Let me ask you something:

Why do 90% of people stay stuck in the same financial rut their entire lives?

I used to wake up at 3 AM for minimum wage gigs, watching my coworkers grind through life like zombies.

They weren’t just tired, they were terrified of every money decision.

Sound familiar?

Here’s what nobody tells you:

Becoming wealthy isn’t about penny pinching or waiting 40 years for compound interest.

It’s about escaping the “time for money trap” that keeps most people exhausted and unfulfilled.

I learned this the hard way after studying hundreds of successful individuals.

The real secret?

Your mindset.

But if you want to become a millionaire, the answer starts with one powerful truth:

The best investment you can make is in yourself.

Millionaires don’t just save.

They create income producing assets, scale their earnings, and reinvest with purpose.

That journey begins by mastering a high income skill and building the kind of income that supports long term wealth.

That’s exactly what Digital Wealth Academy (DWA) helps you do.

DWA teaches you step by step how to:

- Develop high income digital skills

- Build and grow online businesses

- Create multiple income streams from scratch

Many people in the DWA community have used the program to create a consistent income.

The first step to saving, investing, and building lasting wealth.

If you want to become a millionaire, stop chasing shortcuts.

Start by creating income, controlling your money, and multiplying it through action.

DWA gives you the tools to begin that journey today.

a free beginner’s guide

DWA Sneak Peek

Learn the easiest and fastest way to start or exponentially grow your existing business.

Table of Contents

Key Takeaways

Mindset shifts matter more than dollar amounts

Traditional financial advice often limits growth

Time management beats strict budgeting

New economy = new wealth building opportunities

Stress free finances require proactive strategies

Ready to crack the code?

Let’s ditch the outdated rules and explore what actually moves the needle.

No lottery tickets or shady schemes, just real world tactics that create lasting freedom.

Understanding the Journey to Millionaire Success

You’ve heard the old advice, but what if it’s holding you back?

Traditional money rules preach penny pinching and 401k dependence, strategies that keep most people comfortably average.

The truth?

Lasting wealth begins when you challenge inherited beliefs about money and value creation.

Overcoming Limiting Beliefs

Here’s the uncomfortable reality:

Your bank account struggles often stem from mental blocks, not math.

I’ve met countless people who religiously followed their parents’ “safe path” advice, only to realize those same mentors never became millionaires themselves.

The most dangerous myth?

Thinking wealth requires decades of stock market patience.

One client told me, “I thought being responsible meant avoiding risks”.

Meanwhile, digital creators half his age were building empires through online courses and AI tools.

Defining Your Financial Freedom

Money mastery isn’t about hitting some arbitrary seven figure goal.

It’s designing a life where financial decisions come from confidence, not desperation.

Ask yourself:

Does my current strategy create energy… or drain it?

A friend recently redefined success as “working 15 hours weekly from my Bali villa”.

That clarity transformed her approach.

She stopped chasing promotions and started automating income streams.

Your version might look completely different, and that’s the point.

Embracing a Millionaire Mindset

What if your biggest wealth barrier isn’t your bank account?

I spent years assuming financial freedom required some magical formula.

Then I realized:

Your thoughts about money shape your reality more than your paycheck ever will.

Building Confidence and Discipline

Here’s the truth bomb:

Confidence grows when you stop trading hours for dollars.

One client doubled her income after realizing her value came from solving clients’ headaches, not working overtime.

They’re currency, but only if you price them like a CEO, not an employee.

Discipline gets a bad rap.

It’s not about saying “no” to lattes.

It’s saying “yes” to investments that compound.

I automate 22% of every check into assets that pay me while I sleep.

Your future self will high five you for starting today.

Cultivating a Growth Oriented Perspective

Ever notice how millionaires see problems as dollar signs?

That’s not luck, it’s practice.

When my first business crashed, I treated it like a paid MBA program.

Now I spot opportunities in:

- Market gaps others ignore

- Skills that scale beyond 1:1 work

- Trends most people call “risky”

Abundance thinking changes everything.

Money flows where value lives.

Start asking:

“What can I build that makes people’s lives easier?”

