What if I told you budgeting isn’t about math, it’s about freedom?

Think about it: When’s the last time you felt truly in control of your money instead of it controlling you?

Let’s get real.

A solid spending plan isn’t just for spreadsheet warriors.

It’s your secret weapon for crushing goals without sacrificing lattes or weekend fun.

I’ve seen folks transform from “Where’d my paycheck go?” to “Let’s book that vacation!” just by mapping their cash flow.

Here’s the kicker: Budgeting doesn’t mean living like a monk.

It’s about making your money work harder so you don’t have to.

Think of it as a GPS for your dollars, no more financial detours or running on empty when life throws curveballs.

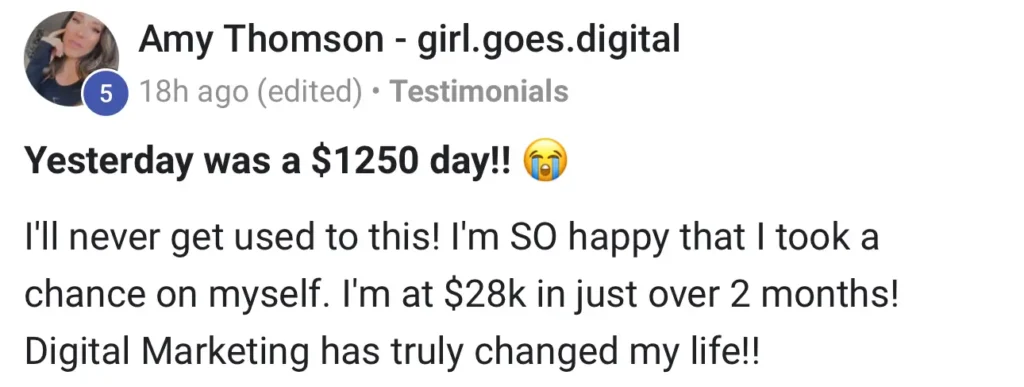

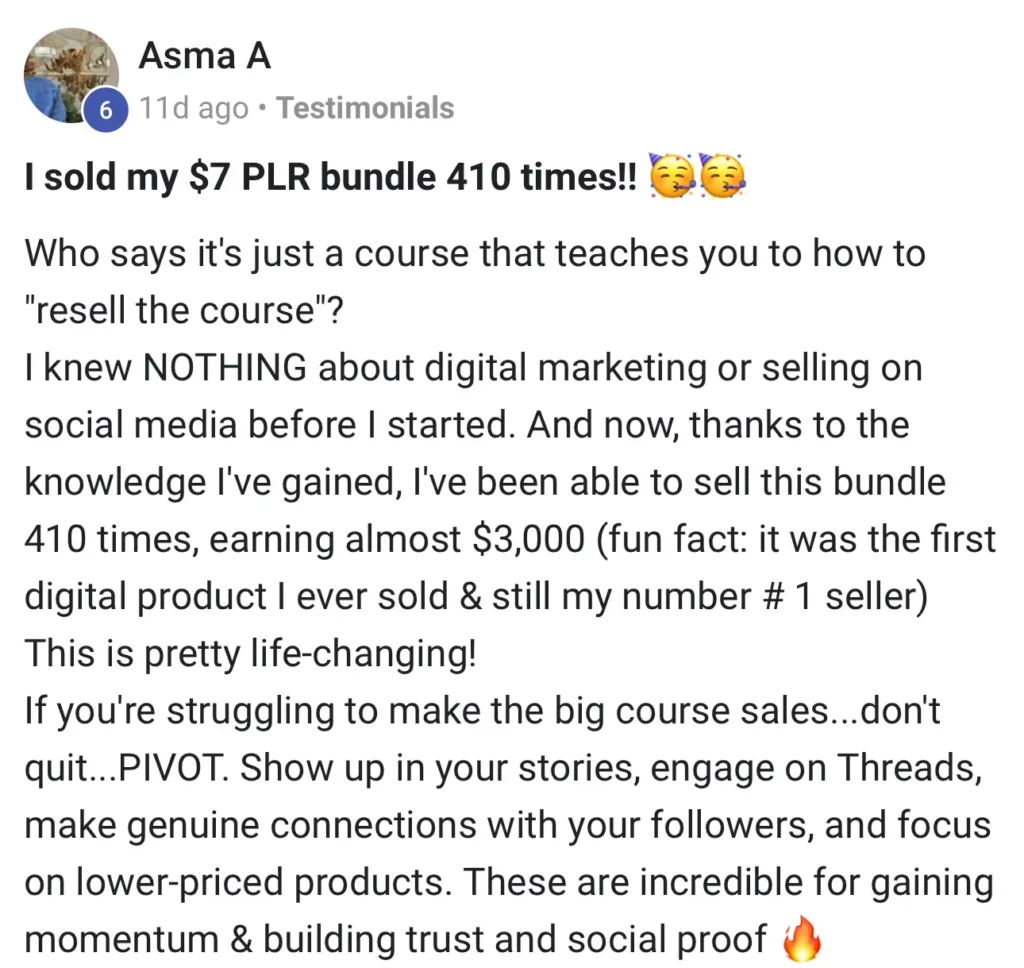

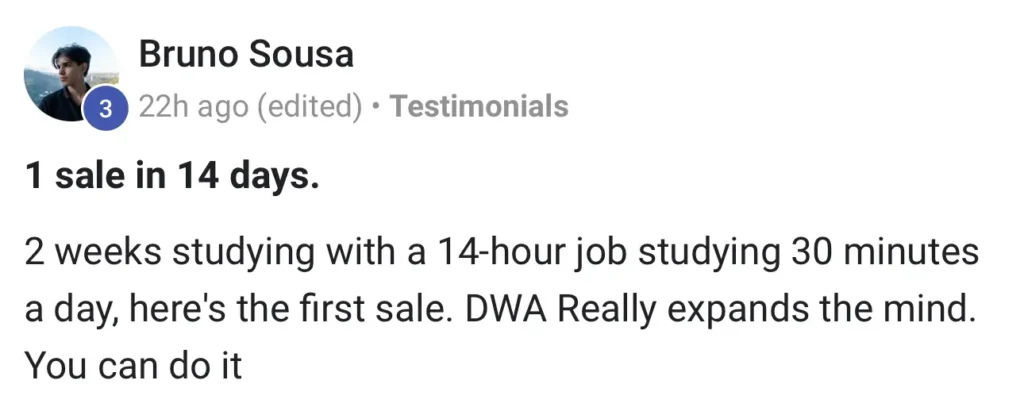

The Digital Wealth Academy

earn 85% as AN affiliate – learn how to start or scale your own business

Table of Contents

Key Takeaways

Budgets create clarity, not restrictions

Every dollar has a purpose (yes, even fun money)

Stress reduction starts with awareness

Flexible plans survive real life surprises

Ready to turn money anxiety into action?

Let’s build a system that fits your life, not the other way around.

Spoiler: You’ll sleep better tonight.

Understanding Budgeting Basics

Ever felt like your paycheck vanishes before month end?

A budget fixes that.

It’s not a straitjacket for your wallet, it’s your money’s personal navigation system.

Think of it as putting your cash flow on GPS mode, where every dollar gets clear directions instead of wandering.

What Is a Budget and Why Does It Matter?

A budget is your financial mirror.

It shows exactly where your money goes, no filters.

When I started tracking my coffee runs, I realized they cost more than my streaming subscriptions.

That’s the magic of awareness.

This plan helps you spot patterns.

Maybe you’re spending 30% on dining out but only 5% on hobbies.

Flip those numbers, and suddenly life feels more intentional.

Your money starts working for you, not against you.

The Role of a Budget in Financial Control

Consistency turns budgets into superpowers.

Track income and expenses for just 30 days, and you’ll see leaks you never noticed.

I once found $120/month disappearing into forgotten app subscriptions, enough for a weekend getaway!

Set realistic targets.

If you slash your entertainment fund too hard, you’ll binge spend later.

Leave room for pizza nights while steering funds toward bigger goals.

Balance beats perfection every time.

