Desiring to know how to make money from money?

What if your cash could hustle harder than you do?

Let me tell you a secret I wish I’d learned earlier: your dollars aren’t just paper.

They’re employees waiting for a job.

Most people treat their bank accounts like storage units.

But here’s the truth: every dollar you save is either growing or shrinking.

Inflation’s like a silent thief, right?

That’s why parking funds in basic savings accounts is like leaving your car running in the driveway.

It burns fuel without going anywhere.

I used to think investing was only for Wall Street types.

Then I discovered simple tools that turn spare cash into compound growth machines.

We’re talking about strategies so straightforward, you’ll wonder why everyone isn’t doing them.

Want to know the best part?

You don’t need a finance degree or six figure salary.

Whether you’ve got $500 or $50,000, these methods scale.

From automated platforms to low risk options, I’ll show you how to build a system that works while you binge Netflix.

But remember.

To make money from money, the key is to invest wisely.

But before you jump into investments like stocks, crypto, or real estate, it’s crucial to do what most people overlook.

Invest in yourself first.

The truth is, the smartest way to multiply your money is by learning a high income skill that allows you to increase your monthly income.

That’s exactly what I did through Digital Wealth Academy (DWA).

And it changed everything.

This digital course taught me proven marketing strategies and gave me the tools to start earning consistently.

And it doesn’t stop there.

You’ll also learn how to:

- Build multiple online business models tailored to your goals

- Create multiple income streams for long term financial stability

- Access 52+ modules in marketing, business, and automation

- Connect with a community of over 123.5k members

- Join weekly support sessions and webinars in several languages

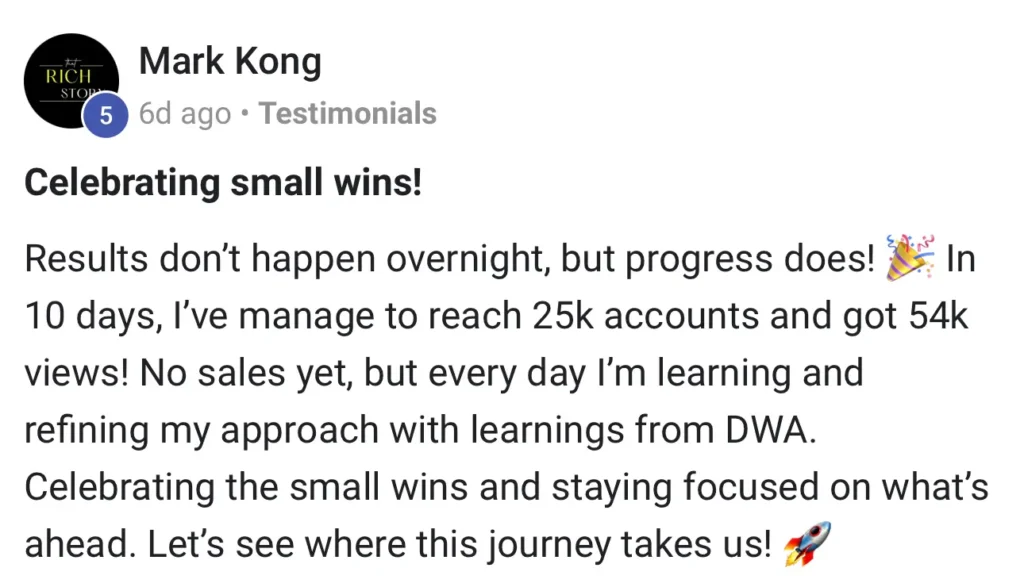

Some students have seen real results within weeks.

But remember: outcomes always depend on your effort, time, and consistency.

Once your income grows, you’ll be in a much better position to reinvest your profits into scalable strategies, and that’s how you truly make money from money.

Discover How I Started With DWA

a free beginner’s guide

DWA Sneak Peek

Learn the easiest and fastest way to start or exponentially grow your existing business.

