Learning how to manage money effectively is a fundamental life skill that empowers you to take control of your financial future.

Whether you’re just starting your financial journey or looking to improve your existing habits, this comprehensive guide will equip you with practical strategies to manage your money with confidence.

From understanding basic principles to implementing advanced techniques, we’ll walk you through everything you need to know about financial management in clear, actionable steps.

Managing money isn’t just about cutting expenses.

It’s about making smarter decisions with your income, creating sustainable habits, and increasing your earning potential.

That’s why the first step and the best investment is to invest in yourself, learn a high income skill, and increase your monthly income.

That’s exactly what I did by enrolling in the same digital course that helped me transform how I approach money.

This course gives you:

- Access to 52+ marketing and business modules, so you can launch or grow an online business aligned with your strengths.

- A community of over 123.5k active members supporting and sharing their progress daily.

- Weekly webinars and support sessions in multiple languages led by experts.

What sets this program apart is its flexibility.

You can build multiple business models and income streams based on your personal goals, which gives you more control and stability when managing your finances.

Some students start seeing results in just a few weeks, but it all depends on your effort, dedication, and consistency.

If you want to manage money more effectively, it starts by earning more, then keeping more.

Learn more about Digital Wealth Academy (DWA)

a free beginner’s guide

DWA Sneak Peek

Learn the easiest and fastest way to start or exponentially grow your existing business.

Table of Contents

What Does It Mean to Manage Your Money?

Managing your money means taking control of your financial life through intentional planning, tracking, and decision making.

It involves understanding your income and expenses, setting financial goals, and creating systems that help you build wealth over time.

Effective money management isn’t about restriction.

It’s about making your money work for you and your priorities.

At its core, financial management encompasses five key areas:

Budgeting

Creating a plan for your income and expenses

Saving

Setting aside money for future needs and goals

Debt management

Strategically handling loans and credit

Investing

Growing your money for long term wealth

Protection

Safeguarding your finances through insurance and emergency funds

How Do You Manage Your Money? Essential Steps

Step 1: Take Inventory and Set Goals

The first step toward managing your finances is to assess your current financial state.

This inventory provides clarity about where you stand and helps you create a realistic plan moving forward.

- Calculate your net income (after taxes)

- List all your expenses and identify unnecessary spending

- Compare your expenses to your monthly income

- Check your credit score and review outstanding debts

- Identify your short term and long term financial goals

Step 2: Track Your Spending

Once you know how much money you have coming in, the next step is to figure out where it’s going.

Tracking your expenses helps you identify spending patterns and find opportunities to save.

Fixed Expenses

Rent or mortgage payments

Utility bills (electricity, water, gas)

Insurance premiums

Car payments

Minimum debt payments

Variable Expenses

Groceries and dining out

Entertainment and subscriptions

Transportation costs

Shopping and personal care

Healthcare expenses

There are several methods to track your spending, from simple pen and paper to sophisticated apps.

Choose a method that works for your lifestyle and that you’ll stick with consistently.

Pro Tip: Track your spending for at least 30 days to get an accurate picture of your habits. Include every expense, no matter how small. Those coffee runs and impulse purchases add up!

Step 3: Create a Budget Plan

A budget is simply a plan for how you’ll use your money.

It helps you allocate your income toward expenses, savings, and financial goals in a way that aligns with your priorities.

Here’s a simple framework for creating your budget:

| Category | Description | Example (Monthly Income: $4,000) |

|---|---|---|

| Income | Your take home pay after taxes | $4,000 |

| Fixed Expenses | Regular monthly bills and payments | $2,000 |

| Variable Expenses | Costs that change month to month | $1,200 |

| Savings | Money set aside for future goals | $600 |

| Debt Repayment | Extra payments toward debt (beyond minimums) | $200 |

What is the 50/30/20 Rule?

The 50/30/20 rule is a simple budgeting method that divides your after tax income into three main categories.

This approach provides flexibility while ensuring your essential needs are met and your future is secured.

50% – Needs

Allocate half of your income to necessities: expenses you can’t avoid.

- Housing (rent or mortgage)

- Utilities (water, electricity, gas)

- Groceries and essential food

- Transportation to work

- Insurance premiums

- Minimum debt payments

30% – Wants

Dedicate 30% to non essential expenses that improve your quality of life.

- Dining out and coffee shops

- Entertainment subscriptions

- Hobbies and recreation

- Shopping for non essentials

- Vacations and travel

- Gym memberships

20% – Savings & Debt

Reserve 20% for building financial security and reducing debt.

- Emergency fund contributions

- Retirement account contributions

- Additional debt payments

- Investment contributions

- Saving for large purchases

- Education savings

The beauty of the 50/30/20 rule is its simplicity and flexibility.

It provides structure without micromanaging every dollar, making it sustainable for long term use.

Financial planning expert

Remember that the 50/30/20 rule is a guideline, not a rigid formula.

