Desiring to know how to invest money for beginners?

What if everything you thought about building wealth was wrong?

Let’s get real: most people assume you need stacks of cash or a finance degree to start investing.

Spoiler alert, you don’t.

Research shows folks with a basic plan triple their wealth compared to those winging it.

And guess what?

You can begin with less than the cost of a weekend getaway.

Here’s the kicker: your savings account isn’t cutting it.

Inflation’s like a slow leak in your wallet, and stuffing cash under a mattress won’t fix it.

But here’s the good news: compound growth works while you sleep.

Start early, and it’s like planting a money tree that grows wilder every year.

Think you need a Wall Street hotshot to manage your cash?

Nah.

I’ll show you why DIY strategies work better for most people.

We’ll tackle myths (no, the market isn’t a casino), and I’ll explain why paying off debt first is like putting on a financial seatbelt.

When you’re just starting out, investing your money can feel confusing, even intimidating.

But the truth is, the earlier you start, the faster you build long term wealth.

That said, here’s something most beginners overlook:

If you invest pennies, you’ll get penny results.

Yes, starting small is fine, but to see real returns, you need to increase the amount you’re able to invest consistently.

And the best way to do that?

Increase your income first.

This is where Digital Wealth Academy (DWA) becomes a game changer.

DWA is designed for people who want to take control of their financial future.

It teaches you how to build multiple streams of income online, whether you’re starting from zero or want to grow what you already have.

With more income, you’re able to:

- Invest larger amounts regularly

- Take advantage of better opportunities

- Grow your portfolio faster with less stress

Inside DWA, you’ll learn high income skills, digital business models, and step by step systems that help you generate and manage money effectively, so you’re not just investing scraps, but building real wealth over time

If you’re serious about investing, start by increasing your earning potential.

Then, put your money to work the smart way.

The Digital Wealth Academy

earn 85% as AN affiliate – learn how to start or scale your own business

Table of Contents

Key Takeaways

You don’t need thousands to begin, small amounts grow faster than you’d think

Compound growth turns time into your biggest financial ally

A solid emergency fund is non negotiable before diving in

Investment plans don’t require complexity. Simplicity wins

Inflation quietly erodes cash savings over time

Understanding the Basics of Investing

Money sitting in your savings account is like a hamster wheel, lots of movement, going nowhere.

Let’s crack the code on making your dollars actually work for you.

First up: knowing when to save versus when to put your cash to work.

Difference Between Saving and Investing

Saving is your financial seatbelt, essential for emergencies but terrible for growth.

That $1,000 emergency fund?

Smart move.

Keeping $50k in cash?

Ouch.

Most basic accounts pay less than 0.5% interest while inflation chomps away at 3% yearly.

You’re literally losing 2.5% purchasing power annually.

| Safety | Accessibility | Growth Potential | |

|---|---|---|---|

| Savings | High | Instant | 0.5%-2% |

| Investments | Variable | Days-weeks | 7%+ (historical avg) |

Benefits of Long Term Investment

Here’s where time becomes your secret weapon.

The S&P 500’s 7% average annual returns after inflation?

That’s not luck, it’s compound growth doing backflips.

Start with $5k at 25, and you’ll have over $150k by 65 without adding another dime.

Market timing is like trying to catch confetti, exhausting and pointless.

Consistent contributions beat perfect timing every time.

Your future self will high five you for starting now.

How to Invest Money for Beginners: Step by Step Guide

Let’s bust some investing myths wide open.

Three lies I hear constantly: “You need Wall Street connections”, “The market’s too scary”, and “This is rich people stuff”.

Spoiler alert: false.

Your greatest wealth building tool?

Time and consistency.

Overcoming Common Misconceptions

Many new investors think they need thousands to begin.

Reality check: most brokerages let you start investing with $5 to $100.

Another fear?

“What if I lose everything?”

The truth:

| Myth | Reality |

|---|---|

| Markets always crash | 7% average annual returns since 1957 |

| Only experts succeed | Index funds beat 80% of pros |

| High risk = high rewards | Consistency beats gambling |

Setting Realistic Investment Expectations

Before buying your first stock, do this financial health check:

- Emergency fund: 3 to 6 months’ expenses (non negotiable)

- Credit card debt: Paid off (18% interest kills growth)

- Monthly surplus: $100+ after bills

Expect 7-10% average annual returns, not 30% “get rich quick” schemes.