Table of Contents

Key Takeaways

Compound interest acts like a snowball for your savings

Diversification reduces risk better than single asset bets

High yield accounts outperform traditional savings 10:1

Automated investing requires minimal ongoing effort

Starting early beats waiting for “perfect” timing

Even small regular contributions create major long term gains

Introduction to Financial Growth

Ever wonder why some people’s cash multiplies while others’ gather dust?

I learned the hard way: money grows when treated like a living thing.

It needs nourishment, space to expand, and protection from predators like inflation.

Understanding the Importance of Financial Moves

Leaving funds in standard accounts is like keeping a racehorse in a closet.

I once met a teacher who turned $200 per month into $87,000 using basic tools.

Her secret?

Strategic placement beats random saving.

“Wealth isn’t about what you earn. It’s about what your earnings do when you’re not looking”.

Setting Your Financial Targets

Goals transform vague wishes into action plans.

When I started, I wrote three objectives:

| Aspect | With Goals | Without Goals |

|---|---|---|

| Focus | Clear priorities | Random spending |

| Progress Tracking | Measured milestones | Guessing games |

| Motivation | Visible finish lines | Endless marathon |

Your plan should answer two questions:

What’s my deadline?

And

What’s non negotiable?

A client recently adjusted her strategy after realizing her “retirement fund” was actually funding next year’s vacation.

Clarity changes everything.

How to Make Money from Money: The Core Principle

What if every dollar you saved recruited a friend?

That’s the power of financial multiplication.

Your cash building value without your direct effort.

The Concept of Letting Money Work for You

I once thought “passive income” meant lazy millionaires.

Then I met a barista whose $50 weekly deposits grew to $19,000 in seven years.

Her secret?

Consistent contributions + compound growth.

Here’s why this works: earnings generate more earnings.

Like a tree dropping seeds that become new trees.

Your initial funds become workers that:

- Generate returns through interest or dividends

- Reinvest those gains automatically

- Multiply their productivity over years

Check this reality check:

| Monthly Input | 5 Years | 20 Years |

|---|---|---|

| $100 | $6,977 | $49,725 |

| $500 | $34,885 | $248,628 |

Numbers assume 7% annual growth.

Notice how time transforms modest inputs into serious results.

That’s why starting today beats waiting for “more money” tomorrow.

Your first move?

Open an account designed for growth.

High yield savings or index funds work well.

Set automatic transfers.

Then watch your financial team expand while you live your life.

High Yield Savings Accounts: A Smart Way to Grow Your Savings

Imagine your emergency fund growing while you sleep.

That’s the magic of high yield savings accounts.

Financial tools that turn your parked cash into active earners.

Benefits of High Yield Accounts Over Traditional Savings

Parking cash in traditional accounts is like feeding dollar bills to a paper shredder.

I once helped a friend move $15,000 from a big bank to an online savings account.

Her annual earnings jumped from $7.50 to $525.

Enough for a weekend getaway.

Here’s why these accounts dominate:

- FDIC protection identical to standard accounts

- Zero minimum balance requirements at most institutions

- Instant access to funds when needed

Comparing Interest Rates and Returns

Let’s break down the numbers that matter.

Traditional banks often pay interest rates that wouldn’t cover a coffee order.

Online banks?

They’re serving full breakfasts.

| Account Type | Average Rate | Annual Earnings on $10k | Best For |

|---|---|---|---|

| Traditional Savings | 0.01% – 0.05% | $1 – $5 | Immediate cash access |

| High Yield Account | 3% – 4.5% | $300 – $450 | Emergency funds/short term goals |

Online banks achieve these rates through lower overhead costs.

No marble lobbies mean more money for your pocket.

The setup process takes 15 minutes

Less time than streaming services spend asking

“Are you still watching?”

Your next move?

Compare current offers using bank comparison tools.

Set up automatic transfers.

Then let compound interest work its silent magic while you tackle life’s real challenges.

Investing in Stocks, Bonds, and Mutual Funds

Your money needs a team, not a savings account.

Stocks act like star athletes, bonds play defense, and mutual funds become your coaching staff.

I learned this after watching a $500 ETF purchase outpace my entire savings account in 18 months.