The answers might surprise you.

a free beginner’s guide

DWA Sneak Peek

Learn the easiest and fastest way to start or exponentially grow your existing business.

Taking Calculated Risks for Success

What separates the wealthy from the rest isn’t luck.

It’s their approach to risk.

I once watched a friend turn $5k into six figures by investing in emerging tech stocks while others hoarded cash.

Safe choices feel cozy, but they rarely move the needle.

Here’s the cold truth:

Playing defense with your money guarantees you’ll lose the long game.

Inflation eats 2 to 3% annually, turning “secure” savings into slow motion financial decay.

The real danger?

Wasting your prime years avoiding opportunities that could multiply your wealth.

Evaluating Risk vs. Reward

Smart risk takers ask one question first:

“What’s my recovery plan if this fails?”

When I launched my first online course, I budgeted six months of runway.

The worst case scenario?

Losing $8k but gaining priceless marketing skills.

That’s calculated risk, not hoping to win the lottery.

Young professionals have a secret weapon: time.

You can rebound from setbacks faster than someone with a mortgage and daycare bills.

I’ve seen people in their 20s:

- Start side businesses during night shifts

- Invest 15% of income in high growth assets

- Pivot careers for emerging industries

The way you frame risk changes everything.

Gambling is betting on red.

Calculated moves?

That’s researching roulette wheel biases and placing strategic chips.

Most self made millionaires I know failed spectacularly before finding their winning formula.

The Value of Early Financial Education

Here’s the kicker:

Our school system wasn’t built to create wealth builders.

The Prussian model they copied in the 1800s?

Designed to train factory workers who’d follow orders, not question systems.

Let that sink in while you’re balancing checkbooks and praying for promotions.

Learning Beyond Traditional Classrooms

I learned more about money from a $29 YouTube course than four years of college economics.

Schools teach you to work for money, not make it work for you.

Meanwhile, 15 year olds are mastering dropshipping between algebra classes.

The internet demolished education gatekeeping.

Want proof?

Last year, I met a former barista who:

- Learned copywriting in 3 months through free blogs

- Tripled her income freelancing

- Now teaches others through her own digital courses

Traditional education takes years to update curricula.

By the time schools add AI literacy programs, ChatGPT N+1 will be running Fortune 500 companies.

Real financial education happens through:

- Case studies of successful people

- Market experiments (yes, you’ll fail sometimes)

- Communities solving modern money problems

Let’s get real:

Waiting for permission to learn about wealth is like expecting your gym teacher to train Olympic athletes.

Your financial future can’t wait for outdated systems to catch up.

Start building your own column of assets (something that puts money in your pocket) today.

Leveraging Passive Income and Active Investments

Let’s cut through the noise about passive income myths.

I used to believe rental properties and dividend stocks would magically print cash while I sipped margaritas.

Then I learned the hard truth:

Passive income requires active work first.

You can’t skip the grind phase.

Passive Income Principles

Here’s the reality check: Building true residual income demands upfront hustle.

A friend’s first “passive” online course took 147 hours to create before earning a dime.

Sustainable wealth streams need:

- Seed funding from active income

- Systems that outlive your direct involvement

- Regular optimization (yes, even “set and forget” assets)

| Active Income | Passive Income | |

|---|---|---|

| Time Investment | High (trading hours) | Low after setup |

| Control | Direct | Delegated |

| Scalability | Limited by capacity | Exponential potential |

Active Income Strategies

Your best wealth building tool?

Skills that command premium rates.

I tripled my consulting fees after mastering AI driven market analysis.

Focus on:

- High demand niches (automation, data storytelling)

- Value based pricing models

- Recurring revenue streams through retainers

One client transformed her $60k salary into $23k per month by combining freelance UX design with template sales.

The key?

Using active income to fund income producing assets.

Not just saving leftovers.

Digital Entrepreneurship and Product Creation

Still trading hours for dollars?

Here’s the wake up call:

Your paycheck is just someone else’s product profit.

I watched a graphic designer friend build a $400k per year font library while his agency clients paid him $45 per hour.

That’s the power shift digital products create.

