Learning how to budget your money is essential, but budgeting works best when you have enough income to organize with purpose, not just survive.

Ever wonder why your bank account feels like a leaky bucket?

You work hard, but the numbers never seem to add up.

Here’s the kicker:

What if your biggest financial problem isn’t how much you earn, it’s how you manage what you’ve already got?

Let’s get real.

Most advice about tracking dollars feels like a part time job nobody wants.

Spreadsheets?

Apps that guilt trip you?

No thanks.

I’ve seen countless folks, busy professionals like you, toss their plans by Week 2 because traditional methods just… suck.

But here’s the secret:

Budgeting isn’t about saying “no” to lattes.

It’s about saying “heck yes” to the stuff that lights up your life.

Imagine funding that beach vacation and crushing credit card debt.

Or finally understanding where your cash goes without feeling like you’re on trial.

This isn’t another lecture.

It’s a GPS for your money.

We’ll tackle why most systems fail (spoiler: they’re designed for robots, not humans), then rebuild your approach with flexible strategies that stick.

By the end, you’ll know exactly how to align your spending with what matters most, whether that’s early retirement or front row concert tickets.

The first step is to invest in yourself, increase your income, and build your first cash-flowing asset.

With more money coming in each month, your budget becomes a tool for growth, not just restriction.

One of the most effective ways to start is through Digital Wealth Academy (DWA).

DWA teaches you how to earn more by building a digital business from scratch.

Once your income grows, you’ll find budgeting easier, clearer, and more motivating.

With a consistent income and a smart budget, you can:

- Cover essentials without stress

- Save and invest strategically

- Pay off debt faster

- Build long term wealth

If you want to master your money, start by growing what you have and use your budget to take control, not hold back.

The Digital Wealth Academy

earn 85% as AN affiliate – learn how to start or scale your own business

Table of Contents

Key Takeaways

Budgeting unlocks spending freedom, not restrictions

Traditional methods often fail because they ignore real life chaos

Effective plans work with your lifestyle, not against it

Financial clarity reduces stress and builds confidence

Guilt free spending becomes possible with the right framework

Long term goals grow from consistent small wins

Understanding the Basics of Budgeting

What if your biggest money problem isn’t earning more, but directing it smarter?

Let’s demystify the foundation of financial control without spreadsheets or guilt trips.

Your Money’s Roadmap

A budget isn’t a straitjacket.

It’s your personal cash flow blueprint.

Think of it as a monthly game plan showing exactly where dollars enter and exit your life.

I’ve seen clients transform from financial firefighters to strategic planners just by writing this down.

Why Monthly Matters

Consistent budgeting helps you:

- Spot sneaky spending habits (goodbye, $5 daily app subscriptions)

- Build emergency cushions before crises hit

- Fund goals automatically, like that Costa Rica trip

Remember last month’s surprise car repair?

With a working plan, those “oh crap” moments become “no sweat” situations.

You’ll shift from surviving paychecks to designing your financial future, one intentional choice at a time.

Essential Steps on How to Budget Your Money

Ever feel like your cash plays hide and seek?

Let’s turn on the lights.

This phase separates wishful thinking from real financial clarity, no math degree required.

Gathering Income and Expense Documentation

Start by rounding up your financial paperwork.

Pay stubs, utility bills, bank statements, grab it all.

I’ve seen clients uncover $200 per month in forgotten subscriptions during this step.

| Fixed Costs | Variable Costs | Hidden Costs |

|---|---|---|

| Rent/Mortgage | Groceries | Streaming Services |

| Car Payment | Entertainment | Bank Fees |

Setting Up Your Budget Worksheet

Choose your weapon: spreadsheet, notebook, or app.

List all income sources first: regular paychecks, side gigs, that $20 your cousin owes you.

Then track every outgoing dollar for 30 days.

| Tracking Method | Best For | Success Rate |

|---|---|---|

| Digital Apps | Tech Lovers | 78% Stick With It |

| Spreadsheets | Detail Oriented | 65% Long Term Use |

Pro tip: Categorize expenses as “fixed” or “flexible”.

You’ll spot patterns faster than spotting free office snacks.

This foundation helps you make smarter choices, like realizing those daily lattes cost more than your car insurance.

Identifying Your Income Sources

What’s more unpredictable than your Wi-Fi signal?

For many, it’s their income.

Let’s map out every dollar flowing your way, whether it arrives like clockwork or shows up fashionably late.

Regular Paychecks vs. Irregular Income

Steady 9 to 5 deposits?

Easy peasy.

But when cash arrives in random bursts, hello freelancers and gig warriors.

You need ninja level planning.

I’ve helped Uber drivers and wedding photographers crack this code using one magic formula:

“Annualize, then divide by 12. Your future self will high five you.”