Risk decreases over time: $10k invested for 1 year could drop 20%, but over 20 years?

Historically grows 300%+.

Remember: Building wealth through investing works like crockpot cooking, not microwave meals.

Steady contributions + compound growth = your secret sauce.

Creating a Solid Investment Plan

Building wealth without a plan is like road tripping without GPS, you might eventually arrive, but you’ll waste gas and time.

Your strategy needs four key ingredients: clear goals, age based timelines, personal risk thresholds, and account types that match your life stage.

Studies reveal folks with written plans triple their net worth compared to winging it.

Identifying Financial Goals

Start by naming what you’re chasing.

A tropical retirement?

College tuition in 12 years?

Write them like GPS destinations with arrival times:

| Goal | Timeline | Strategy |

|---|---|---|

| Down payment | 5 years | Conservative mix |

| Retirement | 30 years | Growth focused |

Ballpark figures beat perfection.

Aiming for $500k in retirement?

Even being 20% off still gives direction.

Your 25 year old self and 55 year old self need different roadmaps, update them like software.

Assessing Risk Tolerance

This isn’t about bravery, it’s about practicality.

Ask: “Would a 20% portfolio drop make me sell everything?”

If yes, dial back the rollercoaster.

Young investors often handle more volatility because time heals market wounds.

- Emergency fund intact? Take calculated risks

- Debt ridden? Play defense first

- Nearsighted goals? Safety over growth

Your plan should flex as life changes.

Got a promotion?

Maybe boost contributions.

Had twins?

Revisit those timelines.

Smart strategies evolve, they don’t crumble, when surprises hit.

Choosing the Right Investment Accounts and Funds

Picking financial accounts is like choosing tools for a kitchen remodel, use the wrong ones, and you’ll waste time fixing mistakes.

Let’s sort through the toolbox.

Brokerage, Retirement, and Educational Accounts

Taxable brokerage accounts work like all access passes.

Want to trade stocks at 2 AM?

Go wild.

Schwab’s platform lets you buy ETFs or bonds instantly.

But there’s a catch: every profit gets taxed that year.

Great for short term goals, brutal for long term wealth.

Retirement accounts play a different game.

Traditional IRAs are like tax deferral magic, slash your current bill but pay Uncle Sam later.

Roth IRAs flip the script: pay taxes now, collect tax free cash at 60.

Pro tip: Choose Roth if you expect higher tax brackets ahead.

Understanding Tax Advantaged Options

529 plans turn college savings into tax ninjas.

Contributions grow tax free when used for education, even K-12 tuition now.

Some states offer deductions too.

Here’s how smart investors mix account types:

- Brokerage: Play money and short term goals

- Roth IRA: Retirement tax hedge

- 401(k): Free money (if employer matches)

- HSA: Triple tax benefits for medical costs

Your best move?

Open multiple accounts like different savings buckets.

A 25 year old might prioritize Roth IRA growth, while a 45 year old focuses on 529 plans and catch up 401(k) contributions.

Flexibility beats perfection every time.

a free beginner’s guide

DWA Sneak Peek

Learn the easiest and fastest way to start or exponentially grow your existing business.

Understanding Asset Allocation and Diversification

Think of your portfolio like a cake recipe, too much flour makes it dry, too little sugar kills the flavor.

The right mix of stocks, bonds, and cash determines whether your financial future tastes like a masterpiece or a burnt mess.

Stocks, Bonds, and Cash Explained

Stocks are ownership slices in companies.

They’re the chili peppers in your portfolio, spicy growth potential but can burn if overdone.

Over decades, they’ve delivered 10% average returns, though short term drops happen.

Bonds work like IOUs.

Lend $1k to Microsoft?

They’ll pay you interest for 10 years, then return your cash.

Safer than stocks, but average returns hover around 5%.

Cash is your financial shock absorber.