Developing Marketable Products

Most people overcomplicate this.

My first successful product?

A $17 Excel template solving a billing headache I faced daily.

The formula works:

Identify your own frustrations → Build a better solution → Package it for others.

Look at existing tools in your field.

A nutrition coach client noticed her clients hated meal planning apps.

She created simple PDF checklists instead.

Now earning more from downloads than 1:1 coaching.

You don’t need groundbreaking ideas, just better execution.

Testing and Iterating for Success

Perfectionism kills profits.

Launch your MVP (Minimum Viable Product) before you’re “ready”.

My first online course had typos and mediocre slides, but real customers revealed what actually mattered:

- Clear action steps beat polished presentations

- Price objections vanished when results were guaranteed

- 80% of requested “features” weren’t needed

Building wealth through products means treating feedback like free consulting.

One software developer doubled his subscription rates after users begged for AI integrations he considered “too advanced”.

Let the market guide your upgrades, not your insecurities.

a free beginner’s guide

DWA Sneak Peek

Learn the easiest and fastest way to start or exponentially grow your existing business.

Building Wealth Through Side Hustles and Innovation

Think your 9 to 5 is the only path to wealth?

I used to believe that too, until my $70k salary started funding $4k per month investments through strategic side gigs.

The real magic happens when you treat spare hours as wealth building rocket fuel rather than Netflix time.

Identifying Lucrative Side Hustle Opportunities

My game changer?

Realizing every industry has hidden pain points begging for solutions.

That billing spreadsheet I hacked together for my day job?

Turned into a $300 per month SaaS tool for small businesses.

Your secret weapon:

Observe frustrations → Build solutions → Monetize relentlessly.

Internet ventures crush traditional models.

You’ll spend the same time building a local bakery (cap: $200k per year) as creating digital products with unlimited upside.

One client transformed her knitting hobby into six figures by selling patterns online, zero inventory, global reach.

True wealth acceleration starts when side income surpasses your job’s earnings.

I reinvested every extra dollar into cash flowing assets, creating a snowball effect.

Your move?

Start small, think scalable, and watch that side hustle muscle grow.