Here’s how it works: Add up last year’s total earnings (yes, even Grandma’s birthday check), then divide by 12.

This creates your baseline “salary”, even if real deposits vary wildly.

Pro tip: Treat financial aid refunds like bonus rounds, not regular players.

Three key strategies for uneven cash flow:

- Build a 2 month buffer during fat months

- Separate “feast” funds from “famine” essentials

- Automate savings when big checks land

Remember that client who budgeted $3k per month as a realtor?

When she actually earned $5k in April, we parked the extra $2k.

By December’s slow season?

She was sipping cocoa stress free while competitors panicked.

Track every income stream, yes, even that $50 garage sale haul.

Visibility transforms financial chaos into controlled momentum.

Tracking and Categorizing Expenses

Ever find yourself staring at a pile of receipts wondering where the month went?

You’re not alone.

Let’s crack the code on where your cash actually flows, without turning into a spreadsheet zombie.

The Non Negotiables vs. The Adjustables

Hard expenses are your financial bedrock, they don’t care if you’re broke or winning at life.

Think:

- Mortgage/rent (roof = non optional)

- Insurance premiums (adulting tax)

- Minimum debt payments (credit card companies don’t accept IOUs)

Flexible costs?

Those are your “oops, I DoorDashed again” categories.

Groceries, gas, Netflix, necessary but variable.

Pro tip: Track these for 30 days.

You’ll spot patterns faster than spotting a clearance rack.

Survival First, Splurges Later

Needs vs. wants isn’t about living like a monk.

It’s strategic prioritization:

“Pay the electric bill before buying concert tickets, dark apartments make terrible venues”.

| Fixed Costs | Adjustable Costs |

|---|---|

| Car payment | Dining out |

| Student loans | Hobby supplies |

I helped a client realize her $200 per month coffee habit exceeded her car payment.

Now she brews at home, and funds beach weekends guilt free.

That’s the power of clear categorization.

Three tracking hacks that actually work:

- Snap receipt photos immediately

- Use app notifications (gentle nudges > guilt trips)

- Weekly 5 minute check ins

Remember: This isn’t about cutting joy, it’s about designing a spending plan that lets you enjoy life while keeping the lights on.

Literally.

Using Digital Tools and Budgeting Apps

Ready to make your phone do the heavy lifting?

Modern tools turn financial tracking from a chore into a background process.

Let’s explore options that fit your tech comfort level, whether you’re a spreadsheet skeptic or an app addict.

Popular Budgeting Tools for the U.S. Market

Mint.com remains the OG of automated tracking.

Link your bank account, and it categorizes spending while you binge Netflix.

But newer players like YNAB (“You Need A Budget”) and EveryDollar offer unique twists:

| Tool | Best Feature | Cost |

|---|---|---|

| Mint | Automatic categorization | Free |

| YNAB | Debt payoff focus | $14.99/month |

| EveryDollar | Zero-based budgeting | Free (basic) |

The FTC’s free worksheet is perfect for analog fans.

Some people use it alongside apps for double clarity.

One grad student tracked her ramen budget manually while apps handled recurring bills.

Three signs you’ll love digital resources:

- You forget cash transactions (apps remember)

- You want real time alerts when funds dip

- Visual graphs make your brain happy

Traditional pen and paper still works if you thrive on tactile feedback.

The key?

Choose tools that match your rhythm, not what influencers push.

Creating a Customized Budget Plan

What if your budget could flex like your weekend plans?

Let’s build a money strategy that moves with your life, not against it.

Whether flying solo or coordinating with a crew, personalization beats generic templates every time.

Tailored Money Blueprints

Single?

Your plan might focus on maxing out retirement contributions.

Couples?

It’s about merging priorities without murdering each other.

One client couple avoided divorce by switching from 50/50 splits to proportional contributions, suddenly, arguments about grocery bills vanished.

| Method | How It Works | Best For |

|---|---|---|

| Full Merge | Combine all income into joint accounts | Shared long term goals |

| Percentage Split | Each contributes 30% of income to shared costs | Income disparities |

| Separate + Shared | Individual accounts + joint expense pool | Financial independence seekers |

Families need extra layers.

I helped a household of five create “category captains”, each kid managed a budget line (groceries, utilities, entertainment).

Surprise, teenagers became coupon clipping ninjas when responsible for the snack fund.

Start each month with a 15 minute huddle.

Review last month’s wins (“We stayed under dining out limits!”) and adjust for upcoming needs.

Pro tip: Schedule these talks over pancakes, everything’s negotiable with maple syrup involved.

Build in a 10% flexibility buffer.

When your car tire explodes or concert tickets drop, you’re ready.