You may need to adjust the percentages based on your unique circumstances, such as living in a high cost area or focusing on aggressive debt repayment.

Adapting the 50/30/20 Rule: If you live in an expensive city where housing costs more than 50% of your income, you might use a 60/20/20 split instead.

If you’re focused on paying off high interest debt, consider a 50/20/30 approach to prioritize debt repayment.

How to Manage $1000 a Month

Managing a limited income requires careful planning and prioritization.

With $1000 a month, every dollar needs a specific purpose to ensure your essential needs are met.

Here’s a sample budget for managing $1000 a month:

| Category | Amount | Percentage | Tips |

|---|---|---|---|

| Housing | $400 | 40% | Consider shared housing or room rentals to reduce costs |

| Food | $200 | 20% | Cook at home, meal plan, and use grocery store loyalty programs |

| Utilities | $100 | 10% | Conserve energy and water. Consider bundling services |

| Transportation | $100 | 10% | Use public transportation or carpool when possible |

| Healthcare | $50 | 5% | Explore subsidized healthcare options and preventive care |

| Phone/Internet | $50 | 5% | Look for budget plans or consider prepaid options |

| Emergency Fund | $50 | 5% | Start small but be consistent with contributions |

| Personal/Misc | $50 | 5% | Include small treats to maintain motivation |

Strategies for Managing on a Limited Income

Prioritize essential expenses

Housing, food, and utilities should come first

Eliminate unnecessary subscriptions

Review all recurring charges and cut what you don’t need

Use cash for discretionary spending

It’s easier to track and control spending with physical cash

Look for free or low cost alternatives

Entertainment, exercise, and social activities don’t have to be expensive

Build a support network

Share resources and skills with friends and family

Explore income boosting opportunities

Side gigs, selling unused items, or developing new skills

Important: When managing a limited income, avoid payday loans and high interest credit cards. These can create debt cycles that are difficult to escape. Instead, explore community resources, assistance programs, or negotiate payment plans for bills.

Understanding Compound Interest

Compound interest is a powerful concept that can either work for you or against you in your financial journey.

When it works for you (in savings and investments), it helps your money grow exponentially over time.

When it works against you (in debt), it can make repayment increasingly difficult.

How Compound Interest Works

Compound Interest in Savings

When you save or invest money, compound interest helps your balance grow in two ways:

- You also earn interest on previously earned interest

- You earn interest on your principal (original amount)

Example: $1,000 invested at 7% annual return will grow to approximately $7,612 after 30 years without adding any additional money.

Compound Interest in Debt

With debt, compound interest works against you:

- If not paid off, you also pay interest on accumulated interest

- You pay interest on the principal amount borrowed

Example: A $5,000 credit card balance at 18% APR with only minimum payments could take over 15 years to pay off and cost over $5,400 in interest.

Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.

Albert Einstein

Building Your Emergency Fund

An emergency fund is a financial safety net that helps you handle unexpected expenses without derailing your budget or going into debt.

It provides peace of mind and financial stability during challenging times.

How Much Should You Save?

| Emergency Fund Level | Amount to Save | Best For |

|---|---|---|

| Starter Fund | $500 – $1,000 | Those just beginning to save or with limited income |

| Basic Fund | 1 month of expenses | Those with stable income and low debt |

| Standard Fund | 3 to 6 months of expenses | Most households |

| Extended Fund | 6 to 12 months of expenses | Self employed, variable income, or specialized careers |

Where to Keep Your Emergency Fund

High yield savings account

Offers better interest rates than regular savings accounts while maintaining liquidity

Money market account

Often provides higher interest rates and limited check writing privileges

No penalty CD

Certificates of deposit that allow withdrawals without fees

Cash management account

Combines features of checking, savings, and investment accounts

Quick Tip: Keep your emergency fund separate from your regular checking account to reduce the temptation to spend it. Look for accounts with no monthly fees and easy access when needed.

Effective Debt Management Strategies

Managing debt is a crucial component of overall financial health.

Strategic debt management helps you reduce interest costs, improve your credit score, and free up money for other financial goals.

Popular Debt Repayment Methods

Debt Snowball Method

Pay minimum payments on all debts, then put extra money toward the smallest balance first.

- Provides quick wins for psychological motivation

- Reduces the number of debts faster

- Works well for those who need motivation to stay on track

Debt Avalanche Method

Pay minimum payments on all debts, then put extra money toward the highest interest rate debt first.

- Saves the most money in interest over time

- Mathematically optimal approach

- Best for those who are highly motivated by efficiency

Tips for Managing Different Types of Debt

Planning for Retirement

Retirement planning is an essential part of managing your money for the long term.

Starting early allows you to benefit from compound interest and build a secure financial future.