Savings accounts and CDs won’t make you rich, but they’ll keep the lights on during market storms.

Ideal for goals under 3 years away.

Building a Balanced Portfolio

Your asset allocation depends on two things: timeline and stomach strength.

A 25 year old might rock 80% stocks/20% bonds.

Nearing retirement?

Flip that ratio.

| Risk Level | Stocks | Bonds | Cash |

|---|---|---|---|

| Conservative | 40% | 50% | 10% |

| Moderate | 60% | 35% | 5% |

| Aggressive | 85% | 15% | 0% |

Rebalance annually like tuning a guitar, small tweaks keep everything sounding right.

Markets shift, life changes, and your portfolio should too.

Mix ingredients wisely, and you’ll bake wealth that lasts.

Evaluating Investment Vehicles and Options

Navigating investment options is like staring at a 10 page restaurant menu, overwhelming until you learn the categories.

Let’s simplify the stocks, funds, and real assets that build modern portfolios.

Stocks, Mutual Funds, and ETFs

Stocks let you own slices of companies.

Think Apple or Tesla shares, potential growth engines but volatile.

One bad earnings report could sour your position.

Mutual funds are group dinners where everyone shares the meal.

Managers pool money to buy hundreds of securities.

Great for diversification, but watch those 1 or 2% annual fees.

ETFs?

These trade like stocks but track entire markets.

SPY (S&P 500 ETF) costs 0.03% annually versus mutual funds’ 0.75% average.

Perfect for cost conscious builders.

| Vehicle | Minimum | Fees | Trade Frequency |

|---|---|---|---|

| Stocks | $1+ | $0 commissions | Real time |

| Mutual Funds | $500+ | 0.5-2% | End of day |

| ETFs | $1+ | 0.03-0.25% | Real time |

Real Assets and Fixed Income Investments

REITs let you own apartment complexes without fixing toilets.

They pay rent dividends monthly.

Commodities like gold?

Hedge against inflation but don’t generate income.

Fixed income options are your portfolio’s shock absorbers.

Treasury bonds pay 4 or 5% with near zero risk.

Corporate bonds offer 5 to 7% but require credit checks.

| Bond Type | Risk | Avg Return |

|---|---|---|

| U.S. Treasury | Low | 4-5% |

| Corporate | Medium | 5-7% |

| High Yield | High | 7-9% |

Your ideal mix?

Maybe 60% stocks/ETFs, 30% bonds, 10% real assets.

Adjust ratios like seasoning, more spice if you’re young, milder if retirement’s near.

Managing Risks and Navigating Market Volatility

Ever tried surfing during a hurricane?

That’s what managing investment risks feels like when unprepared.

Markets swing like ocean waves, predictable in patterns but wild in execution.

Your mission: ride the chaos without wiping out.

Risk Assessment Techniques

First, know your breaking point.

Risk tolerance measures emotional grit during 20% portfolio drops.

Risk capacity calculates actual financial safety nets.

They’re different:

| Tolerance | Capacity | |

|---|---|---|

| Definition | Emotional comfort | Financial ability |

| Example | Sleeping through dips | Emergency fund size |

Got shaky hands during downturns?

Maybe stick to 60% stocks instead of 80%.

Your gut reaction matters more than spreadsheets.

Strategies to Mitigate Losses

Volatility isn’t the enemy, panic selling is.

Spread your bets like a Vegas pro who knows when to walk away:

- Mix asset classes (stocks, bonds, real estate)

- Dollar cost average through storms

- Keep 5 to 10% cash for fire sales

Rebalance yearly like checking tire pressure.

And when headlines scream “CRASH!”, call a financial coach.

Pros spot opportunities in chaos you might miss.

Remember: losses are temporary unless you cash out.

Markets reward the steady, not the skittish.

Your portfolio’s value fluctuates, your plan shouldn’t.

Additional Tips and Strategies for Long Term Wealth Growth

Let’s cut through the noise, building wealth isn’t about secret hacks or Wall Street voodoo.

Your best move?

Automate contributions like clockwork.

Set up recurring transfers to your accounts before you even see the cash.

Out of sight, out of mind, until it’s six figures later.