How to Budget Effectively

Ever opened your banking app and thought, “Wait, that’s all I have left?”

Let’s fix that panic button.

Effective money management starts with three core elements: knowing what you earn, where it goes, and how to grow it.

No jargon, just actionable steps that work.

Your 5 Step Financial GPS

| Step | Action | Pro Tip |

|---|---|---|

| 1 | Calculate real income | Use net pay, not gross |

| 2 | Pick your system | Try 3 methods for 2 weeks each |

| 3 | Monitor spending | Weekly 10 minute check ins |

| 4 | Auto save first | Treat savings like a bill |

| 5 | Quarterly tune ups | Align with life changes |

The Trifecta: Earn, Spend, Save

Start with your actual take home pay, the number that hits your account after taxes.

If your income fluctuates, use last year’s lowest month as your baseline.

This isn’t pessimism, it’s smart planning.

Track expenses for 30 days without judgment.

You’ll spot patterns like “I spend more on Uber Eats when stressed”.

Awareness creates choice.

From there, allocate funds to savings before other spending, even 5% adds up fast.

My friend Jen automated $50 weekly transfers and saved $2,600 in a year, without noticing the difference.

Systems beat willpower every time.

Remember: Your plan should bend without breaking when life gets messy.

Essential Budgeting Tools and Techniques

Your money tracking tools should fit like your favorite jeans, comfy and tailored to your lifestyle.

Whether you’re a spreadsheet geek or a receipt hoarder, the right system turns financial chaos into clarity.

Using Apps, Worksheets, and Manual Tracking

I tested 14 apps last year.

My takeaway?

The fanciest tool means nothing if you abandon it after week two.

Consistency beats features every time.

Here’s what works:

| Method | Best For | Pros | Cons |

|---|---|---|---|

| Apps | Tech lovers | Auto syncs accounts | Subscription fees |

| Worksheets | Visual planners | Custom categories | Manual updates |

| Notebook | Hands on types | No tech required | Easy to lose |

Create spending categories that mirror your life.

My friend Dave had “Taco Tuesday” as a separate line item, until he realized 27 food subcategories were ridiculous.

Simplify:

- Fixed costs (rent, bills)

- Flexible spending (groceries, gas)

- Fun money (concerts, hobbies)

Track cash by snapping receipt photos.

For cards, review statements weekly, it takes 8 minutes.

Pro tip: Color code expenses with highlighters if you’re old school.

The goal?

See where your money flows without drowning in data.

Prioritizing Your Financial Goals

Money triage exists, and no, I’m not talking about hospital dramas.

Imagine your dollars as patients: Which ones need immediate attention, and which can wait?

Let’s build your financial ER.

Needs vs Wants: The Great Sorting

My wake up call came when I realized my “need” for daily lattes equaled $180/month, enough to fund a basic car repair.

True needs keep roofs overhead and lights on.

Wants?

Those are the extras that make life sweet but won’t wreck your world if paused.

| Needs | Wants |

|---|---|

| Rent/mortgage | Streaming upgrades |

| Groceries | Designer shoes |

| Utilities | Concert tickets |

Building Safety Nets And Slaying Debt

Here’s your action plan ranked by urgency:

| Priority | Action | Why It Matters |

|---|---|---|

| 1 | $500 emergency fund | Covers sudden expenses |

| 2 | 401(k) employer match | Free retirement money |

| 3 | High interest debt | Stops interest bleeding |

Once these bases are covered, grow your emergency fund to 3-6 months’ expenses.

Keep it in a separate account, visible enough to motivate you, hidden enough to avoid temptation.

Pro tip: Name it “Do Not Touch Unless 🔥” in your banking app.

Debt repayment gets strategic: Attack cards with rates over 10% first.

Every dollar paid here gives instant ROI.

My cousin saved $2,300 in interest this way, enough for a last minute Hawaii trip when borders reopened.

Balance comes from knowing when to shift focus.

You shouldn’t ignore retirement to pay low rate student loans, just like you wouldn’t skip vaccines to buy concert tickets.