Retirement Account Options

| Account Type | Tax Advantages | Contribution Limits | Best For |

|---|---|---|---|

| 401(k)/403(b) | Pre tax contributions: tax deferred growth | $23,000 ($30,500 if 50+) | Employees with employer match benefits |

| Traditional IRA | Potentially tax deductible contributions: tax deferred growth | $7,000 ($8,000 if 50+) | Those expecting lower tax bracket in retirement |

| Roth IRA | After tax contributions: tax free growth and withdrawals | $7,000 ($8,000 if 50+) | Those expecting higher tax bracket in retirement |

| SEP IRA | Tax deductible contributions: tax deferred growth | Up to 25% of compensation or $69,000 | Self employed individuals and small business owners |

Retirement Savings Guidelines

The Power of Starting Early: If you start saving $500 per month at age 25 with a 7% average annual return, you could have approximately $1.2 million by age 65. If you wait until age 35 to start, you’d need to save about $1,100 per month to reach the same amount.

Review and Adjust Your Financial Plan Regularly

Financial management is not a set it and forget it activity.

Regular reviews and adjustments ensure your plan remains aligned with your changing life circumstances and goals.

When to Review Your Financial Plan

- Monthly: Track spending against budget, review account balances

- Quarterly: Assess progress toward short term goals, adjust budget categories

- Annually: Comprehensive review of all financial aspects, update long term goals

- Life Events: Marriage, children, job changes, home purchase, inheritance

Budget and Spending

- Income changes

- Expense patterns

- Category adjustments

- Savings rate

Debt and Credit

- Credit score

- Debt payoff progress

- Interest rates

- Refinancing opportunities

Goals and Investments

- Goal progress

- Investment performance

- Asset allocation

- Retirement contributions

The most successful financial plans are living documents that evolve as your life changes. Regular reviews aren’t about perfection. They’re about progress and adaptation.

Financial advisor

Taking Control of Your Financial Future

Managing your money effectively is a journey, not a destination.

By implementing the strategies and principles outlined in this guide, you’re taking important steps toward financial security and freedom.

Remember that everyone’s financial situation is unique, and the best approach is one that aligns with your personal goals and circumstances.

Start where you are, use what you have, and do what you can to build a stronger financial foundation one step at a time.

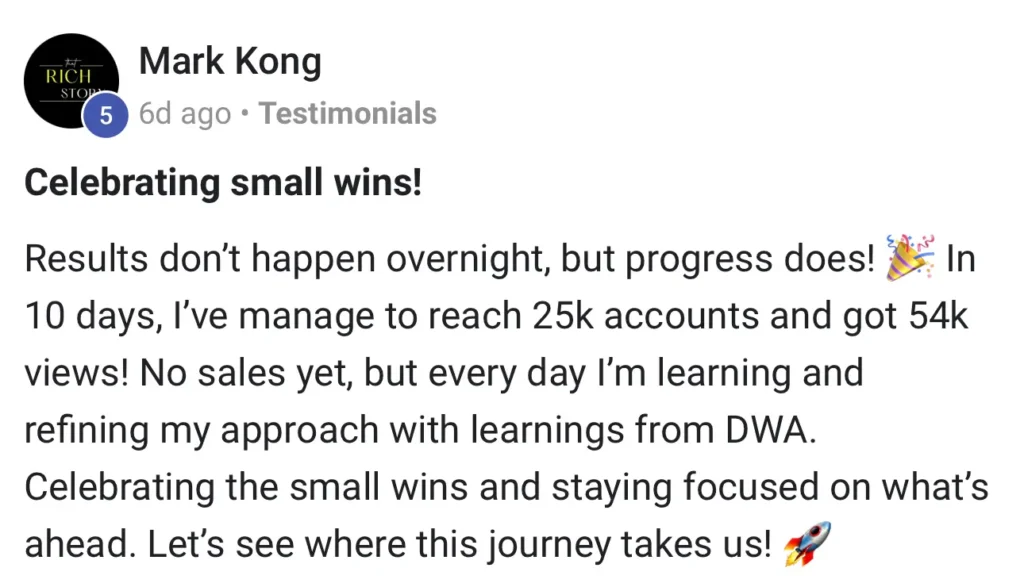

Real Life Results: Explore More DWA Testimonials

Discover how Digital Wealth Academy is changing lives.

Read authentic success stories and see the incredible results members are achieving with the DWA program.

FAQ

How can I manage credit card debt effectively?

Credit cards typically carry the highest interest rates, making them a priority for repayment.

Stop using credit cards while paying them down

Consider balance transfer offers with 0% introductory rates

Negotiate with creditors for lower interest rates

Pay more than the minimum payment whenever possible

What’s the best approach for student loan debt?

Student loans often have lower interest rates and potential forgiveness options.

Explore income driven repayment plans if you’re struggling

Check eligibility for loan forgiveness programs

Consider refinancing for lower interest rates if you have good credit

Make bi weekly payments to reduce interest and pay off faster