Review your portfolio quarterly, but don’t tinker like a mad scientist.

Rebalance when allocations drift 5%+ from targets.

Think annual tune ups, not daily engine overhauls.

Apps like Mint or Personal Capital track progress without spreadsheet headaches.

Stay curious without chasing trends.

Read one finance article weekly, skip the hype, focus on fundamentals.

Knowledge compounds faster than you’d expect.

Remember: Time forgives early mistakes but punishes procrastination.

Here’s the real talk: Markets will crash.

Your job?

Keep pouring fuel on the fire.

Every dollar added during dips buys more future growth.

Trust me, your 65 year old self will throw a party for your younger, wiser choices.

Final pro tip: Celebrate milestones.

Hit $10k?

$100k?

Do a victory dance.

Rewiring your brain to enjoy the process turns wealth building from a chore into a game you’ll keep winning.

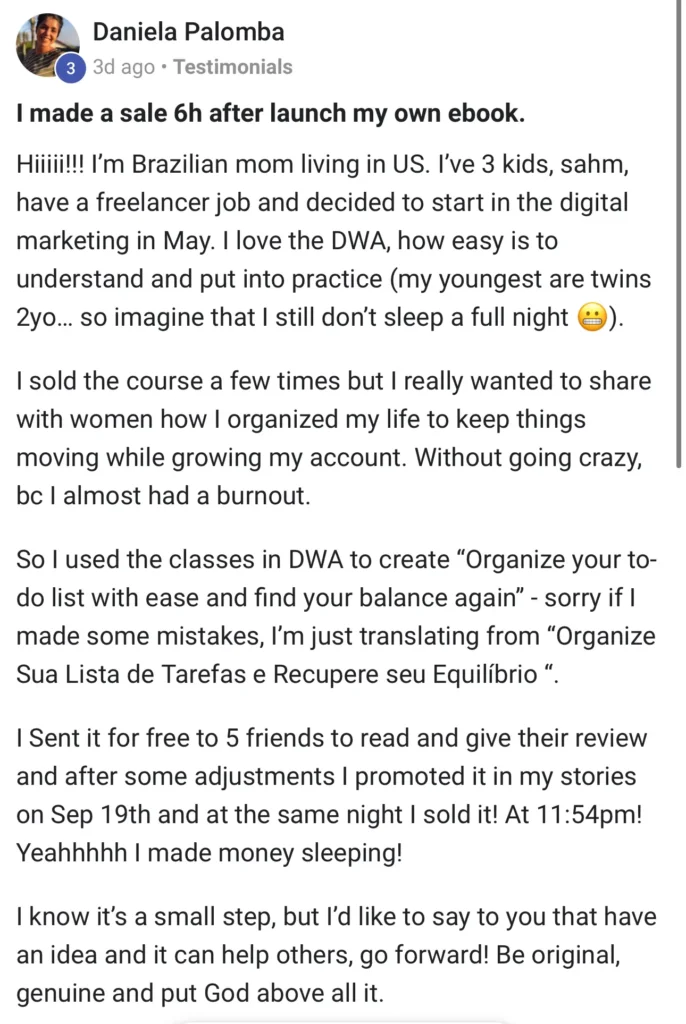

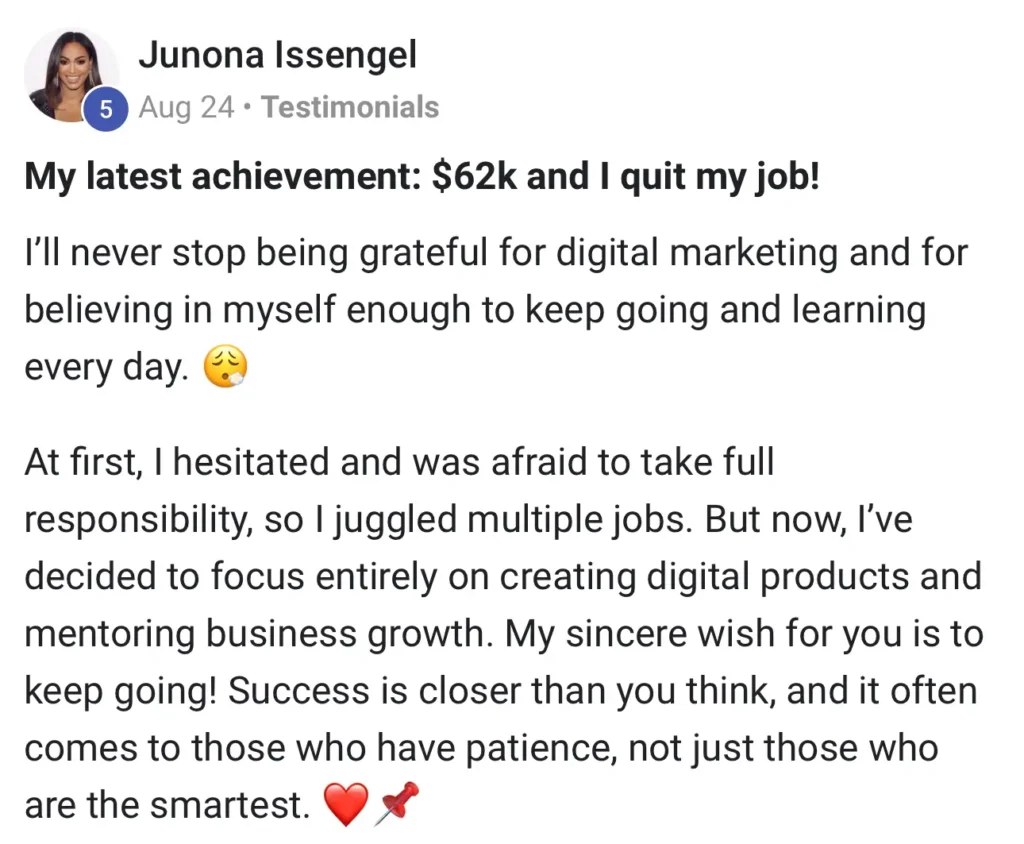

Real Life Results: Explore More DWA Testimonials

Discover how Digital Wealth Academy is changing lives.

Read authentic success stories and see the incredible results members are achieving with the DWA program.

FAQ

What’s the difference between my savings account and actual investing?

Your savings account is like a safe (but low growth) piggy bank, while investing puts your money to work in assets like stocks or ETFs. Savings accounts offer minimal growth potential (think 0.5% interest), but investments like index funds historically average 7-10% annual returns. Just remember: higher rewards come with short term volatility.

Are target date funds worth it for hands off investors?