Managing Daily Spending Habits

Want to know where your cash disappears before payday?

The answer’s simpler than you think.

Daily expense tracking acts like financial x ray vision, it reveals what’s actually happening with your dollars, not what you think is happening.

Tips for Recording Daily Expenses

Forget ledger books and hour long sessions.

Modern tracking takes three minutes daily.

Try these painless methods:

- Snap receipt photos while waiting in line

- Use voice memos: “$4.75 latte at 8:15 AM”

- Drop virtual pins on Google Maps for location based spending patterns

A friend saved $200 per month simply by noting coffee runs in her phone’s notes app.

“Seeing those $6 charges add up shocked me into brewing at home”, she told me last week.

Review spending every 30 days like a detective solving a mystery.

Look for:

- Recurring subscriptions you forgot about

- Emotional spending triggers (late night Amazon scrolling, anyone?)

- Patterns that clash with your priorities

“Tracking isn’t about judgment, it’s about creating choices”.

Set weekly alerts to categorize expenses.

Apps like Wally or Goodbudget automate 80% of the work.

The key?

Consistency beats perfection.

Miss a day?

No guilt, just resume tomorrow.

Reducing Costs and Cutting Unnecessary Expenses

Trimming expenses doesn’t mean living on ramen.

It’s about spending smarter where it counts.

Let’s talk real strategies that keep cash in your wallet without sacrificing life’s little joys.

Smart Shopping and Meal Planning

Ever grab snacks you didn’t plan to buy?

Your stomach might be hijacking your grocery cart.

Never browse aisles hungry.

It’s like texting your ex after midnight.

Always dangerous.

Create weekly meal plans using ingredients that pull double duty.

That rotisserie chicken becomes tacos Tuesday and soup Thursday.

Apps like Flipp compare prices across stores instantly.

No more driving to three markets for deals.

Transportation eats budgets faster than a Tesla charges.

Carpooling cuts gas costs while making commute podcasts more entertaining.

Bonus: Public transit riders save an average $10k yearly versus car owners.

Still need wheels?

Generic oil changes and tire rotations keep maintenance affordable.

House brands and bulk bins are your new best friends.

That $4 cereal tastes identical to the $8 “premium” box.

I’ve done blind taste tests.

Pro tip: Pack snacks before road trips.

Gas station beef jerky prices should be illegal.