Your money goals deserve this level of care.

a free beginner’s guide

DWA Sneak Peek

Learn the easiest and fastest way to start or exponentially grow your existing business.

Simple Budget Models for Every Lifestyle

Budget frameworks work like your favorite recipes, adjust the ingredients to suit your taste.

Let’s explore flexible systems that adapt to your income and priorities without spreadsheet headaches.

The 50/30/20 Plan Explained

This popular split acts like financial training wheels.

Half your income covers needs, think rent, groceries, and utilities.

Pro tip: Minimum debt payments count here too.

Miss that detail, and your plan derails fast.

The 30% wants category?

That’s guilt free cash for concerts or fancy coffee.

One client spent hers on vintage viny, no judgment.

The remaining 20% tackles savings and extra debt payments.

“But my rent eats 45%!”

No sweat, shave 5% from wants or savings.

Flexibility keeps you on track.

Alternative Approaches Like 60/20/20

High cost areas demand creativity.

The 60/20/20 model helps when housing consumes 40%+ of income.

Essentials get 60%, savings 20%, wants 20%.

I’ve seen teachers use this when rent spiked in their city.

| Model | Needs | Wants | Savings/Debt |

|---|---|---|---|

| 50/30/20 | 50% | 30% | 20% |

| 60/20/20 | 60% | 20% | 20% |

| Fidelity 50/15/5 | 50% | 30%* | 15% retirement + 5% emergencies |

*Fidelity’s method bundles wants with essentials after savings.

Works great for freelancers needing predictable cash reserves.

A baker client uses this to fund both her 401(k) and “oven repair fund”.

Your perfect plan lives where math meets reality.

Start with percentages, then tweak until it feels sustainable.

Remember, a budget you abandon helps no one.

Addressing Challenges and Adjusting Your Budget

Ever felt like your budget ghosted you?

You’re not alone.

Financial plans need checkups like your car needs oil changes, skip maintenance, and things grind to a halt.

Spotting Sneaky Spending Traps

Impulse buys love disguising themselves as “emergencies”.

That limited edition concert tee?

Not urgent.

Peer pressure trips up more people than avocado toast prices.

Pro tip: Wait 24 hours before swiping your card for non essentials.

Track where your cash flows each month.

If groceries keep busting your limits, maybe meal planning needs a revamp.

Life shifts faster than TikTok trends.

Review your plan every 3 months, did your rent spike?

Get a raise?

Adjust allocations like you’d update playlists.

Flexibility beats rigidity when managing money.

If your current system feels clunky, switch tools.

Apps bored you?

Try cash envelopes.

Spreadsheets stress you?

Use a bullet journal.

The right method sticks when it fits your habits.

FAQ

Can I budget if my income changes every month?

Absolutely! Start by calculating your average monthly income from the last 6 months. Allocate funds to essentials first (rent, utilities, groceries), then prioritize flexible categories like entertainment. Apps like YNAB specialize in variable income budgeting.

What’s the fastest way to track expenses?

Automation is your friend. Link accounts to Mint or PocketGuard for real time tracking. For manual folks, carry a tiny notebook (yes, like your grandma did) or use voice memos. My hack? Snap receipts and sort them later with Expensify.

Is the 50/30/20 rule realistic with high debt?

It’s a starting point, not gospel. If you’re drowning in credit card debt, flip the script: prioritize debt repayment over savings temporarily. I once put 40% toward student loans, painful but worth it for long term freedom

How do I stop overspending on “wants”?

Try the 24 hour rule: wait a day before buying non essentials. I also use separate accounts for discretionary spending. Pro tip: Delete food delivery apps during tight months. Your wallet (and waistline) will thank you.

How big should my emergency fund be?

Start with $1,000 ASAP (baby emergency fund), then build to 3-6 months’ expenses. If you’re freelance or have unstable income, aim for 8 months. Keep it in a high yield savings account – Ally Bank currently offers 4.25% APY.

Can I budget for vacations and fun stuff?

Heck yes! I have a “Guilt-Free Spending” category. Want that Bali trip? Create a sinking fund, auto transfer $200/month to a separate account. Watching that balance grow beats impulse-buying airport souvenirs.