Absolutely. These “set it and forget it” funds (like Vanguard’s 2065 fund) automatically adjust your stock or bond mix as you near retirement. They’re perfect if you want diversification without daily management. Just check the expense ratio, keep it under 0.15% for maximum growth.

Why does everyone obsess over asset allocation?

Because putting all your cash in GameStop memes is a one way ticket to volatility town! A balanced mix of stocks (growth), bonds (stability), and cash (emergency buffer) protects you during market dips. Younger investors can lean heavier on stocks. Near retirees might prefer bonds.

How do I avoid panic selling when markets crash?

First, don’t check your portfolio daily, it’s not TikTok. Second, build an emergency fund (3-6 months of expenses) so you’re not forced to sell low. Third, remember: every downturn since 1929 has recovered. Time in the market > timing the market.

Should I prioritize my 401(k) or a brokerage account?

Max out tax advantaged accounts first! Contribute enough to get your 401(k) employer match (free money alert!), then fund a Roth IRA for tax free growth. Brokerage accounts are great for goals.

Are dividend stocks safer for new investors?

Not necessarily. While companies like Coca Cola pay steady dividends, their stock prices can still drop. Dividends are nice, but focus on total returns (price growth + dividends). ETFs like SCHD offer diversified dividend exposure without betting on single companies.

How do I know if I’m taking too much risk?

If market swings keep you awake, dial back your stock exposure. Use tools like Charles Schwab’s risk questionnaire to find your comfort zone. Remember: losing 50% requires a 100% gain just to break even. Balance growth potential with sleep at night stability.