Effective money management is the cornerstone of financial stability and long term wealth building.

Whether you’re struggling with debt, trying to save for a major purchase, or simply looking to gain more control over your finances, understanding the principles of money management can transform your financial future.

This comprehensive guide will walk you through proven strategies, common pitfalls, and practical rules to help you take charge of your financial life.

But first, remember that money management isn’t just about tracking expenses or setting budgets.

The foundation of real financial control starts with one thing: earning more.

Before diving into spreadsheets and saving hacks, focus on learning a high income skill, because when your monthly income increases, money management becomes easier and more impactful, allowing you to see better results faster.

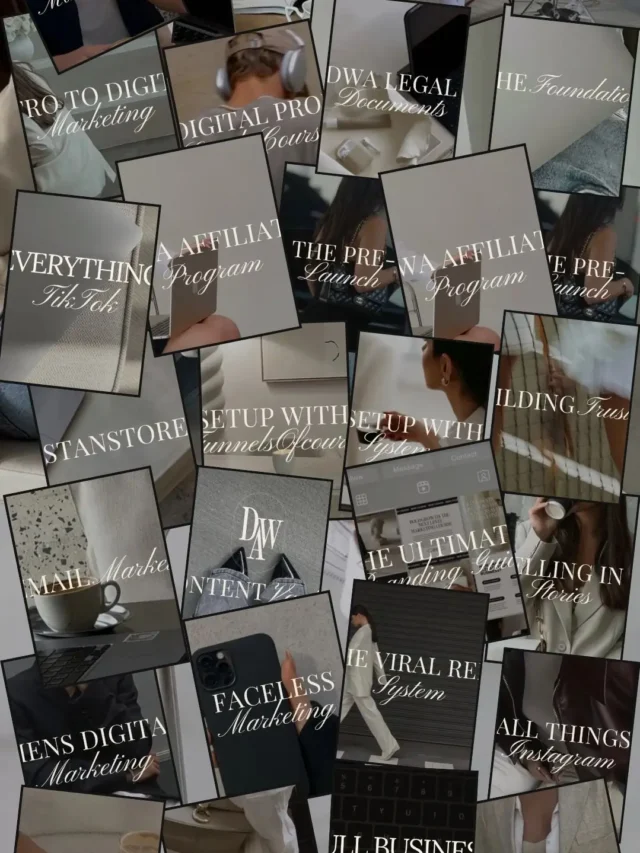

That’s where Digital Wealth Academy (DWA) comes in.

The same digital course that I took helped me learn a high income marketing skill and significantly increase my monthly income.

It helps you:

- Build your first digital income stream from scratch

- Master proven business models that generate real results

You’ll get:

- More than 52 marketing and business modules, from which you can choose to start your online business, or grow your existing one based on your needs and preferences.

- An amazing active community, that at the moment of writing this post, counts with more than 123.5k members

- Weekly support sessions and webinars in multiple languages by different specialists

To learn more about it, download your free DWA PDFs (2 of them) below.

a free beginner’s guide

DWA Sneak Peek

Learn the easiest and fastest way to start or exponentially grow your existing business.

Once you create a stronger income base, you’ll manage your money with purpose, not pressure or stress.

Want to take control of your finances?

Start by growing your income, then manage it wisely with confidence.

Table of Contents

What is Money Management?

Money management involves tracking your finances through budgeting, saving, and investing with the goal of growing your available funds.

It encompasses all activities related to handling your money effectively, from daily spending decisions to long term financial planning.

Good money management creates a foundation for achieving both immediate needs and future aspirations.

At its core, money management is about making intentional choices with your money rather than wondering where it all went at the end of each month.

It’s about creating systems that work for your specific situation and goals, not following one size fits all advice that might not apply to your circumstances.

Common Money Management Mistakes to Avoid

Even with the best intentions, many people fall into common financial traps.

Recognizing these pitfalls is the first step toward avoiding them.

Top Money Management Mistakes

| Living without a budget | Operating without a clear spending plan leads to financial uncertainty and stress. |

| Neglecting emergency savings | Without a financial cushion, unexpected expenses can lead to debt cycles. |

| Paying only minimum payments | This approach maximizes interest costs and extends debt repayment timelines. |

| Emotional spending | Making purchases based on feelings rather than needs or planned wants. |

| Delaying retirement savings | Missing out on compound interest by starting too late. |

| Carrying high interest debt | Allowing credit card balances to accumulate with 15 to 25% interest rates. |

| Lifestyle inflation | Automatically increasing spending as income rises without prioritizing savings. |

Avoiding these common mistakes requires awareness and intentionality.

By recognizing potential pitfalls, you can create systems to protect yourself from financial missteps that might otherwise derail your progress.

Core Principles of Money Management

Successful money management is built on several fundamental principles that apply regardless of income level or financial goals.

These principles create a framework for making sound financial decisions.

Create and follow a budget

Track income and expenses to ensure you’re living within your means and allocating funds toward priorities.

Build an emergency fund

Aim for 3 to 6 months of essential expenses saved in an accessible account for unexpected situations.

Pay yourself first

Automatically direct a portion of each paycheck to savings before spending on discretionary items.

