Are you desiring to know simple ways to save money?

What if I told you that building financial security doesn’t require drastic sacrifices or a six figure salary?

Most people overcomplicate their savings journey, but what if the real secret is starting smaller than you’d ever imagine?

Here’s the truth…

America Saves found that folks who begin with a $500 emergency fund goal succeed twice as often as those aiming for loftier targets.

Why?

Because small wins create momentum.

Think $20 weekly deposits instead of unrealistic monthly quotas.

That’s how real progress happens.

I’ve helped countless people transform their finances through bite sized strategies that stick.

No deprivation diets or spreadsheet marathons here, just practical systems that work with your actual life.

We’ll explore everything from automated savings tools to psychological tricks that make growing your safety net feel effortless.

When exploring smart ways to save money, one of the most overlooked strategies is increasing your income first, because the more you earn, the more you can save consistently.

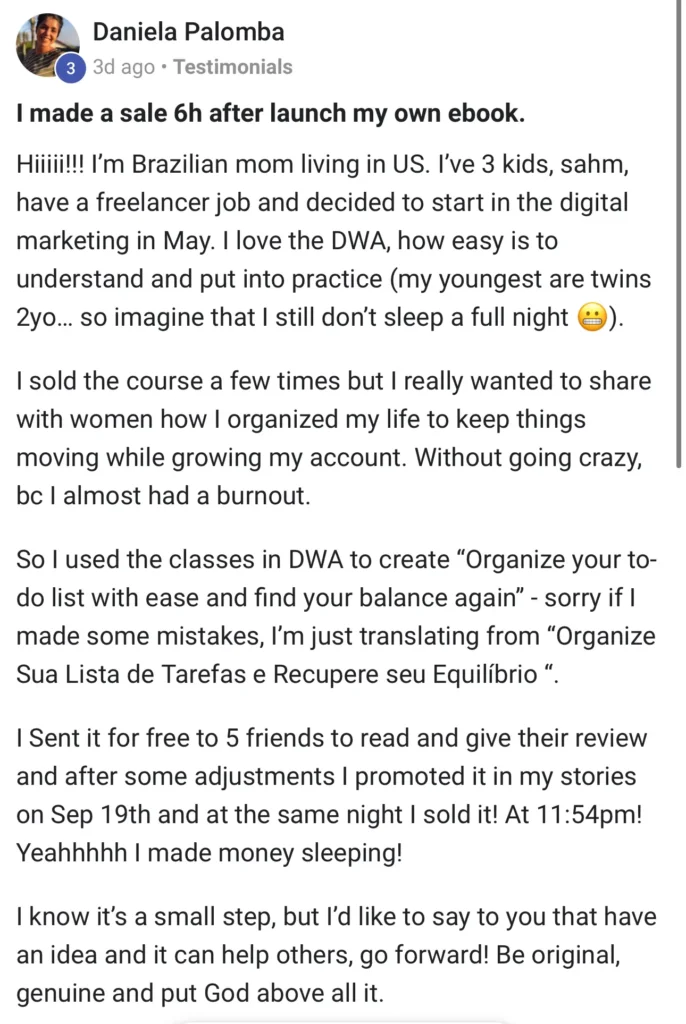

After years of research, trial, and error, I’ve found the best method to boost income (and indirectly save more) is Digital Wealth Academy (DWA).

DWA teaches you step by step how to build online income streams, choose a business model that fits your lifestyle, and manage your money wisely.

Many in the community have seen results in just a few weeks, which allows them to save more, faster.

Of course, your experience may vary.

Saving money successfully depends not only on your income but also on your discipline, consistency, and the financial systems you follow.

If you’re serious about saving more, not just cutting costs, but growing your surplus, DWA is an excellent place to start.

The Digital Wealth Academy

earn 85% as AN affiliate – learn how to start or scale your own business

Table of Contents

Key Takeaways

Start with achievable targets like $20 per week to build momentum

Automated transfers make saving consistent and painless

Short term goals increase success rates by 100%

Emergency funds begin with just $500

Personalized systems beat generic budgeting rules

Building a Budget Foundation for Saving Money

Let’s cut through the noise, creating a budget isn’t about restriction, it’s about financial GPS.

I’ve watched countless clients transform their bank accounts simply by understanding where their dollars wander each month.

Here’s the real talk: you can’t steer your finances if you don’t know your starting point.

Track Your Expenses for Clarity

Grab your phone and snap pictures of every receipt this week, yes, even that parking meter charge.