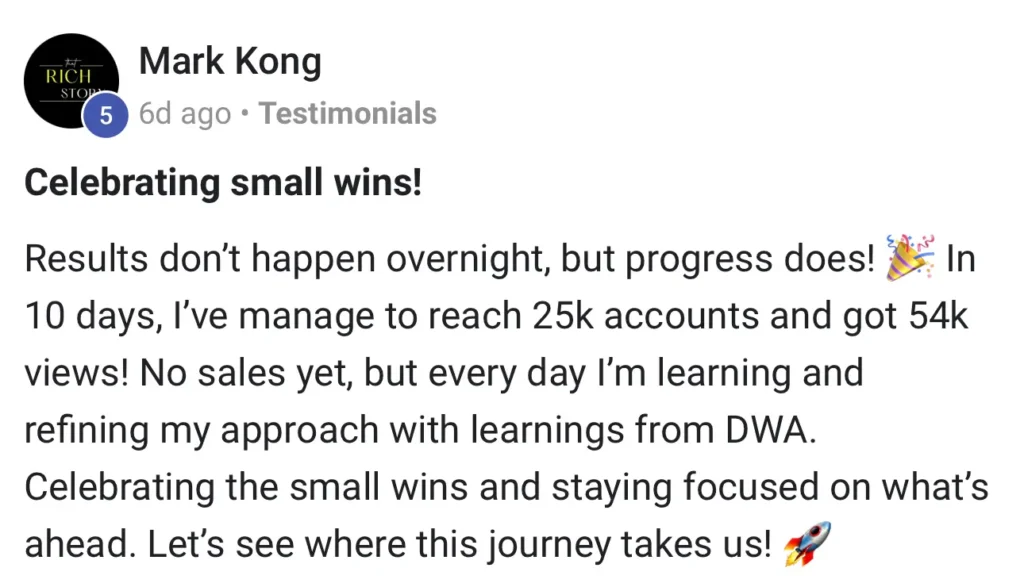

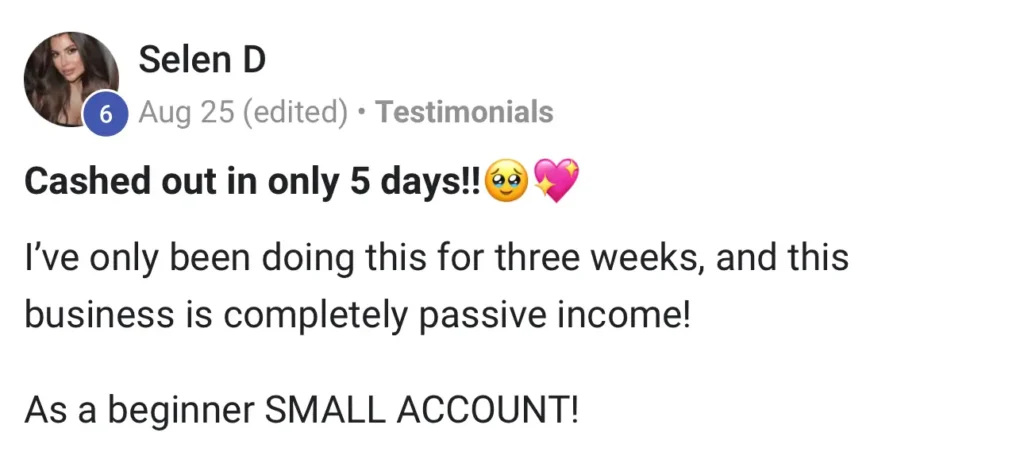

Real Life Results: Explore More DWA Testimonials

Discover how Digital Wealth Academy is changing lives.

Read authentic success stories and see the incredible results members are achieving with the DWA program.

FAQ

How long does it realistically take to reach $1M?

Depends on your starting point and strategy. If you invest $1,000 per month at 7% returns (historically conservative for the S&P 500), you’d hit millionaire status in ~25 years. Bump that to $2,500 per month? You’re looking at 15 years. Time and compound growth are your best friends here.

Can I build wealth without a high paying job?

Absolutely. Warren Buffett still lives in his $31,500 Omaha house bought in 1958. Focus on living below your means, side hustles (like freelance coding or Airbnb hosting), and letting investments work. I’ve seen teachers become millionaires through rental properties and index funds.

Does becoming a millionaire require being a genius?

Thankfully nope. It requires consistency more than IQ. Automatic 401(k) contributions, avoiding lifestyle inflation, and learning basic stock market principles (like dollar cost averaging) matter way more. Most millionaires are ordinary people who didn’t quit.

Are stocks safer than keeping cash under my mattress?

Mattresses lose to inflation (3.27% average). Even “boring” index funds like VOO (Vanguard S&P 500 ETF) have averaged 10% annual returns since 1926. $10k invested in 2014 would be $32k today, versus $10k cash becoming worth $8,300 in purchasing power.

Do I need a finance degree to manage money well?

Hell no. Robert Kiyosaki’s “Rich Dad Poor Dad” (which explains assets vs liabilities) has sold 40M copies without being a textbook. Free resources like The Money Guy Show podcast or r/personalfinance teach budgeting and investing better than most MBA programs.

What’s the fastest way to build wealth today?

Combine high income skills (like SaaS sales commissions) with scalable side hustles. Example: A nurse making $80k per year starts a telehealth consulting biz earning $5k per month extra. Invest 50% of that surplus? You’re adding $30k per year to investments, accelerating your timeline dramatically.

Can I test business ideas without going broke?

100%. Use MVP (Minimum Viable Product) strategies. Create digital products using Canva templates, sell through Gumroad, and validate demand with $0 inventory. One client made $18k testing a PDF gardening guide on Etsy before investing in printed copies.

Are side hustles still worth it in 2024?

Depends on the hustle. Uber driving? Meh. Teaching AI prompt engineering on Kajabi? Goldmine. Focus on high margin, low time gigs. A friend clears $8k per month helping businesses optimize ChatGPT, working 10 hours per week from Bali. That’s the modern hustle blueprint.