Minimize debt

Distinguish between productive debt (mortgage, education) and consumer debt, prioritizing high interest debt reduction.

Invest for the future

Utilize retirement accounts and investment vehicles to grow wealth over time.

Practice conscious spending

Make intentional decisions about purchases based on values rather than impulse.

Continuously educate yourself

Stay informed about personal finance topics to make better decisions.

Budgeting: The Foundation of Money Management

A budget is simply a plan for your money.

It helps you understand where your money comes from and where it goes, allowing you to make adjustments to reach your financial goals.

Steps to Create an Effective Budget

Calculate your total income

Include your salary, side hustles, investment income, and any other sources of money.

Track your expenses

Review bank and credit card statements to categorize your spending over the past few months.

Categorize expenses

Divide spending into fixed expenses (rent, utilities), variable necessities (groceries, gas), and discretionary spending (entertainment, dining out).

Set financial goals

Define short term and long term objectives to guide your budgeting priorities.

Invest for the future

Utilize retirement accounts and investment vehicles to grow wealth over time.

Create your budget plan

Allocate income to different categories based on your needs and goals.

Track and adjust

Monitor your spending against your budget and make adjustments as needed.

The Digital Wealth Academy

earn 85% as AN affiliate – learn how to start or scale your own business

Effective Saving Strategies

Saving money is a crucial component of sound money management.

These strategies can help you build savings consistently, even if you’re on a tight budget.

Automate Your Savings

Set up automatic transfers from your checking account to your savings account on payday. This “pay yourself first” approach ensures saving happens before discretionary spending.

Save Windfalls

When you receive unexpected money: tax refunds, bonuses, or gifts, save at least 50% before spending any portion on wants.

Use the 24 Hour Rule

For non essential purchases, wait 24 hours before buying. This cooling off period helps eliminate impulse purchases and emotional spending decisions.

Use High Yield Savings Accounts

Store your emergency fund and short term savings in accounts that offer competitive interest rates to maximize growth.

Find and Eliminate Money Leaks

Review subscriptions, memberships, and recurring charges. Cancel services you don’t use regularly or find less expensive alternatives.

Try a Savings Challenge

Motivate yourself with structured challenges like saving all $5 bills you receive or increasing your savings amount each week.

Popular Money Management Rules

Financial rules of thumb can provide helpful frameworks for allocating your money.

While no rule works perfectly for everyone, these guidelines offer starting points that you can adjust to your situation.

| Rule | Description | Best For |

|---|---|---|

| 50/30/20 Rule | Allocate 50% of income to needs, 30% to wants, and 20% to savings and debt repayment | Beginners seeking balanced approach to spending and saving |

| 70/20/10 Rule | Allocate 70% to living expenses, 20% to savings, and 10% to debt repayment | Those with moderate debt looking to build savings |

| 80/20 Rule | Save 20% of income and live on the remaining 80% | Simplified approach for consistent savers |

| 7 Day Rule | Wait 7 days before making any non essential purchase over a set amount | Impulse shoppers who need spending discipline |

| 25 Rule | You need 25 times your annual expenses to retire (4% withdrawal rule) | Retirement planning and long term savings goals |

Applying the 50/30/20 Rule

For someone earning $5,000 monthly after taxes:

- $2,500 (50%) would go toward needs like housing, utilities, groceries, and minimum debt payments

- $1,500 (30%) would be allocated to wants like dining out, entertainment, and hobbies

- $1,000 (20%) would be directed to savings and additional debt payments

This framework provides flexibility while ensuring essential financial priorities are addressed.

How to Track Spending for Effective Money Management

Tracking your spending is essential for understanding your financial habits and making informed decisions.

There are several approaches to monitoring where your money goes.

Methods for Tracking Expenses:

Budgeting Apps

Apps like Mint, YNAB, or Personal Capital automatically categorize transactions and provide insights into spending patterns.

Best for: Tech savvy individuals who prefer automated tracking

Spreadsheet Tracking

Create a customized Excel or Google Sheets document to manually record and categorize all expenses.

Best for: Detail oriented people who want complete control over categories

Envelope System

Allocate cash to different envelopes representing spending categories, limiting spending to the cash available.

Best for: Visual learners who benefit from physical spending limits

Tracking Tips for Success

Review your spending at least weekly to catch patterns early

Create specific categories that align with your financial goals

Don’t forget to track cash purchases and small expenses

Use consistent timing (such as Sunday evenings) to review finances

Adjust your tracking system if it becomes too time consuming to maintain

Debt Management Strategies

Managing debt effectively is a crucial component of overall money management.

Strategic approaches to debt repayment can save you thousands in interest and accelerate your path to financial freedom.

Debt Avalanche Method

Focus on paying off debts with the highest interest rates first while making minimum payments on other debts. This approach minimizes total interest paid over time

Debt Consolidation

Combine multiple high interest debts into a single loan with a lower interest rate. This simplifies payments and potentially reduces total interest.

Debt Snowball Method

Pay off the smallest debts first to build momentum and motivation. As each debt is eliminated, roll that payment into the next smallest debt.