I’ve seen clients gasp when they discover $150 per month disappearing into forgotten streaming subscriptions.

Your bank’s spending tracker works like a financial detective, automatically sorting purchases into categories.

Pro tip: Carry a mini notebook for cash transactions.

One client found $87 per month in unrecorded coffee shop tips!

These small leaks add up faster than you’d think.

Create a Realistic Spending Plan

Now comes the magic: aligning your income with priorities.

The 50/30/20 framework works beautifully here:

“Half for needs, 30% for joys, 20% for tomorrow’s security”

But here’s my twist: budget $50 per month for spontaneous fun.

Rigid plans break, flexible ones bend without snapping.

Remember to squirrel away funds for annual expenses like car registrations.

I call these “financial termites”, small costs that chew through budgets if ignored.

Your final plan should feel like comfy jeans, snug enough to keep you accountable, but with room to breathe.

Check in weekly for the first two months, adjusting as life happens.

Before you know it, you’ll be steering your money instead of chasing it.

Automate Your Savings for Consistent Growth

Ever notice how gym memberships auto renew but savings don’t?

Let’s fix that.

Automation turns financial discipline into autopilot mode, your future self will high five you.

Set Up Automatic Transfers

Our brains weren’t built for resisting late night shopping sprees.

That’s why I route cash straight to my savings account before I can debate “need vs. want.”

Here’s how it works:

- Schedule transfers for payday mornings

- Start with $25 weekly (less than most takeout orders)

- Gradually increase by $5 every 3 months

Most banks let you split direct deposits, send 10% to savings before it hits checking.

It’s like hiding veggies in mac and cheese for your budget.

Maximize Employer Retirement Matches

This one’s a no brainer.

If your job offers 401(k) matching, take advantage like it’s free guac at Chipotle.

A Vanguard study shows 28% of workers leave money on the table here.

“Not claiming full matches is like refusing a raise, except worse, because it compounds over decades.”

Even if cash is tight, contribute enough to get the full match.

That 4% match on a $50k salary?

That’s $2,000 per year in retirement funds you’re literally being paid to accept.

Ways to save money: Essential Strategies for Everyday Spending

We’ve all fallen victim to that 2 AM scroll through shopping apps, justifying purchases we’ll forget by sunrise.

The good news?

You don’t need superhuman willpower, just smarter guardrails for your daily spending habits.

Your Brain’s Reset Button

That $100 jacket screaming “BUY ME NOW”?

Try this: add it to your cart, then close the app.

Come back tomorrow, I’ve had 80% of my “must haves” turn into “meh, pass” after 24 hours.

It’s like giving your lizard brain a cold shower.

Math That Changes Everything

Here’s my favorite reality check: convert prices into work hours.

Those $150 sneakers?

At $15 per hour, that’s 10 hours of your life.

Suddenly, “need” becomes “hard pass” faster than you can say buyer’s remorse.

Three game changing moves I use daily:

- Blocked retail emails (goodbye, FOMO sales alerts)

- A sticky note on my card asking “Future You Approved This?”

- Monthly subscription audits (RIP, unused yoga app)

These tweaks helped me slash $200 per month in sneaky costs.

Best part?

You’ll feel richer without feeling restricted, just smarter about what truly matters.

Planning for the Future: Long Term Savings and Retirement

Let’s talk about your future self, you know, the one sipping margaritas on a beach instead of eating ramen at 65.

The secret sauce?

Time and compound interest working together like financial besties.

I wish someone had shaken 22 year old me and screamed: “Compound growth is free money magic!”

Start Early to Harness Compound Interest

Here’s why your 20s matter: $100 invested at 7% interest becomes $1,500 by age 65.

Wait 10 years to start?

You’ll only get $750.

It’s like your money has kids, then grandkids, then a whole dynasty.

| Age Started | Monthly Savings | Total by 65 |

|---|---|---|

| 25 | $200 | $525,000 |

| 35 | $200 | $245,000 |

| 45 | $200 | $110,000 |

Set Specific Short Term and Long Term Goals

Big dreams feel overwhelming.

Try this instead:

- Next 6 months: $20 per week emergency fund

- 2 years: $3k car down payment

- 10 years: Start 529 plan for college

“Saving $100 this month beats fantasizing about $50k someday.”

I keep a vision board with my retirement cabin photo.

When Amazon tempts me, I ask: “Does this help future me chop firewood in the Rockies?”