Diversifying Through Stocks and ETFs

Think of the S&P 500 as your financial GPS.

This index of top U.S. companies has delivered 9 to 10% annual returns for decades.

A $10,000 investment here could balloon to $175,000 in 30 years.

ETFs let you own slices of this growth without picking individual stocks.

- One ETF = ownership in 500+ companies

- Automatic rebalancing maintains ideal allocations

- Lower fees than actively managed funds

| Investment | 10 Year Growth | 30 Year Growth |

|---|---|---|

| S&P 500 ETF | $23,673 | $174,494 |

| Savings Account | $10,480 | $13,268 |

Balancing Risk with Bonds and Mutual Funds

Bonds are your portfolio’s shock absorbers.

When stocks dip, bond payments keep rolling in.

A friend’s 60/40 stock and bond mix lost only 8% during the 2020 crash vs. 20% for all stock portfolios.

- Corporate bonds offer higher yields than government issues

- Mutual funds provide instant diversification

- Target date funds adjust risk automatically

Your ideal mix?

Younger investors can handle more stocks.

Nearing retirement?

Shift toward bonds.

My rule: subtract your age from 110 to get your stock percentage.

A 30 year old?

80% stocks, 20% bonds.

Simple math for smarter growth.

Time in the Market: Letting Compounding Do Its Work

The stock market’s greatest magic trick isn’t timing.

It’s clock management.

I spent years trying to outsmart rallies and crashes before realizing consistent presence beats perfect timing.

Missing just five key trading days between 1980 to 2023 could slash returns by 37%.

That’s like skipping dessert at a five course meal.

Here’s what changed my strategy: bull markets last 42 months on average.

Bears claw for just 19.

Markets rise 15% annually during growth spurts.

Your portfolio thrives when you treat investments like a marathon, not a sprint.

The Role of Patience in Investment Growth

I once panicked sold during a dip…

Then watched the market rebound 28% in six months.

Lesson learned.

Trees don’t grow faster when you yank them upward.

Compounding works best when undisturbed.

Consider this timeline:

- Year 1: $10k becomes $10,700 (7% return)

- Year 10: $19,671

- Year 30: $76,122

Early withdrawals sabotage the snowball effect.

Another friend’s $500 per month contributions grew to $217k in 20 years.

Without stock picking genius.

They simply stayed seated while others hopped off the rollercoaster.

Your best move?

Set automatic investments.

Check statements quarterly, not daily.

Let time transform modest deposits into serious wealth.

Markets reward those who keep their chairs when the music stops.

Minimizing Taxes and Managing Investment Fees

Hidden fees and taxes are like sand in your gas tank.

They’ll grind your financial engine to a halt if you ignore them.

I learned this the hard way when a 2% advisory fee quietly consumed $12,000 of my potential gains over a decade.

Smart investors protect their returns with the same intensity as earning them.

Turning Losses Into Tax Opportunities

Tax loss harvesting transformed my approach to market dips.

Here’s how it works: sell underperforming assets to offset capital gains taxes.

Imagine writing off vacation expenses because your airline stock tanked.

The IRS allows this financial judo move.

Key moves:

- Swap similar assets to maintain portfolio balance

- Offset up to $3,000 in ordinary income annually

- Carry forward unused losses indefinitely

The Fee War You Can’t Afford to Lose

Financial fees compound against you.

A 1% annual charge on a $100k portfolio becomes $28,000 in lost growth over 30 years.

That’s a luxury car vanishing into thin air.

| Fee Percentage | Annual Cost | 30 Year Impact |

|---|---|---|

| 2% | $2,000 | $134,000 |

| 0.5% | $500 | $33,500 |

My rule?

Never pay for active management that trails the market.

Index funds charging 0.04% now manage 80%+ of my portfolio.

The savings fund my annual fishing trips.

A tangible reward for financial discipline.

Remember: tax advantaged accounts are your best allies.

Max out 401(k)s and IRAs before taxable accounts.

Your future self will toast to your fee slashing, tax savvy strategies.

