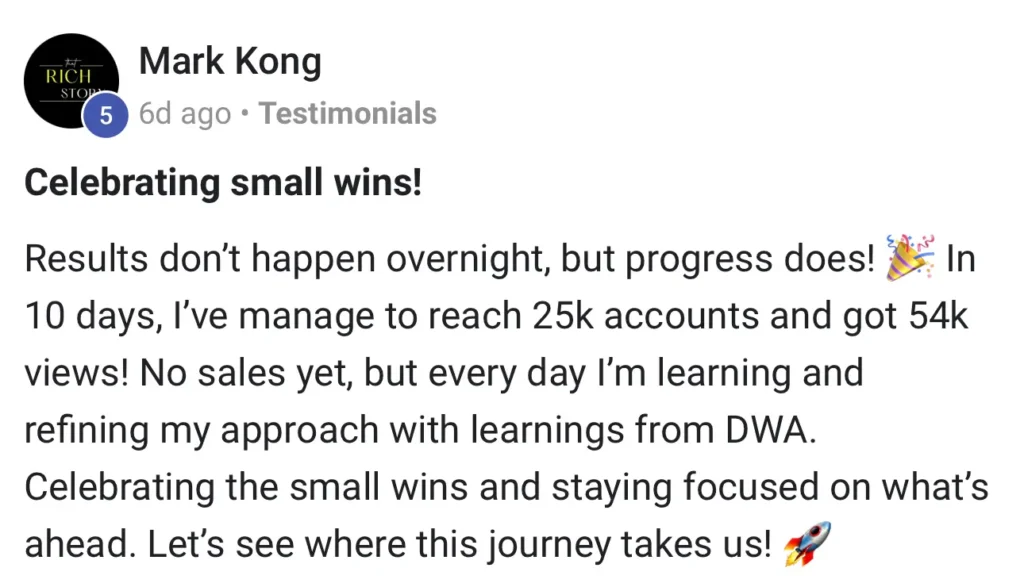

Real Life Results: Explore More DWA Testimonials

Discover how Digital Wealth Academy is changing lives.

Read authentic success stories and see the incredible results members are achieving with the DWA program.

FAQ

Does “attracting money” just mean positive thinking?

Nope. It’s way more than rainbow thoughts! While mindset matters, financial success requires aligning beliefs with consistent action. Think of it like planting seeds (visualization) AND watering them daily (smart habits).

Can budgeting actually help manifest wealth?

100%. Tracking cash flow isn’t restrictive. It’s strategic awareness. You’ll spot leaks (hello, unused subscriptions) and redirect funds toward investments. Pro tip: Apps like Mint turn budgeting into a wealth building game.

What’s the fastest way to shift from a scarcity mindset?

Start small. Replace “I can’t afford this” with “How can I create value to earn this?”. Celebrate micro wins, even $10 saved counts. Scarcity shrinks when you focus on solutions, not limitations.

Do spiritual practices like scripting really work for money?

They work IF paired with action. Scripting future wins (e.g., “My business hit $10K months”) programs your subconscious to spot opportunities. But you still gotta send pitches and refine offers. The universe helps those who hustle.

How often should I visualize financial goals?

Make it a daily ritual, 5 minutes while brewing coffee works. Vivid details matter: imagine the texture of new leather seats in your dream car or the relief of zero debt. Emotion fuels manifestation.

Why do I self sabotage when money starts coming in?

Classic abundance blocks. Maybe you inherited beliefs like “rich people are greedy”. Therapy or journaling helps uncover these. Remember: Your worth isn’t tied to your bank account. You’re allowed to thrive.

Are side hustles necessary to build wealth?

Depends. If your 9 to 5 covers bills + investments? Maybe not. But diversifying income (rental properties, freelance skills) accelerates financial freedom.

How long until these techniques show results?

It’s a marathon, not a sprint. Small mindset shifts create immediate momentum, but substantial wealth? Months to years. Celebrate progress: that first $1K emergency fund? That’s proof the system works.

How do I stop feeling guilty about wanting wealth?

Swap scarcity stories for abundance logic. Money amplifies who you are. It’s neutral. Wanting financial freedom lets you help others MORE. Ever seen Warren Buffett apologize for compounding interest? Exactly.