Spoiler: New shoes usually don’t make the cut.

Smart Banking and Debt Management Techniques

Raise your hand if you’ve ever stared at a credit card statement wondering, “How did avocado toast become a financial crisis?”

Let’s flip the script, your plastic and bank accounts can actually work for you instead of against you.

The trick?

Treat credit like a power tool: incredibly useful when handled properly, disastrous when mishandled.

Optimize Credit Card Payments

Here’s the golden rule I live by: If you can’t pay it off this month, don’t swipe it.

Those airline miles?

Worthless if you’re paying 29% interest.

Start small, aim to slash just $1,000 from your balances.

Check out what that does to your interest payments:

| Original Debt | Interest Rate | Annual Savings |

|---|---|---|

| $5,000 | 24% | $240 |

| $10,000 | 29% | $580 |

Pro tip: Stick to your bank’s ATMs.

Those $3 fees?

They add up faster than TikTok dances go viral.

$12 per month could cover your Netflix and Hulu subscriptions instead.

Monitor and Improve Your Credit Score

Your credit score isn’t just a number, it’s your financial fingerprint.

I set calendar reminders to check my reports at AnnualCreditReport.com every February (because nothing says romance like financial health).

Found errors?

Dispute them like you’re arguing about pizza toppings, persistently and with evidence.

Auto pay is your new BFF.

Not only does it prevent $35 late fees, but some lenders knock 0.25% off your interest rate for enrolling.

That’s free money for hitting “enable” in your bank app.

“A 50 point credit score jump can save $15,000 on a mortgage. That’s a used car sitting in your credit report!”

Home and Energy Savings Strategies

Your home isn’t just where your heart is, it’s where your wallet leaks.

I discovered this the hard way when my winter heating bill rivaled a car payment.

The fix?

A free energy audit from my utility company revealed attic gaps big enough to throw a cat through (don’t ask how I know).

Plug Those Money Drains

Weatherstripping windows costs less than takeout for two.

My local power company even installed free smart thermostats, ask yours about rebates.

These tweaks slashed my home’s energy costs by 18% last year.

Play Hardball With Big Bills

I call my insurance agent every fall like clockwork.

Last renewal, switching providers saved $400 per year, enough for a weekend getaway.

For mortgage rates?

Set calendar alerts to check lenders quarterly.

Even 0.5% difference could buy you a new laptop annually.

Your house becomes a wealth building machine when you attack costs smarter.

Start small: replace one lightbulb today.

Next week, challenge one bill.

Before you know it, you’ll fund vacations with found money instead of credit cards.

Real Life Results: Explore More DWA Testimonials

Discover how Digital Wealth Academy is changing lives.

Read authentic success stories and see the incredible results members are achieving with the DWA program.

FAQ

How do I start saving money if I’ve never budgeted before?

Begin by tracking every dollar you spend for 30 days using apps like Mint or YNAB. Once you see where your cash flows, create a realistic spending plan that prioritizes essentials and sets clear limits on extras like takeout or streaming services. Think of it as a GPS for your wallet. You can’t reach your destination without knowing where you are first!

What’s the easiest way to make saving automatic?

Set up automatic transfers from checking to savings right after payday. Even $25 per week adds up to $1,300 per year! Bonus move: If your employer offers a 401(k) match, contribute enough to grab that free money, it’s like getting a raise just for being smart with your retirement funds.

How can I stop blowing cash on impulse buys?

Try the 24 hour rule: Sleep on non essential purchases. Most “must haves” become “meh” by morning. For recurring expenses, audit subscriptions annually you’ll likely find forgotten memberships draining your account. Pro tip: Unsubscribe from retail emails to avoid temptation!

When should I start saving for retirement?

Yesterday. Seriously, the magic of compound interest means a 25 year old investing $300 per month could have over $1M by 65 (assuming 7% returns). Start small if needed, but start NOW. Your future self will high five you through time.

What’s the best strategy for handling credit card debt?

Attack high interest cards first while making minimum payments on others. Consider balance transfers to 0% APR cards, but watch for fees. Always pay on time. Late payments trash credit scores faster than a toddler destroys a clean living room.

How can I lower my home energy bills?

Do a DIY energy audit: Check for drafts, swap old bulbs for LEDs, and adjust your thermostat by 3 to 5 degrees. Then, compare insurance rates annually. Companies like Progressive often offer better deals for loyal customers. Small tweaks = big savings over time!