Diversifying with Alternative Investments and Real Estate

Your financial toolbox needs more than hammers.

Adding real estate and alternative investments is like packing wrenches and screwdrivers.

Different property types solve different wealth building challenges.

I watched a buddy turn $5k into 17 rental units using strategic refinancing.

Now his tenants cover his mortgage and his golf habit.

When Paper Assets Need Concrete Partners

REITs blew my mind when I discovered them.

These real estate trusts trade like stocks but pay hotel style income.

One REIT in my portfolio owns everything from cell towers to hospitals.

Best part?

No midnight calls about clogged toilets.

Rental property offers a unique double play.

My first duplex delivered $400 per month cash flow plus 22% appreciation in three years.

The secret sauce?

Location scouting beats stock picking for tangible results.

During the 2008 crash, my REIT dividends kept flowing while stocks tanked.

Commercial real estate often weathers storms better than paper investments.

That stability makes it perfect for balancing market swings.

Modern investing options let anyone play landlord.

Fractional platforms now offer shares in apartment complexes for less than a video game console.

Your cash becomes part owner of actual buildings.

No property management degree required.

Whether through REITs or rentals, real estate adds texture to your wealth plan.

It’s the bass line that keeps your financial symphony rocking when the stock market hits sour notes.

Real Life Results: Explore More DWA Testimonials

Discover how Digital Wealth Academy is changing lives.

Read authentic success stories and see the incredible results members are achieving with the DWA program.

FAQ

What’s the difference between a high yield savings account and a regular one?

High yield accounts like those from Ally Bank or Marcus by Goldman Sachs offer interest rates 5 to 10x higher than traditional savings accounts. Your cash grows faster with minimal risk. Perfect for emergency funds or short term goals.

How do dividends help build long term wealth?

Dividends, like those from companies like Coca Cola or Procter & Gamble, provide passive income. Reinvesting them through DRIPs (Dividend Reinvestment Plans) compounds growth over time, turning small investments into significant portfolios.

Should I prioritize paying taxes now or later for retirement savings?

It depends! Roth IRAs (Fidelity, Vanguard) let you pay taxes upfront for tax free withdrawals later. Traditional 401(k)s defer taxes until retirement. Match your choice to your expected income bracket and tax rates.

Are bonds really safer than stocks?

Generally, yes. Bonds from issuers like the U.S. Treasury or Apple Inc. offer predictable returns and lower volatility. But they’re not risk free. Inflation or rising interest rates can erode their value. Balance them with stocks for a diversified portfolio.

How much cash should I keep in savings vs. investments?

Aim for 3 to 6 months of expenses in high yield savings (e.g., Discover Bank). Beyond that, invest excess cash in index funds (SPDR S&P 500 ETF) or real estate (REITs like Realty Income) to avoid losing purchasing power to inflation.

What’s the easiest way to start investing with little money?

Micro investing apps like Acorns or Robinhood let you buy fractional shares. Even $50 per month in low cost ETFs (Vanguard’s VTI) can grow significantly over 10+ years thanks to compounding. Time beats timing!

Do I need a financial advisor to manage my portfolio?

Not necessarily. Robo advisors like Betterment automate investing for a 0.25% fee. But if you’ve got complex goals, tax optimization, estate planning. A certified advisor (look for CFP credentials) adds value.

Why do fees matter so much in mutual funds?

A 1% annual fee can cost you $300k+ over 30 years on a $1M portfolio. Stick to low expense ratio funds (Fidelity’s FXAIX at 0.015%). Every dollar saved on fees stays invested, boosting your compound growth.

Can rental properties replace stock market investments?

They can diversify your income. But require active management. REITs (like AvalonBay Communities) offer passive real estate exposure. Weigh the hassle vs. returns: stocks are liquid, rentals build equity but demand work.

How do I protect investments during a market crash?

Don’t panic sell. Rebalance your portfolio toward stable assets like Treasury bonds (TLT ETF) or dividend aristocrats. Use dollar cost averaging. Keep investing regularly. To buy low and reduce emotional decisions.