Balance Transfer

Move high interest credit card debt to a card offering a 0% introductory APR period. Be aware of transfer fees and plan to pay off the balance before the promotional period ends.

Benefits of Effective Money Management

Implementing sound money management practices yields numerous benefits that extend beyond your bank account.

These advantages impact your overall quality of life and future opportunities.

Key Benefits of Good Money Management

Reduced financial stress – Understanding your financial situation creates peace of mind and reduces anxiety.

Improved financial security – Emergency funds and proper insurance protect against unexpected events.

Greater financial freedom – More options and flexibility to make life choices based on preferences rather than financial constraints.

Ability to achieve goals faster – Directed spending and saving accelerates progress toward important milestones.

Better relationships – Reduced money conflicts with partners and family members.

Improved credit score – Consistent bill payment and debt management lead to better borrowing terms.

Long term wealth building – Compound interest works in your favor through consistent investing.

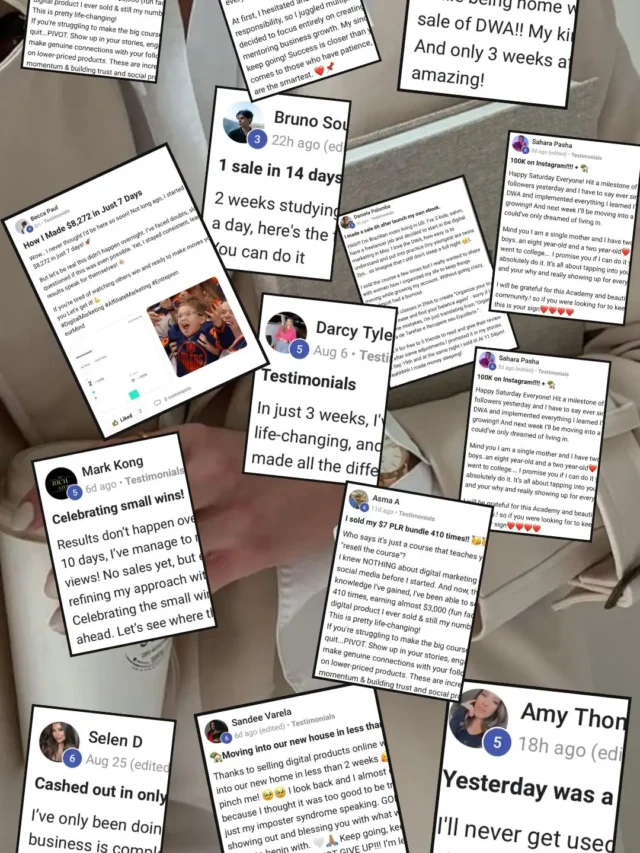

Real Life Results: Explore More DWA Testimonials

Discover how Digital Wealth Academy is changing lives.

Read authentic success stories and see the incredible results members are achieving with the DWA program.

FAQ – Frequently Asked Questions About Money Management

What is the 50/30/20 rule of money?

The 50/30/20 rule is a budgeting framework that suggests allocating 50% of your after tax income to needs (housing, food, utilities), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. This balanced approach ensures essential expenses are covered while still allowing for enjoyment and future financial security.

What is the best way to manage your money?

The best way to manage money involves creating a realistic budget, building an emergency fund, minimizing high interest debt, automating savings, and investing for long term goals. The specific approach should be tailored to your income, expenses, goals, and personal values. Consistency and regular financial reviews are key to successful money management.

What is the 7 day rule for money management?

The 7 day rule is a spending strategy where you wait seven days before making any non essential purchase. This cooling off period helps eliminate impulse buying by giving you time to consider whether the item is a need or a want, and whether it aligns with your financial priorities. Many people find that after seven days, the desire to purchase has diminished.

What is the 70/20/10 rule money?

The 70/20/10 rule suggests allocating 70% of your income to living expenses (housing, food, transportation), 20% to savings (emergency fund, retirement), and 10% to debt repayment or giving. This framework is particularly helpful for those focused on building savings while managing moderate debt levels.

How to split your money 50/30/20?

To implement the 50/30/20 rule, first calculate your after tax income. Then multiply by 0.5, 0.3, and 0.2 to determine your allocations for needs, wants, and savings or debt respectively. Track your spending in each category and adjust as needed. If your essential expenses exceed 50%, you may need to find ways to reduce costs or temporarily adjust the percentages while working toward the ideal balance.

How much money should you have leftover after bills each month?

Following the 50/30/20 rule, you should aim to have at least 20% of your income remaining after paying for necessities. This remainder should be directed toward savings goals and debt reduction. If you consistently have less than 20% remaining, consider reducing expenses or increasing income to create more financial flexibility.

Taking Control of Your Financial Future

Effective money management isn’t about following rigid rules or depriving yourself of enjoyment.

It’s about making intentional choices that align with your values and goals.

By implementing the strategies outlined in this guide, you can reduce financial stress, build security, and create opportunities for yourself and your family.

Remember that financial management is a journey, not a destination.

Start with small steps, celebrate progress, and adjust your approach as your life circumstances change.

The most important thing is to begin taking control of your money today.