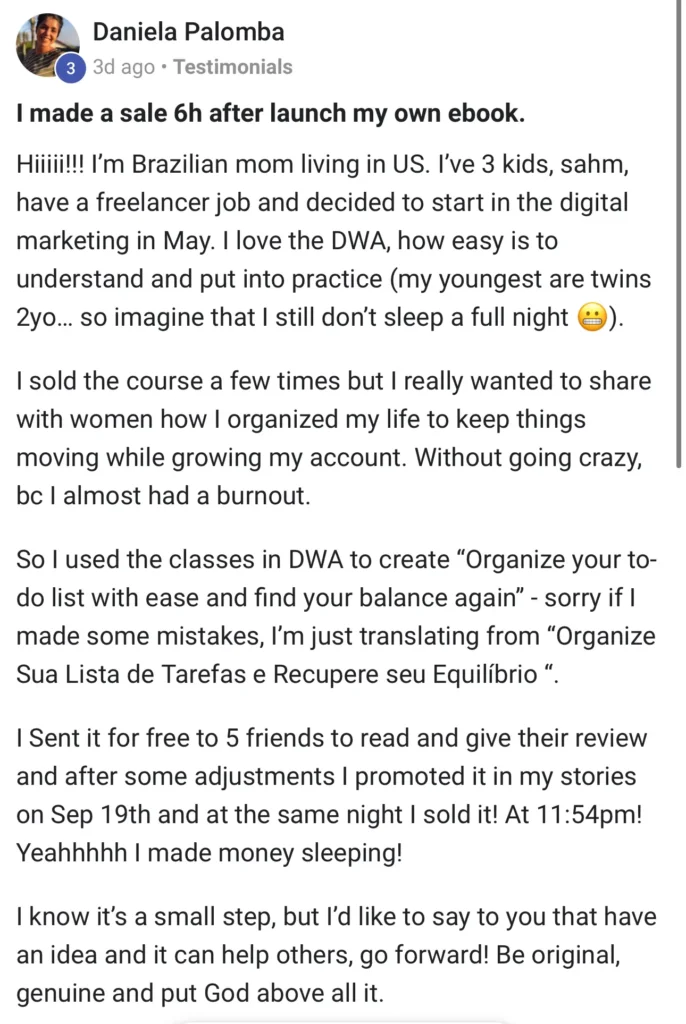

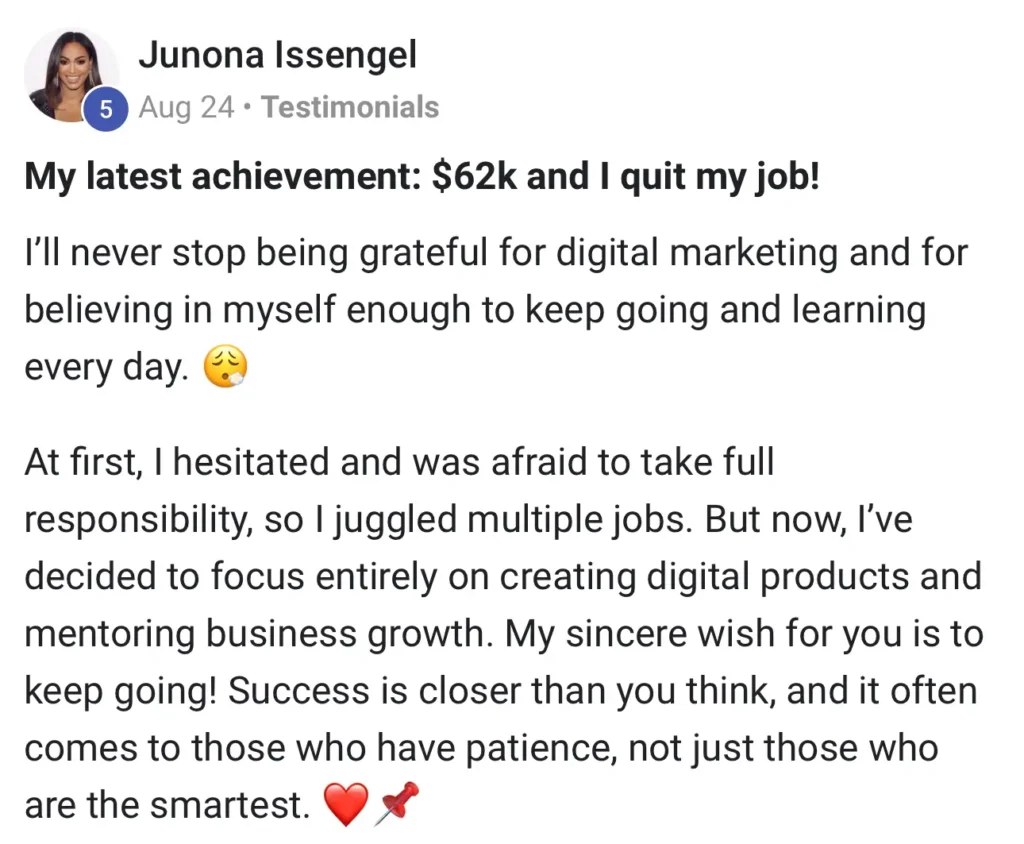

Real Life Results: Explore More DWA Testimonials

Discover how Digital Wealth Academy is changing lives.

Read authentic success stories and see the incredible results members are achieving with the DWA program.

FAQ

How much should I allocate to emergency savings each month?

Aim to stash at least 10 to 15% of your income into an emergency fund until you hit 3 to 6 months’ worth of expenses. Start small if needed. Even $20 per week adds up. Treat this like a non negotiable bill to build financial safety nets.

What’s the fastest way to pay off debt while budgeting?

Try the debt snowball method: List debts smallest to largest, attack the little ones first while making minimum payments on others. Every dollar freed up from paid off debts gets rolled into the next target. Celebrate those wins, they keep you motivated!

Should I use cash or credit cards for daily spending?

Cash works great for flexible expenses like groceries or entertainment. It’s harder to overspend when you see physical money leaving your wallet. For bills or tracked subscriptions, credit cards (paid in full monthly) can build credit and earn rewards, just stick to your budget!

How often should I review my budget plan?

Do a weekly check in to track spending against your categories. At month’s end, analyze what worked (hello, under spent gas budget!) and adjust next month’s amounts. Life changes? New job, rent hike, or pet costs mean it’s time to tweak those numbers ASAP.

What percentage of income should go toward entertainment?

Most plans suggest 5 to 10% max for fun stuff like streaming services, dinners out, or concerts. But this depends on your goals. If you’re crushing debt, maybe temporarily slash it to 3%. Use apps like Mint to set alerts when you’re nearing your limit.

How do I handle unexpected car repairs in my budget?

Create a “sinking fund”. A separate savings bucket for irregular expenses. Set aside $50 to $100 per month so when Mr. Transmission acts up, you’re not raiding your emergency fund or swiping credit cards. No car? Apply this strategy to medical copays or holiday gifts, too.